-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Lessons from Union Budget in Personal Finance

Jan 31, 2019

6 mins

5 Rating

The Union Budget 2019 is without a doubt one of the most anticipated financial events of the year. It is expected to bring some impactful tax reforms.

Each year, we wait with bated breath for the Finance Minister’s budget speech, hoping for some favorable changes in the form of tax rate cuts and exemptions.

However, we often miss that the budget goes beyond announcement of policy changes and tax reforms. It holds the key to something a lot closer to home - our individual financial planning.

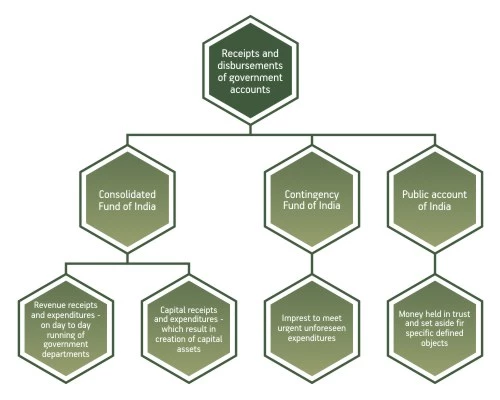

The Union Budget is a detailed report of the government’s finances including a detailed estimate of the receipts and expenditures of the government for a particular year. Every government has certain developmental goals that it seeks to achieve through its budget allocations each year. Similarly, our individual financial goals can be met through sound financial planning.

As we begin the countdown to the budget, let’s look at what we can learn from the upcoming Union Budget to apply to our own financial planning.

Budget key elements:

The Union Budget lays down in detail the past, current as well as the estimates of the receipts and expenditures of the government for the upcoming year. It is therefore also referred to as the ‘Annual Financial Statement’.

The receipts and expenditures are further broken down into categories:

Source: https://www.indiabudget.gov.in/ub2018-19/keybud/keybud2018.pdf

The Budget therefore provides for the sum total of all anticipated expenditures alongside all streams of revenue from which it seeks to meet such anticipated expenditures.

The basis of policy reforms announced in the Budget is this very financial roadmap. Policy reforms are made so as to raise adequate revenue to meet the expenditure outlay on the policy goals of the government.

Lessons we can learn in decoding the budget:

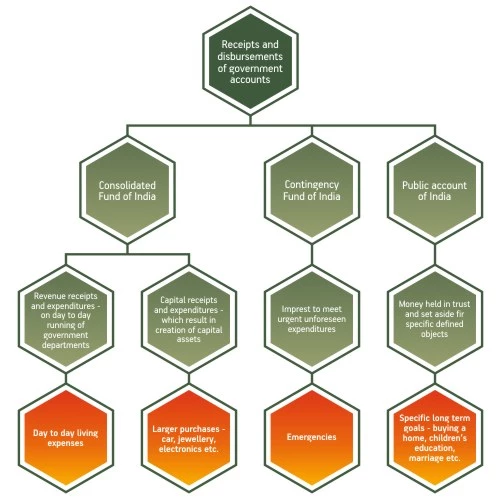

The manner in which the Union Budget is framed and laid out by our policy makers holds important tools to determine our own individual financial roadmap.

If we take cue from the scheme of budget allocations, we can arrive at certain rules to apply to our own financial planning:

-

Estimate receipts for the year

- Be prudent to consider salary/business income as well as interest incomes from existing investments

- Account for any potential change of job or any break in work that could impact cash inflow

- Be conservative in estimates of variable components of pay

- Be sure to consider post tax receipts

-

Budget for day to day expenses

- Look at expenses over the last few years to budget weekly/monthly expenses extrapolated for the year

- Account for inflation – one could consider this in the range of 6 to 10%

- Consider periods of higher expenditures – on account of any planned holidays, weddings etc. in the family

-

Better safe than sorry

- Always maintain an emergency fund for unforeseen circumstances – medical emergencies, loss of job etc.

- Experts suggest that one should have an emergency fund amounting to at least 6 months of expense.

-

Identify financial goals

-

Identify and prioritize individual financial goals:

- Short term goals – buying a car, jewelry, appliances and electronics etc

- Long term financial goals - building a retirement fund:, purchasing a home, saving up for children’s education and marriage - to name a few.

- Identify the time frame within which we seek to achieve those goals

-

Identify and prioritize individual financial goals:

-

Achieving your financial goals

- It’s often said – ‘Don’t work for money, make it work for you’

- The mantra to achieve your financial goals lies in how we make our monthly savings work for us

- Merely saving money from our monthly paycheck is not enough, choosing the correct saving instrument to match your specific financial goal is imperative.

So, while the government works on its financial roadmap for the country for the upcoming financial year, let’s take a look at our own individual finances and seek to align them to our individual financial goals.

Watch this space for more on the much-anticipated Union Budget 2019

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000

.jpg?h=403&w=725&la=en&hash=9D8A3BE92C1D1DBB8CD7227660A9ECDF)