-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Is it Time to Invest in Nifty Next 50?

Mar 06, 2019

5 mins

5 Rating

Can mimicking really pays? Ask the growing legion of Exchange Traded Fund (ETF) investors across the globe and they will say “yes”. ETFs, which mimic an underlying index, are also listed on stock exchanges. They are in contrast to actively managed funds where expert fund managers implement their own investment philosophy, approach and strategy. Internationally, ETFs1 have increasingly found investor acceptance after global financial crisis of 2008 after which fund outperformance declined and investors veered towards lower cost, lower risk equity investments like ETF.

1Source: https://www.cnbc.com/2018/09/14/the-trillion-dollar-etf-boom-triggered-by-the-financial-crisis.html

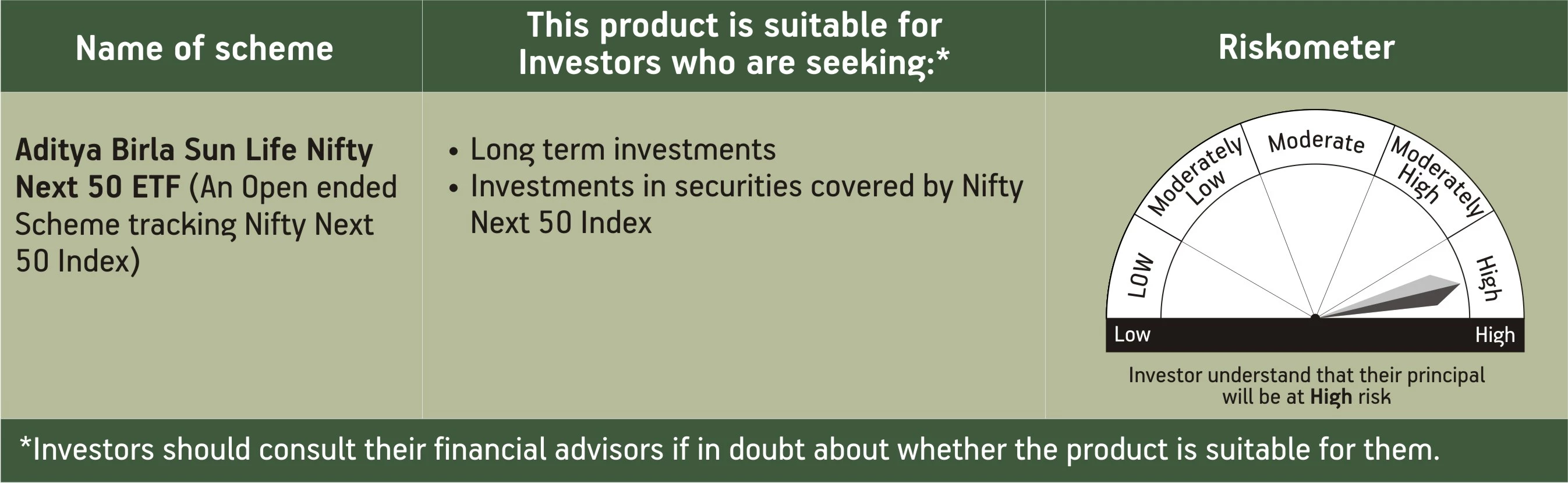

In India, while many actively managed funds have delivered reasonable returns, ETFs have also grown from 0.8% of mutual fund industry AUM in 2008 to 4.8% in 2018, according to Association of Mutual Funds of India (AMFI). While much of this can be attributed to them finding favour with large institutions, individual investors are also discovering ETFs’ virtues. Launch of new ETFs like the recent one of Aditya Birla Sun Life Nifty Next 50 ETF (An Open ended Scheme tracking Nifty Next 50 Index), has reinforced this trend. This fund tracks Nifty Next 50 or Nifty Junior constituting of 50 stocks in the Nifty 100 that come after Nifty 50 stocks. Individual investors are increasingly getting attracted to ETFs due to their following five features.

Why ETFs Score Big?

-

Diversification without stress

By investing in underlying indices, ETFs like Aditya Birla Sun Life Nifty Next 50 ETF (An Open ended Scheme tracking Nifty Next 50 Index) end up investing in a well-diversified basket of high quality securities that helps manage risks better. ETF investors don’t get stressed trying to time the market thanks to “buy-and-hold” ETF investment strategy and are also better placed to deal with market turbulence.

-

Lower expenses

ETF fund management costs are significantly lower since they mimic their underlying index and along with cost reductions due to lower portfolio turnover, effectively enhance returns. Since equities deliver growth in the long term i.e. 8-10 years or more, ETFs can help create wealth over the long term.

-

Low minimum investment

You can start an investment in an ETF with low amounts such as Rs 5,000.

-

Ease of performance tracking

ETFs are listed on stock exchanges and thus the information about their progress can be easily tracked by investors.

-

Liquidity

The listing of ETFs also helps investors exit whenever they want.

At this stage, if you are wondering which ETF to buy, you may consider Aditya Birla Sun Life Nifty Next 50 ETF (An Open ended Scheme tracking Nifty Next 50 Index). Here are some compelling reasons.

Here are its few Advantages

-

Index composition helps combat volatility

This fund tries to deliver returns close to total returns provided by Nifty Next 50 index. The index essentially consists of large-cap stocks that are less volatile, with the potential of future inclusion in the Nifty.

Nifty Next 50 is also more diversified and has lesser cyclical stocks compared to other large cap indices. The top 10 stocks of Nifty Next 50 comprise 35.46%2 of the index while the top 10 stocks comprises of 59.67%2 of the Nifty 50 portfolio. This enhances the prospects of more consistent returns despite periods of market volatility.

-

Index performance edge

Total returns in the form of capital appreciation and dividends for Nifty Next Index as indicated by Nifty Next 50 Total Returns Index (Nifty Next 50 TRI), has consistently been more than that of large cap, mid cap, large & mid cap and multi cap categories returns over long tenures. For instance, for a 5 year period, Nifty Next 50 TRI provided 18.71%3 returns compared to 14.50%3 for large-cap, 16.39%3 for multicap, 16.58%3 for large and mid-cap categories.

The story is the same when Nifty Next 50 is compared to other Nifty indices. For a 10 year period, Nifty Next 50 TRI returned 22.12%3, compared to 16.05%3, 17.02%3 and 16.83%3 for Nifty 50 TRI, Nifty 100 TRI and Nifty 500 TRI, respectively.

-

Ideal for new equity investors

This fund could be ideal for new equity investors who prefer returns that mirror market growth.

-

Good addition to existing portfolio

This fund can also be a good addition to mutual fund portfolios of existing investors, reducing volatility of portfolio returns.

2Source - NSE, India

Clearly, in the uncertain world of equity investments, this fund aims to help you forge ahead and navigate turbulent stretches with ease.

3 Source: Advisorkhoj.com, As on 08 Feb. 19

For Further details refer SID/KIM

Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000