-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Inflation: The curious case of Food Inflation

Apr 11, 2019

7 mins

5 Rating

Food inflation in India has been a touchy topic. We have seen the government falling in the past over high food inflation, while curiously we might currently see a Government, which is feeling threatened due to low food inflation. We would hence look to examine the history of food inflation in India, the reasons for the recent negative food inflation and how we see it evolving in future.

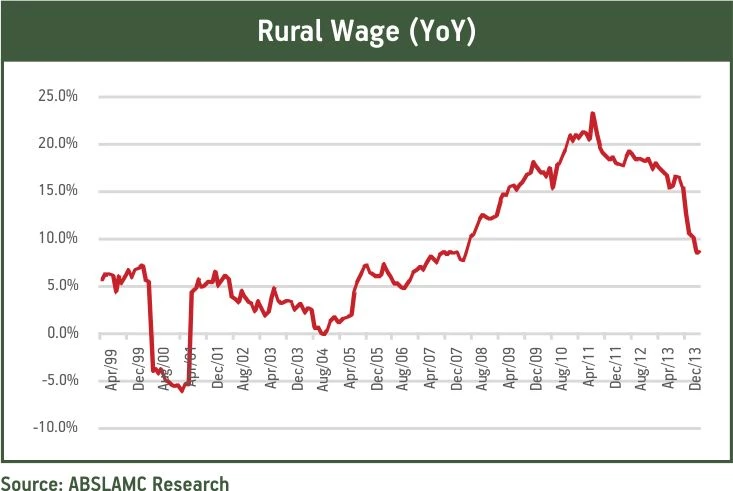

The historical data on food inflation in India reveals that we have traditionally suffered from high food inflation in the past which have also involved bouts of very high inflation in specific items. We have taken the CPI Industrial Worker food inflation as the actual CPI series doesn’t have that long history.

Even if we take the WPI food inflation data we get similar statistics.

We can therefore conclude that India has traditionally suffered from high food inflation, however we have had 2 periods of low food inflation. 1999-2004 and then 2014-current are the two eras which have seen low food inflation. There are certain empirical factors which seem to have been present in both these periods.

Low MSP (Minimum support price) seems to be a common feature in both these periods.

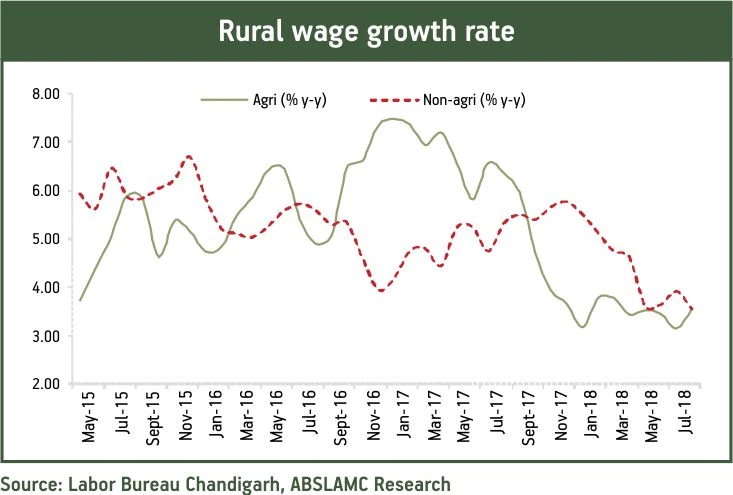

This period has also been period in which we have seen low rural wages.

This is presented as two different series as the data quality was broadened post 2014 which makes a rigorous analysis not possible but broadly evidence suggests that this period saw low rural wages. Of the two factors mentioned above while the direction of causality in rural wages is not clear however it is clear that MSP has acted as stimulant to either increase food inflation or a brake upon the food inflation. In recent past that empirical relationship seems to be breaking down as double digit MSP hike seen last year has proven unable to break the record low food inflation prints we have seen recently. It maybe that there might be a greater lag in those data than we think, however we cannot ignore another structural factor which seems to be at work.

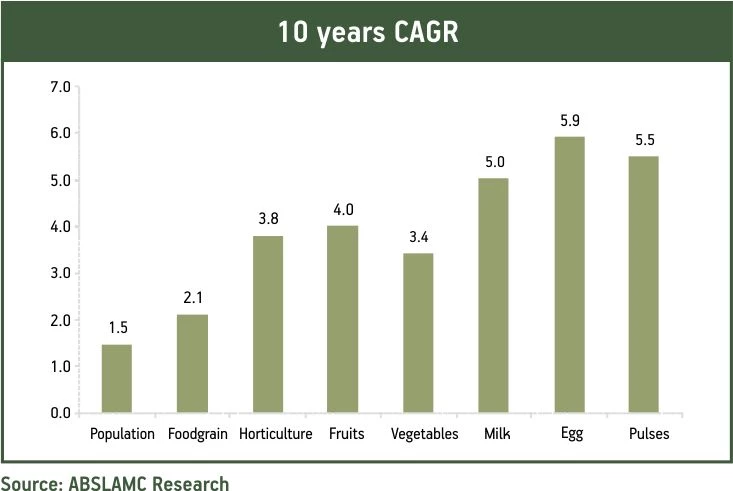

In the last couple of decades we have seen very good increase in productivity in both food grain and horticulture. While the productivity and yield has grown over the years what has changed over the last decade has been the per capita productivity increase in production which depends on both increase in production and decrease in rate of population growth. As we can see in this chart below that the total availability has been relatively constant till 2012, but we have seen a meaningful increase since then.

This combined with low global prices for food has provided a structural headwind for lower food inflation. An interesting facet which can be observed is that the increase in production of fruit, vegetables, pulses and eggs which coincidentally are the items which has shown sharp disinflation as can be seen from the chart below.

The combination of the above tactical and structural factors has thus ensured that we are seeing record low food inflation currently.

Now we come to the tricky part of predicting food inflation going ahead. As we had highlighted earlier that the current political system is facing rural voter disapproval due to low food prices which has translated to lower income for farmers and allied activities. The ensuing unrest has ensured that current polity has been forced to take action on this front. We have seen double digit increase in MSP last year. Going ahead, we have seen loan waivers and DBT for farmers announced in various state/union budget and various pre-election promises. These steps would ensure that the term of trade has shifted in favour or rural economy which can arguably push food prices higher. Thus the food prices currently faces two upward pressure in the form of both mean reversion of food price and change in term of trades in favour of rural economy.

Tactically therefore in short term we can see food inflation going up sharply from current levels which can push the overall inflation also higher. The long term structural forces however remain in the economy which means that food inflation in long term will remain at reasonable and manageable levels.

Click here to learn about -

How to Beat Inflation

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

1800-270-7000

1800-270-7000