-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

Jingle Bells and Currency Bills: Nurturing Wealth for Kids with Mutual Funds

Dec 28, 2023

5 min

4 Rating

Christmas, the jolly season of giving is here at last! As parents, you must be getting ready to surprise your children with presents brought home by “Santa Claus”. Isn’t it just wonderful to see their faces light up with joy when they open their Christmas presents wrapped in red and green?

But what if you could give them something even bigger? Something that would give them much more than just momentary happiness and would help them on their journey to adulthood?

Yes, you can put your children’s future on a brighter path by creating a mutual fund investment in their name. This could give them an early head start in investing while they are still quite young.

Planting and Nurturing the Seed of Investment:

As a parent, you are the nurturer of your children teaching them the necessary skills and knowledge for a better life. From material things such as toys, clothes, and books, to more important things such as good values, morals and habits, you do your best to set your children on the right path to a successful and happy life.

As your children grow, so will their needs and desires. Keeping this in mind, it is better to start preparing well in advance so that when the time comes, you will not be burdened with making monetary arrangements. If you nurture your children’s mutual fund investment, it will grow along with your children. And when the time comes, your child will have the financial freedom to choose his/her future.

There are many investing options like stocks, bonds, and short-term debt instruments you can choose from to start pooling money for your children’s future. Another option that can give you all these in a single basket is Aditya Birla Sun Life Bal Bhavishya Yojna.

Investing in Your Child’s Tomorrow Today with Aditya Birla Sun Life Bal Bhavishya Yojna

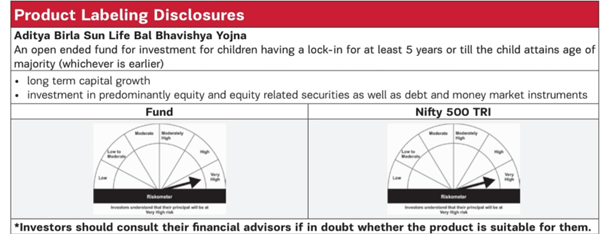

Investing, in general, is a game of patience and long-term commitment. Aditya Birla Sun Life Bal Bhavishya Yojana invests in equity funds and equity-related securities (65%-100%) as well as debt and money market instruments (up to 35%), giving you the benefits of both these asset classes.

In the current scenario, the equity portion of the investment has scope to reap the potential benefits offered by India’s rising growth story. At the same time, the debt portion helps balance out the risks of equity investing by imparting relatively more stability against sudden market volatility.

This open-ended fund has a lock-in period of at least 5 years or till the child attains the age of majority (whichever is earlier). This lock-in period has a dual advantage. Firstly, it encourages investors to stay invested and not redeem when the market is on a high, which is important as the very purpose of the investment is to support the growth of your children. Secondly, it instills the habit of disciplined investing in you as an investor. It is this disciplined approach that will help ease the burden of increasing future expenses on your children’s higher education or marriage.

The Power of Diversification:

Apart from the duration of staying invested, Aditya Birla Sun Life Bal Bavishya Yojana also helps you diversify your investment across asset classes and market caps in one go. The market, as you know, is cyclical in nature. If one asset class is doing well today, another might be on a high in the future. By being invested across diversified avenues, the potential of your investment increases. By the time your children need the money, the market will have been through many such cycles, each one giving your invested money an opportunity to grow alongside your child.

Most importantly, it can be done for as little as Rs. 1,000! With the option of SIP also available, you can further reduce your stress and help build up a useful amount for your child’s future bit by bit.

Preparing for the Future:

None of us know what the future holds for us or our kids. But it is in our power to make some arrangements to arm our children against financial uncertainties. Today’s investment could mean the difference between a normal education or a specialised course at a good university. It might be just what is needed for your kid to travel to a new place and get their dream job rather than compromise dreams for financial stability.

So be a Santa Claus with a difference this Christmas and try gifting a child a better future with Aditya Birla Sun Life Bal Bhavishya Yojna.

Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing / offering / communicating any indicative yield / returns on investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000