-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Investing in Equity for the first time? Here is where to begin

Sep 21, 2020

5 Rating

Equities are like the dreaded roller-coaster at amusement parks – Enticing yet scary! The volatility, unpredictability and research associated with equity markets can make investors (especially the newbies) overwhelmed. But then there is no denying the potential of these investments to generate reasonably better returns in the long run. The dilemma is real!

If you are a first-time investor and find yourself scratching your head over this dilemma, this article will help you take the right route – the middle path. Something that strikes a balance between the two ends of the spectrum – equity and debt. The answer to your dilemma lies in Hybrid Funds.

Meaning

Hybrid Funds are a type of mutual funds which invest across multiple asset classes – equity, debt, arbitrage, etc. This category seeks to counter the individual limitations of individual asset categories. Hybrid Funds have the potential to offer dual benefits - capital appreciation (through the equity exposure) and regular income (with debt investments). Aiming to strike two milestones with one swing!

Also Read - What are Hybrid Funds?

Benefits of Hybrid Funds

For inexperienced investors, Hybrid Funds could be the steppingstone to the world of equity. They are relatively safer than pure equity funds but has the potential to offer reasonable returns than the pure debt variants. Other benefits are:

-

Diversification

You must have heard the saying, “never put all your eggs in one basket”. Diversification is one of the most effective risk management strategy. Hybrid Funds can invest across asset categories. This may help you to get the best of everything. It also has the potential to cushion the fall in value in any one specific category by bringing together two indirectly or conversely linked groups (i.e. equity and debt).

-

Risk

Equity Funds score high on the risk parameter. Hybrid Funds help to dilute the risk by taking exposure to debt and other asset categories. As a result, this category may be better equipped to endure shocks during the bear phase.

-

Variety

When it comes to hybrid funds, one size does not fit all! There are different sub-types of hybrid funds to cater to varied risk appetite and return anticipations. For instance, aggressive hybrid funds have a higher equity exposure while conservative hybrid funds have a higher debt concentration. So, you can choose a fund basis your need, financial goals, and risk-taking capability.

-

Continuous balance (or re-balance)

Hybrid Fund managers continuously scan the market to establish trends, industry or economic changes or predict future events that can have a bearing on the fund’s performance. They re-balance the portfolio whenever the need arises. Hence, your funds aim to maintain the equilibrium stance (as much practically possible) with this mutual fund category.

-

Conservative Hybrid Fund

Do not want to take too much risk? Then say “I Do” to these funds. They invest predominantly in debt-based instruments and maintain a small (between 10% - 25%) equity exposure to push for growth.

-

Balanced Hybrid Fund

These funds strive to walk the middle line by making almost equitable investment in debt and equity (Between 40% and 60%). Arbitrage is not permitted in these schemes.

-

Aggressive Hybrid Fund

As their name suggests, they have an aggressive (read higher equity exposure) approach to investments. 65% to 80% of their corpus is invested in stocks and rest is invested in debt instruments, making them ideal for the risk-takers.

(Fund houses can offer either of these two schemes- Aggressive Hybrid and Balanced Hybrid Funds.) -

Dynamic Asset Allocation

The USP of these funds is their flexibility to change the debt and equity allocation as per market conditions and insights. They do not have any pre-determined upper and minimum investment guidelines. These funds are also known as Balanced Advantage Funds.

-

Multi-Asset Allocation

These funds need to mandatorily invest in at least three categories (with minimum 10% allocation in each class). You can get additional exposure to varied asset classes such as gold, real estate etc. through these funds.

-

Arbitrage Fund

Arbitrage Funds capitalize on the price differential in different markets and earn from the same. They need to maintain at least 65% equity exposure.

-

Equity Savings

These hybrid funds give you the trinity power – equity, debt and arbitrage! They maintain at least 65% equity exposure and 10% debt presence.

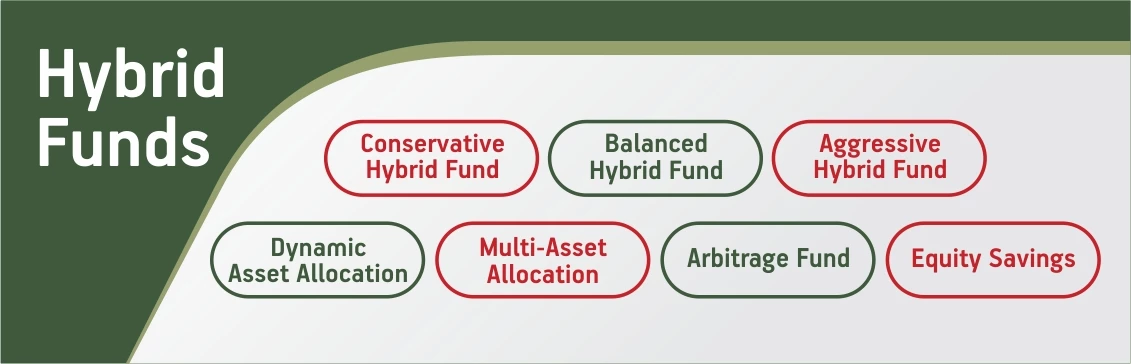

Types of Hybrid Funds

Basis the SEBI’S categorization and rationalization exercise, Hybrid Funds are classified into six categories:

So, whatever be your preference or investment style, there can be a Hybrid Fund out there for you!

Final Words

If you are an equity newbie, hybrid funds can help you take the first steps into the investing ecosystem, without intimidating or overwhelming you. They aim to balance the two 2Rs (Risk and Return) for you and keep your heart and mind at peace.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000