-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Is one SIP really enough?

Mar 29, 2022

3 Min

3 Rating

“Diversification!”- one of the fundamental rules or basis of successful investing! This is precisely what mutual funds have become renowned for. An effective investment option that helps you access several securities through a single investment. To enable ease of investing and affordability, along with a host of other benefits, mutual fund investments today are popularly accessed through SIP investments.

Let’s say you are looking to build a home improvement corpus as well as a long-term retirement corpus. You zeroed in on a good performing Multicap fund and began your long-term SIP investment. You may think that you are getting access to all market cap categories through a single investment and have thus achieved diversification.

Also Read - What is SIP?

But is this enough to meet your portfolio’s requirement for diversification? Probably not.

Diversification too is vast!

When we say diversification, what kind are we referring to? Is investing in a basket of stocks let’s stay stock A, B and then Z, the only type of diversification?

A truly diversified portfolio can consist of several asset classes - across equity, debt and even commodities and currencies. Even within each asset class there is considerable scope for diversification. Equity represents various sectors, as well as the large, mid and small caps. Debt instruments can be G-Secs, corporate bonds, money market instruments and so on… the list goes on.

Mutual funds today are available across these asset classes.

How then can a single SIP encompass all these types of asset classes?

How much is too much or too little when it comes to investing in SIPs?

The answer once again lies in a core investing fundamental – matching the investment type to your investment goals.

Every mutual fund type caters to a specific investor type or for specific investing goals and timelines. The key is to see what fits you best.

Long-term investing goals for example can be matched with equity mutual funds. Furthermore, whether you opt for the blue chips or small caps funds, or something in between is guided by your risk appetite.

For medium to short term goals hybrid funds or debt funds can be your go-to funds for SIP. A conservative investor can opt for G-sec based mutual funds; a less conservative investor can choose a balanced advantage fund.

There is thus no ‘correct’ number of SIPs. The SIPs that can adequately cover your investing goals is the right number.

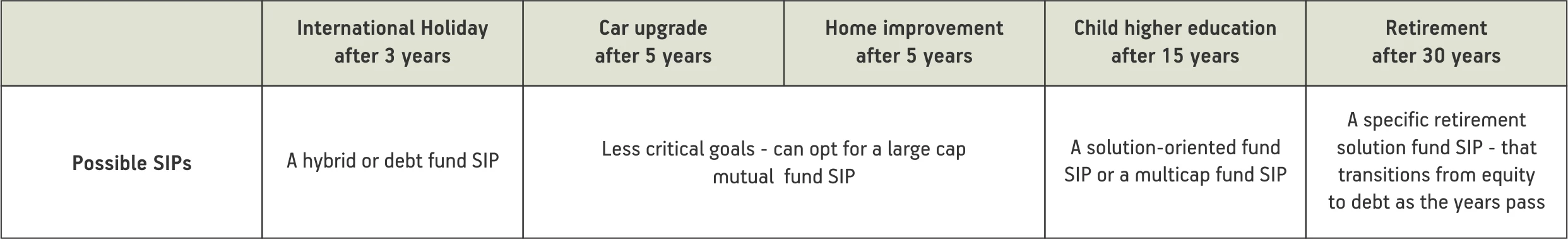

Let’s understand this with an example – Investor A has listed the following goals:

The case for multiple SIPs

Provides diversification for your portfolio as a whole

Coupled with better risk management Look at it as a Plan B for your investments. We wouldn’t want to depend for success on just a single plan!

Multiple SIPs without the hassle with ‘Multi-SIP’

Does setting up multiple SIPs mean the added work of tracking them all as well as ensuring all our paid for on time each month?

Setting up a ‘Multi SIP’ with the fund house removes all these hassles. A multi-SIP is an added SIP feature offering that allows you to invest in multiple mutual fund products through a single SIP. So, invest in plenty, without the problem of plenty!

Also Read - How to Track Mutual Fund Investment

Mutual fund investing is multi-faceted, with many feathers in its cap! It practically has something for everyone and for everything. So, do not restrict yourself to one fund through a single SIP. Capitalise on the benefits of various funds through Multi SIPs.

Types of Mutual Funds

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000