-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

It's coming of age for Debt & Equity SIPs

Feb 24, 2020

4 mins

5 Rating

On the 1st of this month, we had the union budget announcement with a slew of measures aimed at fostering agriculture and infrastructure to revitalise the economy. The finance minister also brought in some major changes to personal income taxes with a new, optional, system with lower rates for those who don’t need to claim deductions or exemptions. The FM also abolished Dividend Distribution Tax while making it taxable, as other income, in the hands of the investors as per their marginal tax slabs. Overall, this budget was a pragmatic one and can potentially aid the revival in the growth of our economy without causing any macro instability.

The Mutual Funds industry has been growing in strength year on year with increasing participation from investors across the country. The share of Assets Under Management (AUM) from cities not in the Top 30 are today almost equal to the share from these Top 30 cities. This, I believe, is a reflection of the growing aspirations of the people of our country as much as their confidence in Mutual Funds as their vehicle of choice to fulfil the same.

Coupled with falling interest rates following demonetisation, the 2017 AMFI campaign of ‘Mutual Funds Sahi Hai’ opened up the floodgates for the Mutual Fund industry with lakhs of first time investors adopting MFs to meet their financial goals. This coincided with strong foreign flows into Indian capital markets that year and as a result, investors saw returns which exceeded their expectations in the very first year. However, in 2018 and 2019, the markets faced several headwinds due to both global and domestic issues which caused volatility in returns. This triggered nervousness in a large section of new investors and they began to prematurely question their decision to invest in MFs. The myth that there’s an opportune time to enter or exit the market began to mire their understanding. However, despite this, we have been noticing that the monthly SIP book for the industry has been steadily growing. This indicates that, behaviourally, investors are OK to allow a standing instruction to continue but when it comes to making new investments, they may tend to postpone the decision to a ‘mythical’, more ‘opportune’ time. This could make them a victim of the fallacy that markets can be timed.

Another observation has been that investors often tend to expect a single investment to cater to all their goals without factoring in the varying time horizons for each goal. This is evident from the fact that the industry AUM and most SIPs are heavily skewed towards Equity funds as a category. However, if investors understood that Debt funds are better suited for their short term goals and Equity funds for their long term ones, then, not only can they have the right expectations from their investments but they may also get closer to realising their goals. This is indicative of an inadequate appreciation of the merits of asset allocation in individual portfolio management.

Hence, while the industry has grown significantly in terms of AUM and number of investors; it is imperative that we continue to educate them about the right ways to invest in order that they ultimately have a good experience while also achieving their financial goals. It is for this very reason that we’ve launched a mega Investor Education campaign, #WINWITHSIP, using mass media, digital and offline channels. In this campaign, we’ve simplified concepts like Rupee Cost Averaging and Asset Allocation, both of which have remained in the realms of technical discussions until now. Using a slice of life approach, we’ve shown the similarities between life and investments to reiterate the benefits of choosing SIP as the ideal way of investing for your financial goals. We hope you will be able to appreciate that, whether the markets are up or down, either way, you can #WINWITHSIP. I, therefore, urge you to strengthen your commitment to your goals by continuing with your SIPs and to also have an SIP for each long and short term goal with the right mix of Equity and Debt Funds.

For long term goals, you may start an SIP in our Equity Funds like Aditya Birla Sun Life Focused Equity Fund, Aditya Birla Sun Life Large & Mid Cap Fund, or Aditya Birla Sun Life Equity Fund, and for short term goals, you may start an SIP in our Debt Funds like Aditya Birla Sun Life Corporate Bond Fund, Aditya Birla Sun Life Banking & PSU Debt Fund, or Aditya Birla Sun Life Short Term Fund.

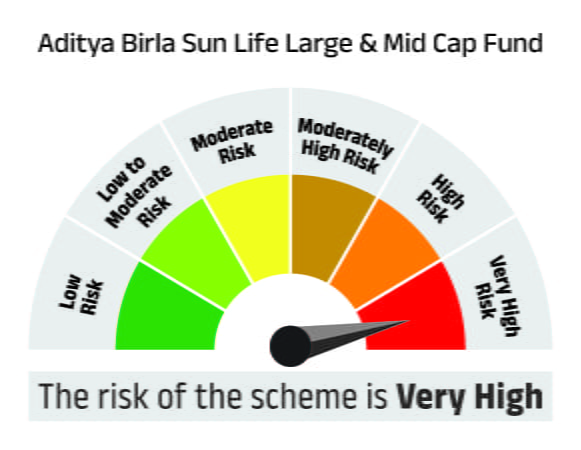

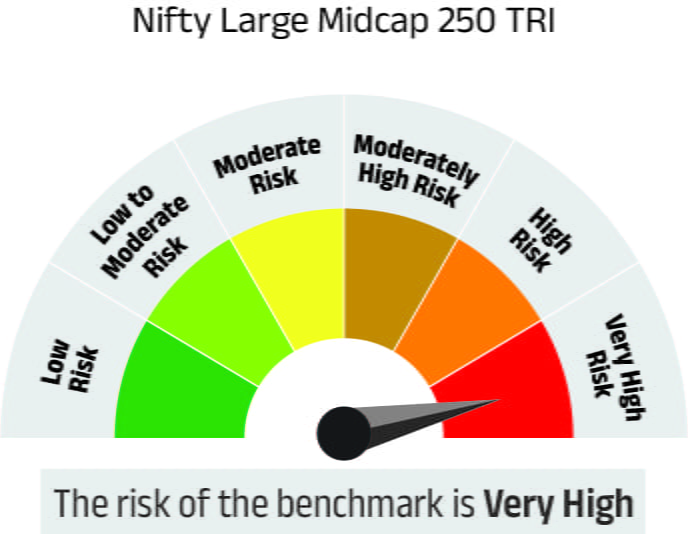

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Large & Mid Cap Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

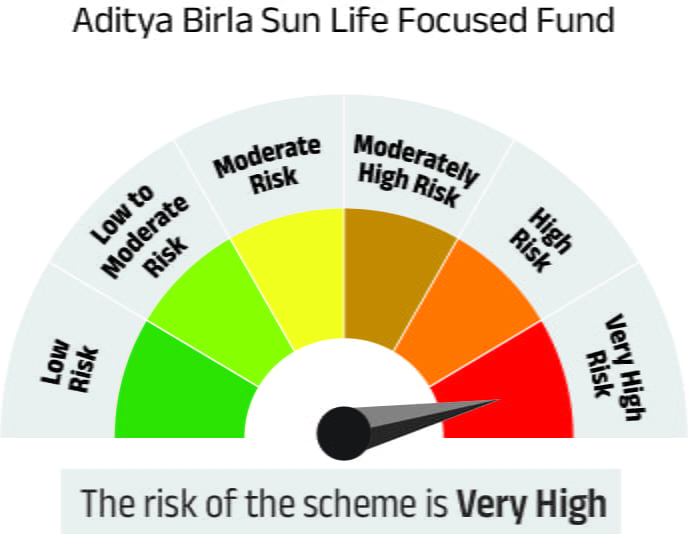

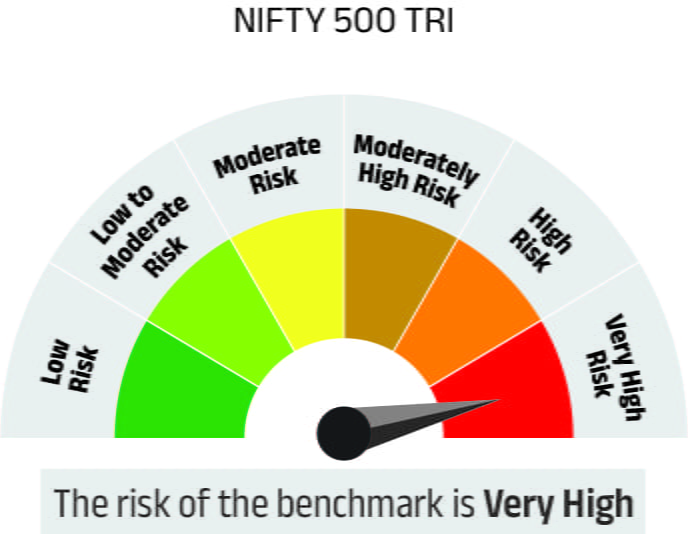

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Focused Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

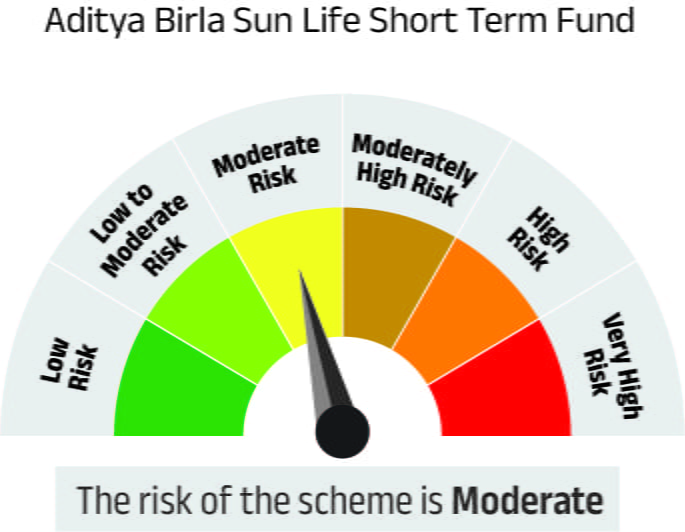

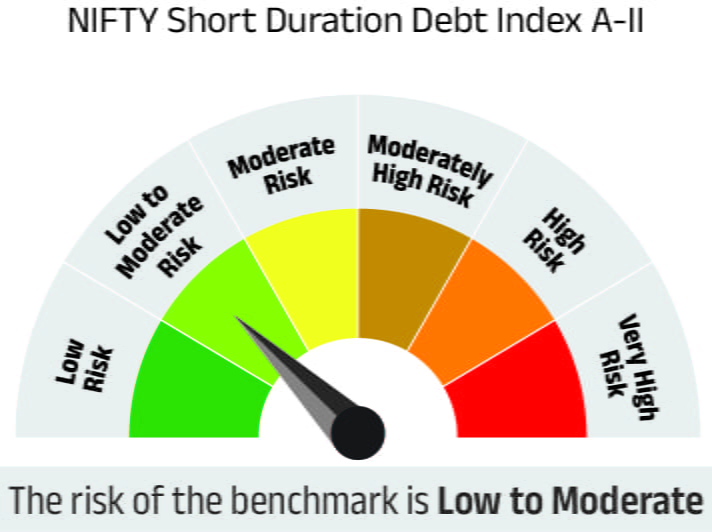

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Short Term Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

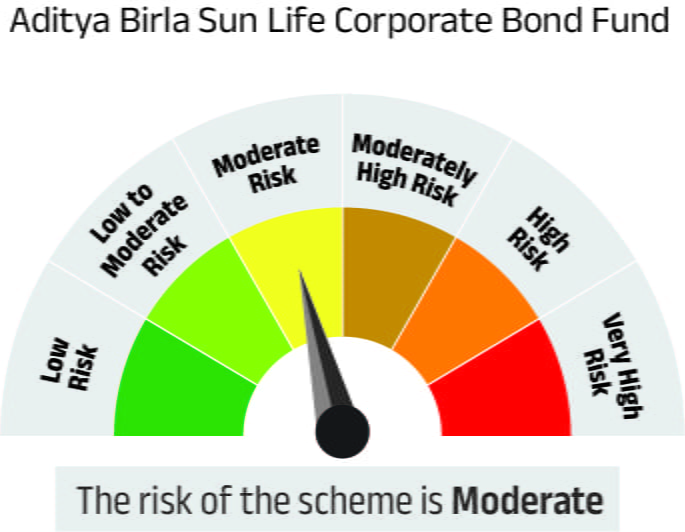

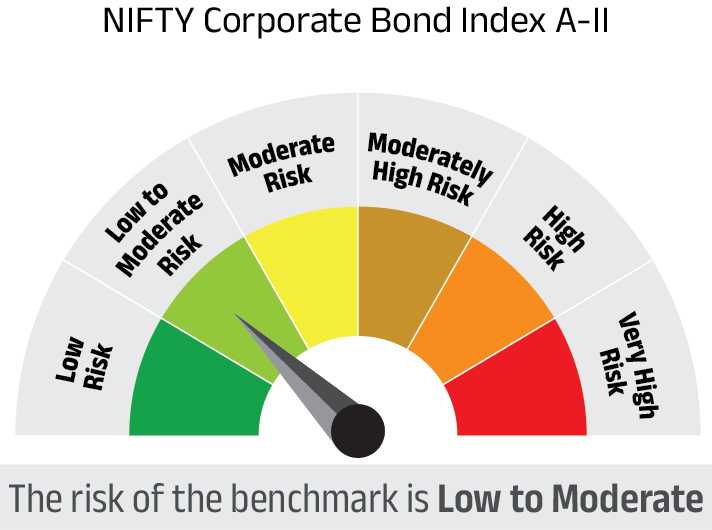

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Corporate Bond Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

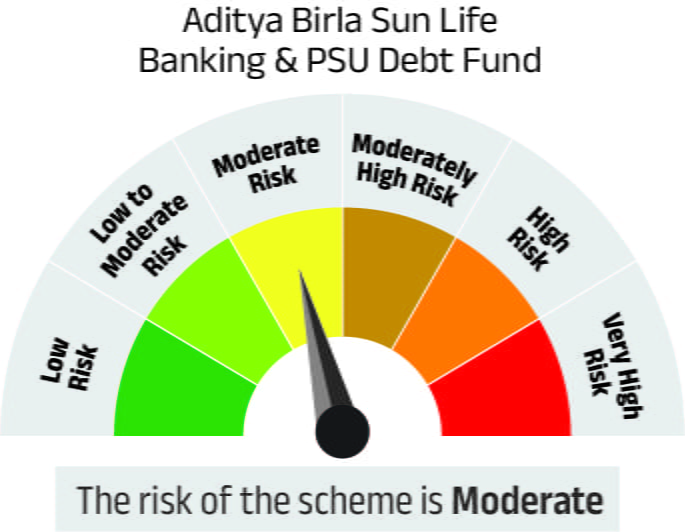

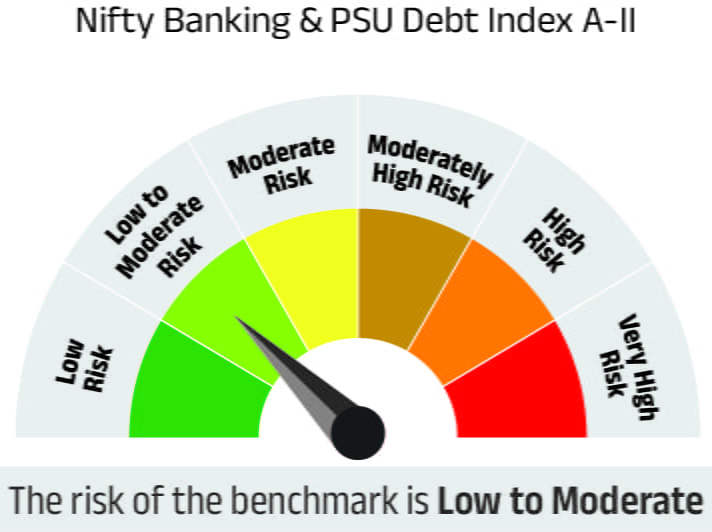

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Banking and PSU Debt Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

For further details please refer SID/KIM of the schemes.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000