-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Inflation In India: A Misplaced Concern?

Jan 03, 2019

7 mins

4 Rating

Inflation in India has always been important with Govt falling and major political upheaval, ex emergency, follow in its wake. However in last few years the focus it has received from Indian policymakers has been unprecedented. One can even say it has gained over primacy over other macro-economic variables like growth and employment. There is a section of analysts who believe that the focus on inflation to such a degree is unwarranted and counter-productive but that’s a debate for another day. Inflation is a very complex subject and history has shown us that our understanding of it is still imperfect. In this blog in an ongoing series we will look at various facets of inflation and hope it expands yours and our understanding of this subject.

Inflation: An India problem?

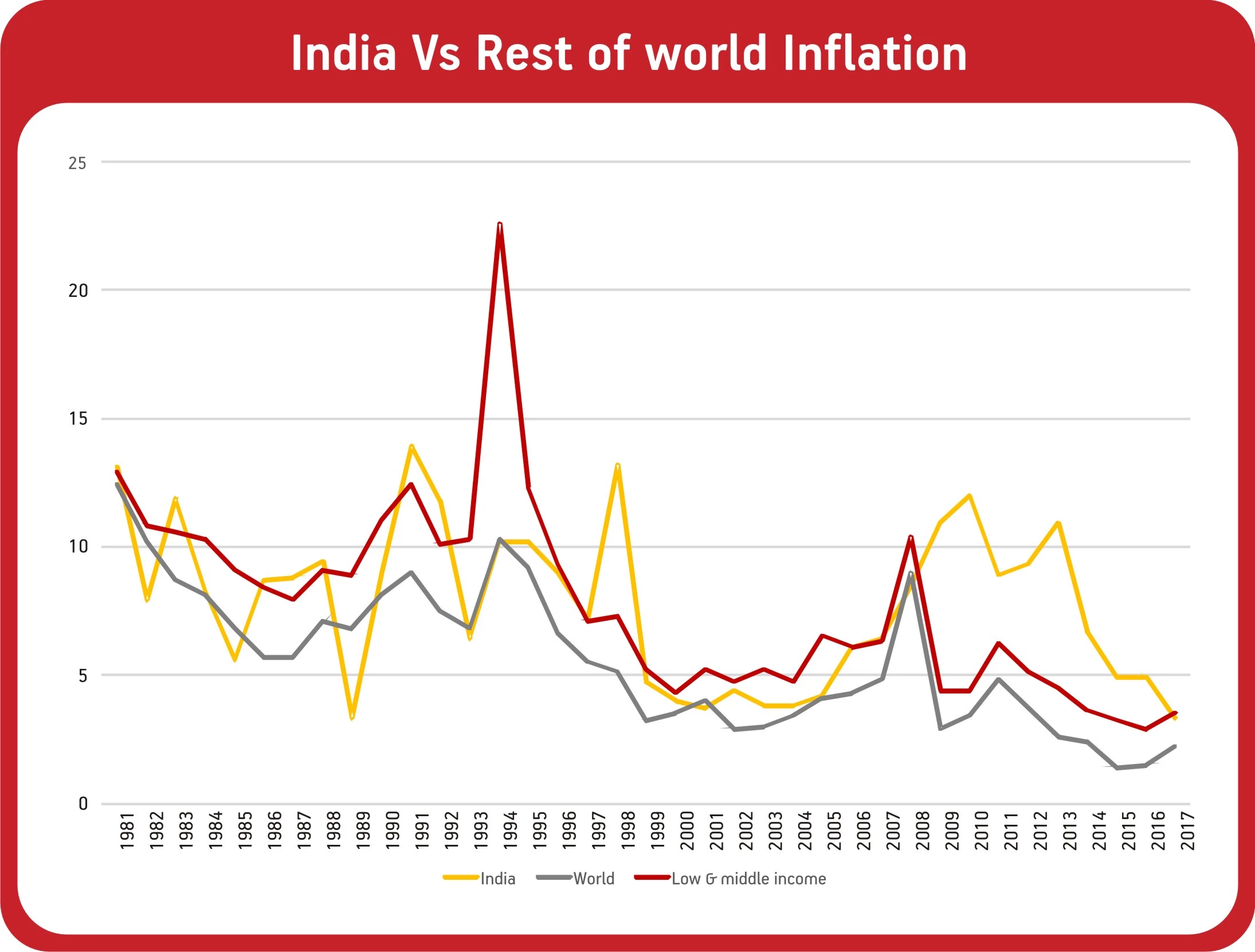

As we have said before there is a hypothesis that there is a specific Indian inflation problem. We would look to deconstruct this looking inflation data for India and rest of the world. Below is the chart from IMF on India versus rest of the word.

This clearly shows that in the context of world we didn’t have an inflation problem till 2009. In fact till then we did better than low and middle income countries while doing much better than them in the high inflation period of early 90s. It’s only in 2009-2015 period that we had underperformed the rest of the pack. Even prior to 1980 in an era of hyper-inflation in world we have seen India outperforming the rest of the world. So India inflation should be analysed in that context taking that period as an anomaly and treating that as not the new normal. A lot of commentary and also some from the policymakers have done the opposite and that has produced and continue to produce hyperbolic reactions to inflation in this country.

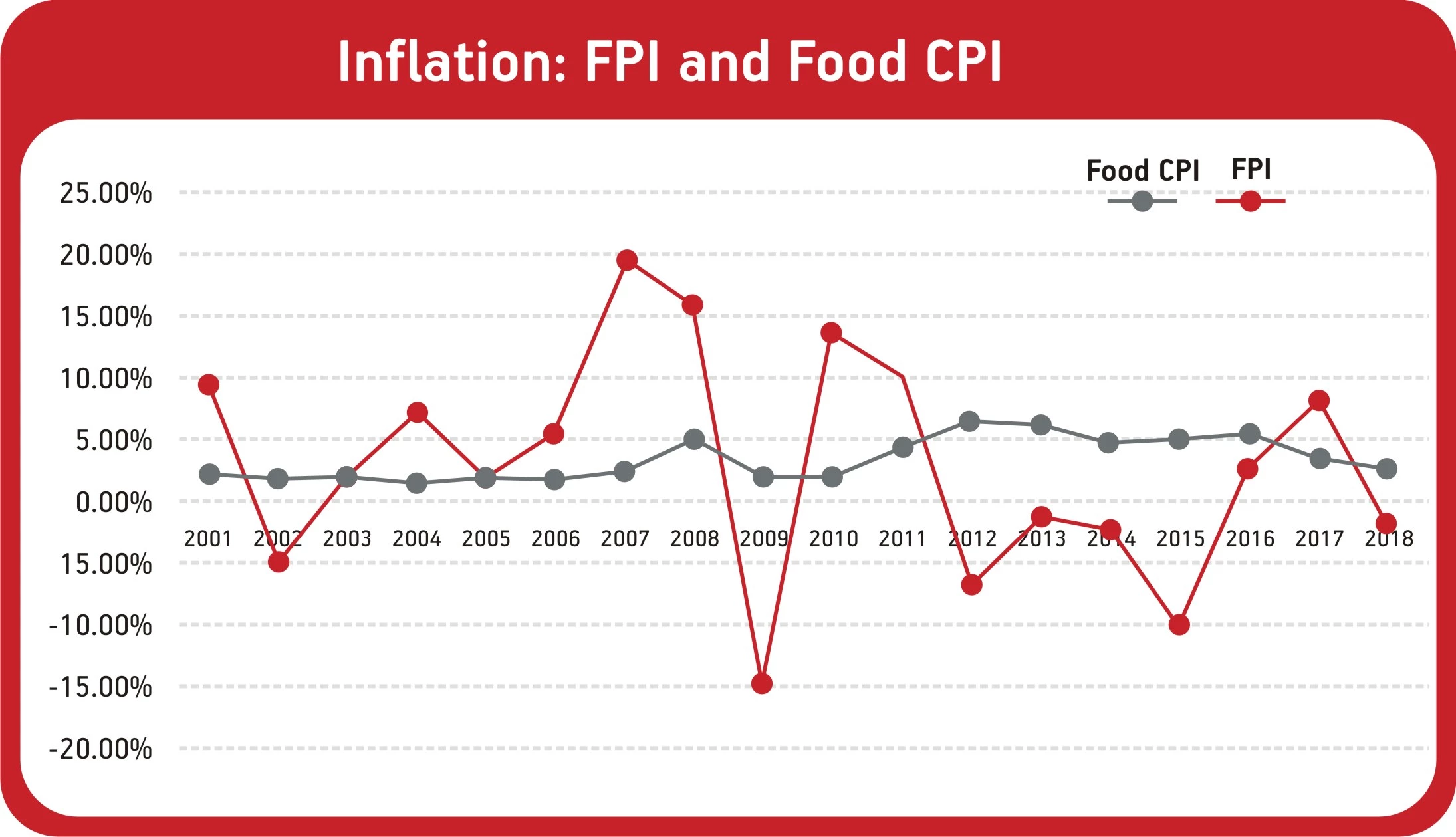

Looking at these above data and chart we can take out the 2009-15 period and then analyse our inflation as a reaction to what is happening inflation globally. In last couple of decades we have seen food inflation staying low and steady for an extended period of time.

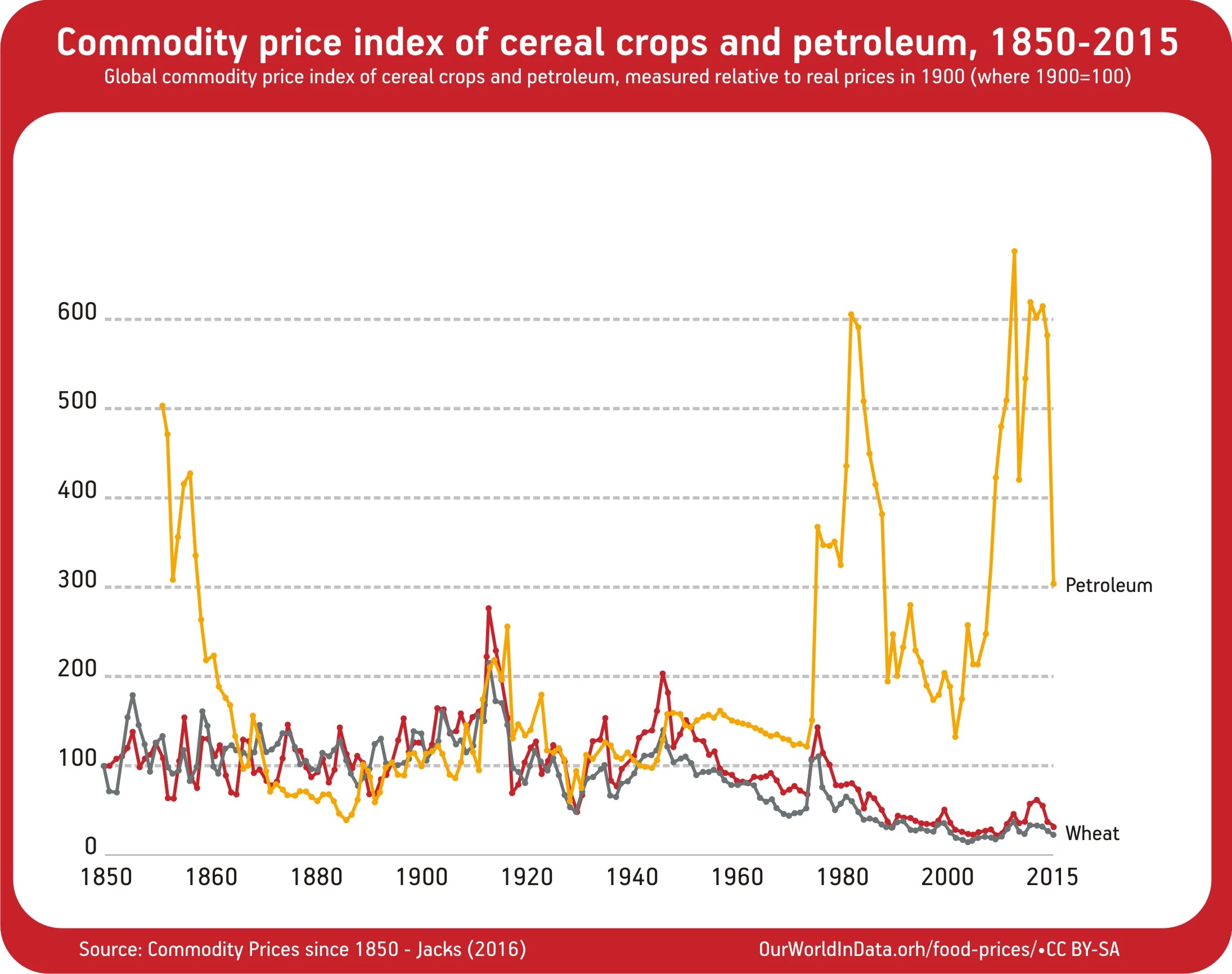

If we look at cereals and petroleum prices worldwide we can see that in real pricesterm we have bouts of either food or fuel prices inflation. However last 2-3 decades we have seen relative stability in cereal prices and even in fuel prices there has been volatility in prices however the actual prices haven’t moved up in long term context.

In inflation terms that has translated into relative calm in both headline and food inflation.

The above charts convey a story of global food inflation being in control and in tandem global inflation in control. In a normal world we would have expected India to tread the same path. However due to very local idiosyncratic reasons we saw a period of disruption. Once those idiosyncratic reasons were removed as a result of govt policies we again have started moving in-step with inflation trends which are happening in the world.

In conclusion, we can derive from the initial set of data that India does not have an inflation problem very different from the rest of the world, and hence our treatment of this subject should be in-line with this understanding.

PS: This was initial analysis we have done. Moving ahead in follow-up to this we would be looking to understand the nuances of inflation through much more rigorous analysis.

Click here to learn about -

How to Beat Inflation

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000