-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Looking for reasons to churn your mutual funds? But really should you?

Mar 19, 2019

5 mins

5 Rating

HoHoHo! Does your money manager turn into Santa and load you with goodies (options) for investment? How about Equity Linked Saving Scheme (ELSS)? Or some Fixed Maturity Plan (FMPs)? A Hybrid fund? Or a Speciality fund perhaps? The list of choices goes on and on.

Well, this could be true for a few of us. For many others, who are independent in making their investment choices, would also time and again consider reviewing their portfolio to align them to their goals and risk profile. The point is, should you? And for what reasons?

Lets’ see what are the considerations before deciding on mutual fund portfolio churning.

-

Volatility Churning is a thing

When market volatility is at its peak, we often see mutual fund investors skipping from one asset class to another, likely, in search of safety. In 2018, the mutual fund portfolio turnover ratio, a measure for the fund provider's buying and selling activity had spiked*. It is calculated* as:

*Source: https://www.valueresearchonline.com/story/h2_storyView.asp?str=45978

https://www.livemint.com/Home-Page/CI0h3nXEiiuHAfB5kDI9eJ/Why-MF-portfolio-turnover-ratios-been-high-recently.htmlWe saw the unrest in Indian markets shooting up, with India VIX (Volatility Index) touching approximately 18.9 in February 2019**.

-

Volatility churning is what you could consider when there is unrest in the market, moving to funds that better suit your risk-return appetite.

**http://www.moneycontrol.com/indian-indices/india-vix-36.html

-

-

Look at Strategic Asset Allocation

Your asset allocation decision comes into the picture here. Some key pointers to consider are:

The ideal debt-equity mix you desire

Being an active or passive investor

Are you risk-taking or risk averse?

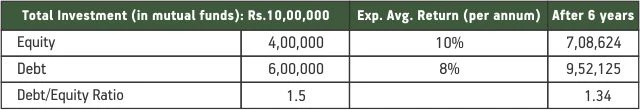

Let's look at an example. Suppose, you have parked money in debt and equity mutual funds, with the debt-to-equity ratio being 1.5.

Total investment = Rs10,00,000, of which Equity = 4 lac and Debt = 6 lac. After 6 years, considering an average return of 10% per annum for equity and 8% for debt, the debt-to-equity ratio will be 1.34 at the end of the 6-year horizon. This means that you are now more exposed to equity than you were earlier. You may want to go back to the 1.5 debt-to-equity mix if you are more risk-averse. This calls for selling a portion of the equity-based fund and buying more debt to strike the desirable balance.

-

Therefore, a strategic asset allocation, wherein the target weights for an asset class are predefined is a yes-nod for churning your mutual fund portfolio.

Taking a short-term view of the capital markets, and drifting from the strategic asset allocation to exploit opportunities is called tactical asset allocation and could be favourable if done correctly.

-

Long-term Capital Gain Tax beneficial or not?

A crucial consideration that we are missing here is the impact of taxation. You may also think of portfolio churning to save on Long-term Capital Gain Tax (LTCG). However, it may or may not be beneficial. Let us take a closer look.

From no LTCG, the government introduced a 10% (plus applicable surcharge and cess) LTCG on profits exceeding Rs.1,00,000 in a year. So you can cash out gains upto Rs. 1,00,000 per annum and pay no tax. To avoid paying a large amount of your money as tax in the longer-run, you could sell out gains annually. A goal-based planning approach to investments could reap benefits here.

-

Simply churning of your mutual fund portfolio to skip the fat-tax bills may slash your long-term net returns. So, you probably have to make a choice here:

Are you looking at higher returns or

Tax savings?

Remember, the idea of churning fund portfolio stands contrary to the much-touted longer-term view for mutual funds. The following illustration will throw some light:

We are looking at how Rs.25 Lac corpus could grow to either Rs.71.3Lac in 10 years with portfolio churning every year and realizing a yearly gain of Rs.1Lac. Or it could be Rs.72.4Lac during the same time if you stayed put. Yes, you could save tax with churning, but it comes at the cost of lower return. Further, there could be additional efforts & costs related to accounting & tax filing every year.

-

-

Cost-Benefit Analysis is the key

A consideration of transaction costs and commissions is also vital. Buying and selling of funds could come with entry and exit loads respectively. Cost analysis of swapping older funds with better prospects is crucial. The trade and transaction cost severs your pockets and has a pernicious effect on the compounding of wealth. It is essential to analyse the benefits of rebalancing your mutual fund portfolio alongside its costs.

-

Macroeconomics play a role

Moving to the macroeconomic factors that contribute to deciding whether you may rebalance your holdings or let it sleep for more years. The comeback of LTCG in Budget 2018 is one such regulation that we have discussed enough. The categorization and rationalization of mutual fund schemes by SEBI in October 2017 was another such move that led to fund houses rebalancing their investments, possibly causing a domino-effect on retail investors.

Another quick reason for moving in and out of securities may be one's preference change as broader capital market expectation changes. You may tilt towards growth versus value funds. Value-stocks are generally assumed to be riskier than growth stocks and may require a longer-term horizon to reap the benefits.

To end the contemplation, if you keep your eyes away from the short-term-horned monster and instead focus on the long-term return, your portfolio value can greet you back wider arms. This is true for mutual fund investments too.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000