-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Journey To Developed India: Investing Opportunities In Transportation and Logistics

Nov 14, 2023

5 min

4 Rating

In the coming 25 years of the “Amrit Kaal”, the Government aims to make India a developed economy where individuals have high per capita income and improved general standard of living, industrialization, economic security, and technological infrastructure. And to achieve this dream, India is looking to become a global manufacturing and export hub.

More manufacturing and export will create business opportunities and jobs, boost infrastructure, and lift the standard of living of people. At the core of this development is a robust transport and logistics ecosystem that can ensure smooth movement of goods and services. Ernst and Young1 estimates that India can increase exports by 5-8% by reducing indirect logistics cost by 10%.

India’s transportation and logistics are undergoing structural change, beginning at policy level and moving to investments, taxes, technology, infrastructure, regulatory, vehicle quality and efficiency. Driving this structural change are several secular trends, creating an attractive investment opportunity in the transportation and logistics area.

Logistics growth drivers

India’s logistics sector, from road transport to warehousing to supply chain services, is highly fragmented and unorganized. The top 10 organized players account for around 1.5%2 of the logistics market share. The sector lacks efficiency. The government has introduced several policies to revolutionize this sector.

Government Policies: India is bringing structural changes3 to the logistics industry to reduce the overall cost of logistics from 14% to 8% of GDP by 2030. Some of the efforts under this policy include a digital logistics system and regulations to smoothen the inter-state movement of goods.

The government is breaking department silos to accelerate the development of multimodal logistics parks, roads and rail tracks, and promote smart cities with integrated logistics systems.Development of logistics infrastructure: The government has set a total capital outlay of Rs. 98,000 crores4 to build new airports by FY 2025 and pledged Rs. 3-3.5 lakh crore5 to build and modernize ports, shipping, and in-land waterways. Even the rail ministry is looking to increase its freight handling capacity by investing in freight wagons, upgrading old tracks, and creating alternate routes.

Growing e-commerce penetration: The growing e-commerce adoption has boosted shipment volumes. And rising competition has created the need for efficient logistics to make last-mile deliveries faster. This has created significant opportunities for several tech startups and organized logistics and supply chain services. Several last-mile delivery companies have switched to fleets of electric two and three-wheelers to cut carbon and reduce operating cost.

Transportation growth drivers

While logistics are concerned with the movement of goods and commodities, transportation caters to the movement of people, be it for work or tourism. The automotive sector contributes 7.1%6 to the overall GDP.

And with the world’s largest population of 143 crore7 residing here, it has a huge potential for growth.

Growing disposable income & premiumisation: India’s current ascendency on the world economic charts has opened up more opportunities for its 66%8 youth population, boosting their disposable income and spending power. India’s per capita Net National Income9 increased by 35.12% from Rs. 72,805 in 2014-15 to Rs. 98,374 in 2022-23.

This growing disposable income has created a trend of premiumisation. SUVs are leading the way, accounting for almost 53% of the Indian passenger vehicle (PV) market. The overall share of premium PVs is expected to increase from ~60% to ~80% in FY2025.Preference for EVs: According to the Oxford Institute for Energy Studies10, only 22 per 1,000 Indians own a car. This number is expected to go up to 72 by 2025. Even then, the automotive penetration is way lower than the US (980 per 1,000) and the UK (850). Despite this, 35 of the 50 most polluted11 cities in the world are in India. The rising awareness among the youth about environmental issues is driving them to opt for eco-friendly electric vehicles (EVs) over internal combustion engine (ICE) vehicles. The CEEW Centre for Energy Finance estimates12 $206 billion in EV sales opportunity by 2030. EV penetration will also create investment opportunities in vehicle charging infrastructure.

Demand for ancillary products: Premium and EV cars have more components. The growing penetration of EVs will drive demand for ancillary products. Under the government’s Make in India initiative, most of these products, including EV batteries, will be manufactured in India, creating a significant opportunity for domestic original equipment manufacturers.

Investing in Transportation and Logistics growth drivers

The above structural reform happening in the transport and logistics industry is a combined effort of the government, private sector, startups and consumers alike. This shift has created an investment opportunity across several industries from automakers to airlines, to ancillary auto parts, to port services, rail wagon makers to digital logistics solutions. The complete supply chain is riding the growth wave and you can hop on this growth.

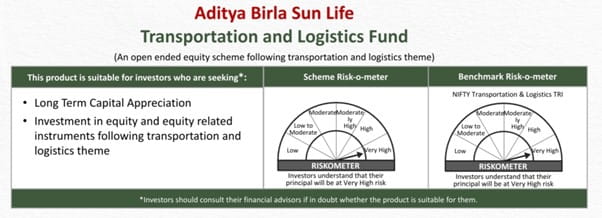

The Aditya Birla Sun Life Transportation and Logistics Fund is an open-ended equity scheme that invests in transportation and logistics-related companies. Its coverage spans 22 basic industries and 200 companies, small and large. The fund manager actively invests in both new-age and traditional companies contributing to the transportation and logistics theme, diversifying your money across sectors and market caps.

The players in transport and logistics are investing heavily in expansion and cost efficiency. Expand your portfolio into India’s new logistics ecosystem with Aditya Birla Sun Life Transportation and Logistics Fund.

Source:

[1] [5] Ernst and Young, April 2023: “Envisioning the Future of Indian Logistics”

https://assets.ey.com/content/dam/ey-sites/ey-com/en_in/topics/esg/04/ey-envisioning-the-future-of-indian-logistics.pdf

[2] [3] Source: CLSA, IBEF, Department of Commerce. June 2023

https://pib.gov.in/PressReleaseIframePage.aspx?

PRID=1957407#:~:text=The%20targets%20of%20the%20NLP,for%20an%20efficient%20logistics%20ecosystem.

[4] Press Information Bureau, Ministry of Civil Aviation, Government of India, 20 July 2023

https://www.pib.gov.in/PressReleseDetail.aspx?PRID=1940972

[6] Invest India, 19 October 2023

https://www.investindia.gov.in/sector/automobile

[7] World Population Review

https://worldpopulationreview.com/countries/india-population

[8] International Labour Organisation: Report on ‘Decent Work for Youth in India’

https://www.ilo.org/newdelhi/info/WCMS_175936/lang--en/index.htm

[9] Press Information Bureau, Ministry of Statistics and Programme Implementation, Government of India, 2 August 2023: Report on ‘Per Capita Income’

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1945144#:~:text=As%20per%20latest%20provisional%20estimate,98%2C374%20in%202022%2D23.

[10] Oxford Institute for Energy Studies, May 2022: India’s Mass-Market Clean Mobility Initiatives and its Unique, Customized Business Models for Light Electric Vehicles

https://www.oxfordenergy.org/wpcms/wp-content/uploads/2022/05/Indias-Mass-Market-Clean-Mobility-Initiatives-ET12.pdf

[11] The South Asia Regional Energy Partnership (SAREP), March 2023: Investment Landscape of Indian E-Mobility Market

https://sarepenergy.net/wp-content/uploads/2023/03/Investment-Landscape-of-Indian-E-Mobility-Market-V3-FINAL.pdf

[12] The CEEW Centre for Energy Finance, December 2020: Financing India’s Transition to Electric Vehicles

https://www.ceew.in/cef/solutions-factory/publications/CEEW-CEF-financing-india-transition-to-electric-vehicles.pdf

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000