-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Making sense of the inflation conundrum in India

Oct 23, 2020

5 mins

5 Rating

By: Pranay Sinha

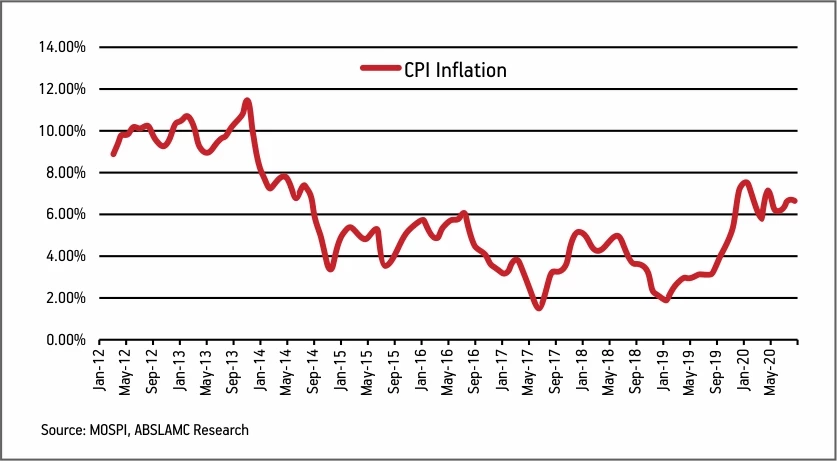

The impact of coronavirus on Indian inflation is a remarkably interesting one. The initial hypothesis was that due to sharp slowdown in growth, we can see a fall in aggregate demand which could lead to fall in inflation. Now that we are more than 6 months into the pandemic, we have a fair idea of how the impact has played out on Indian economy. On the face of it the hypothesis seems incorrect and the reverse has transpired till now. This we can see from the below chart.

The reason of why it has happened can be seen by breaking the inflation component into 3 parts 1) Food inflation 2) Items like gold/silver and petrol which are not a function of aggregate demand & 3) Core inflation

Impact of Food Inflation

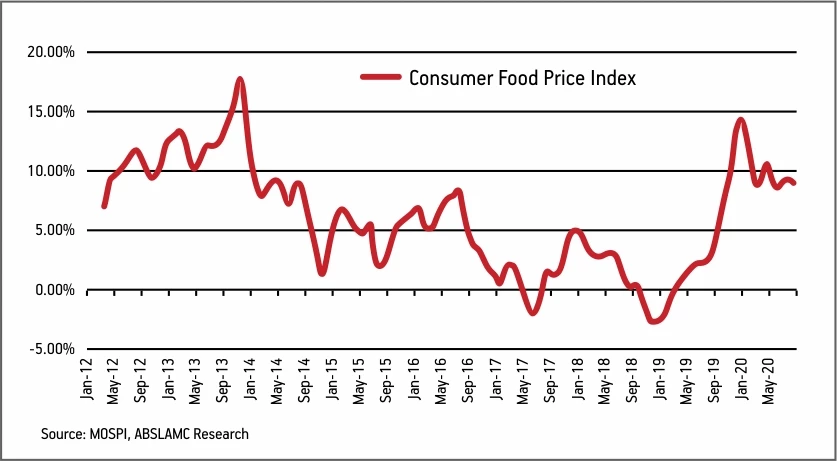

Food inflation has been the big reason for spike in inflation. If we see the graph of food inflation, we can see a big spike in it.

The food inflation graph above indicates that it has been the highest we have seen in last 6 years. This is a product of 1) Base effect due to low inflation in previous years 2) Some sort of mean reversion due to food prices being so low for so long and 3) Significant supply chain disruption due to interruption caused lockdown and Coronavirus induced panic.

The first two points can easily be seen by a cursory look at data and related graphs. Also, if we look at CPI inflation data for cereals and pulses, we can see a 5 year high in them, which is after an extended period of extremely low inflation and hence is mostly explained by the above two reasons.

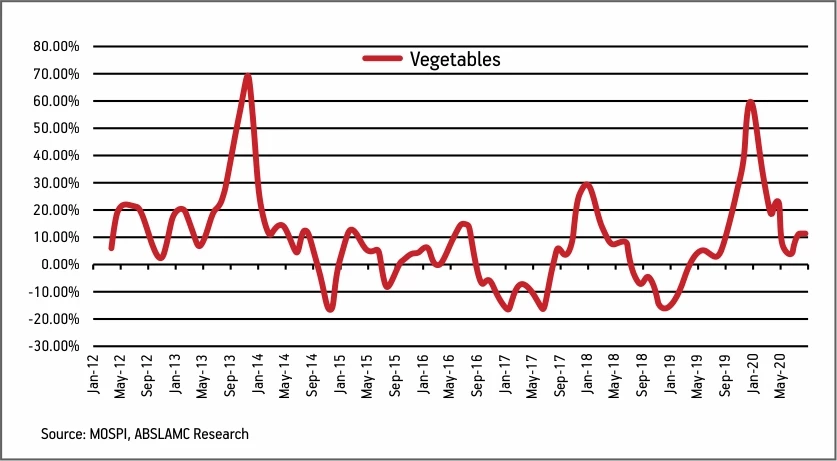

As for the third reason we can hypothesize that if supply chain is the reason for spike in food inflation then due to the nature of supply chain, the disruption would be more amplified in vegetable prices. Hence, if we look at vegetable prices the charts look something like the one below.

The actual data on supply chain of vegetables can simply be seen from the arrival of various vegetables to big mandis across the country. While the data is too big to be pasted here but that data itself confirms that there been a big fall in the amount of vegetables arriving at the top mandis across the country which has led to supply squeeze causing increase in prices as they have eclipsed any demand reduction.

Effect of rise in petrol/diesel & gold/silver prices

The price of these are influenced by international prices and the taxes imposed by the Government on these products. Gold prices are up more than 35% YoY as per CPI data due to spike in global prices of gold. Petrol prices are also up 12% YoY which is a function of tax imposed by the Government due to hike in excise duty on petrol/diesel. These are totally disconnected by the aggregate demand for these products, which as data shows has fallen sharply. Hence proper adjustment should be made for these.

What is core inflation data saying?

Now we come to core inflation which is more of a product of actual aggregate demand and thus should be the input for monetary policy construction. The actual construction of the core index by adjusting for all the above components is a tricky and difficult task and can cause problems in interpretation. Hence for the purpose of simplicity we will look at how the various aggregate demand components of core inflation have behaved.

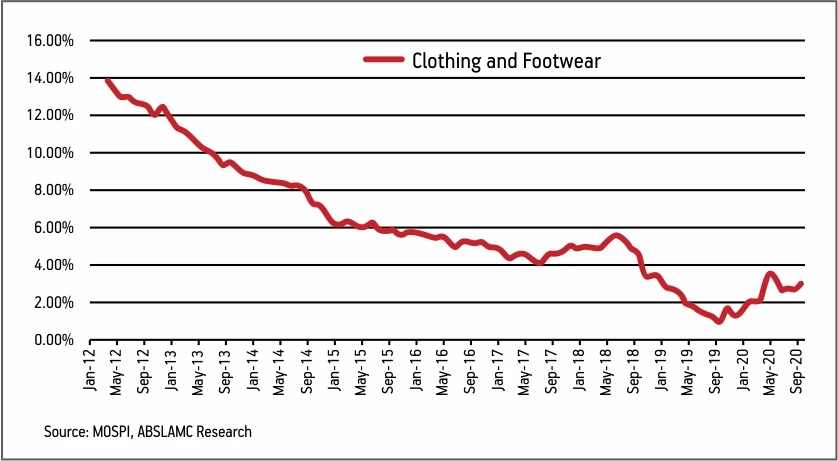

Clothing and footwear: It was going up after the sharp fall last year but has now stabilised.

Housing: It’s at the lowest levels.

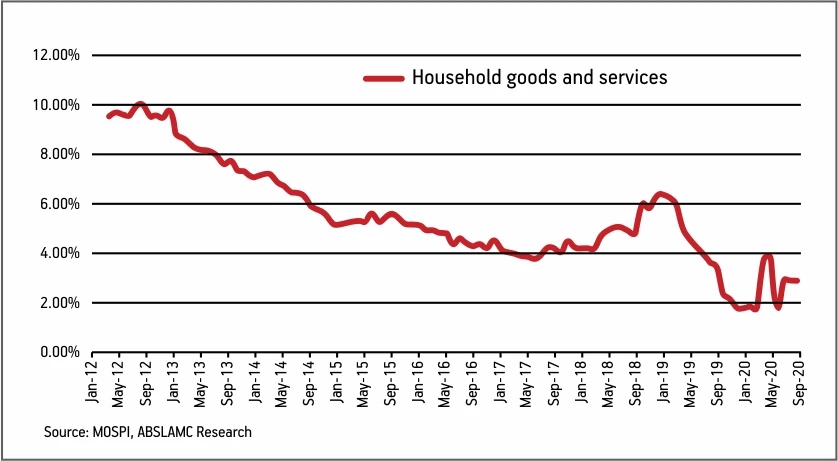

Household goods and services: It has again stabilised at low levels after going up from previous years’ absolute low levels.

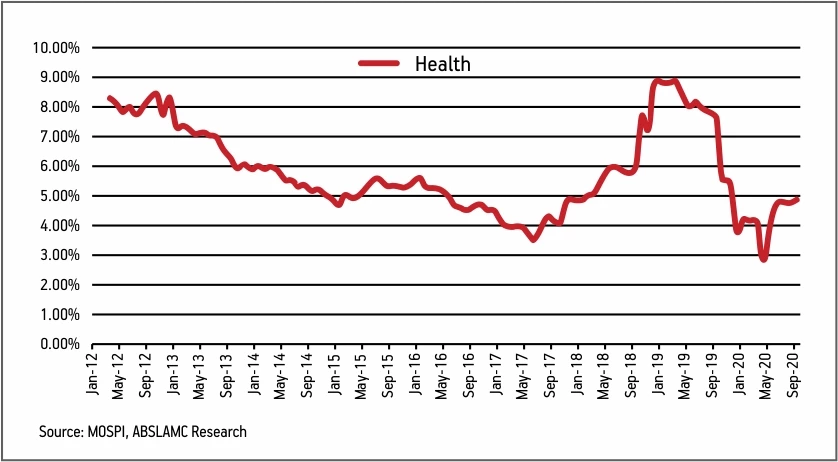

Health: It has gone up slightly as expected due to the situation surrounding the virus but is stabilising at low levels.

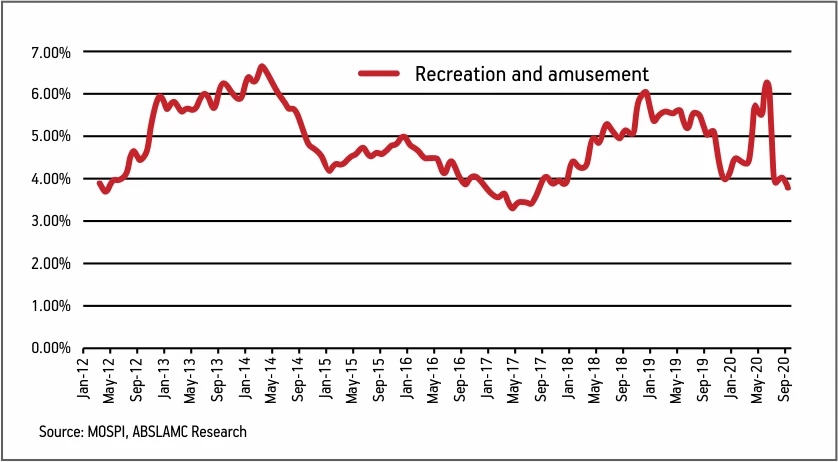

Recreation: This too is stabilising at low levels.

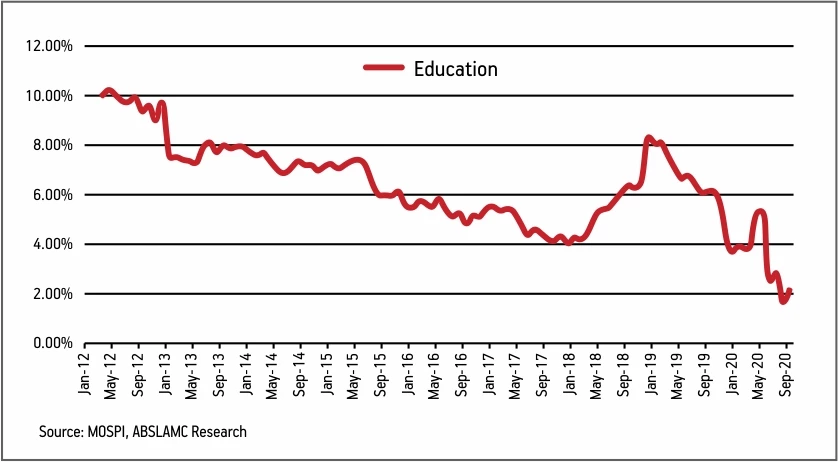

Education: It is at absolute low levels.

So we can see from the above charts that almost all compnents of core inflation have shown a tendency to go lower in the face of weakening of aggregate demand as can be expected.

A look at global inflation

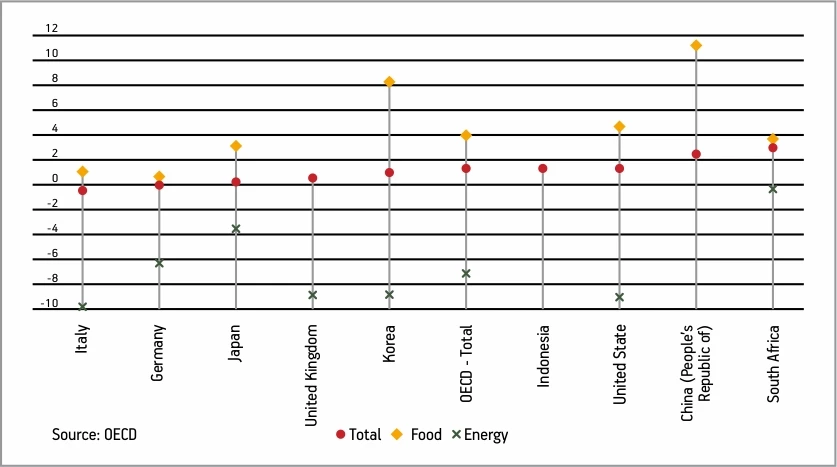

Since we are in the same boat as most of the countries worldwide it would be useful to see how is inflation is behaving in those countries. The data we have from the OECD (Organisation for Economic Co-operation and Development) website comprising of many developed markets (DM) and few other countries is as below:

As we can see from the above that in almost all the DM countries, we are seeing the same phenomenon that food inflation is trending much higher than the headline inflation. Even a country like China and Indonesia is facing the same phenomenon.

The evidence from global inflation rate also suggest that food prices have gone up globally though the evidence there is not very substantial to form a very definite conclusion on that front.

On overall basis however, the inflation levels are not a cause of concern.

Click here to learn about -

How to Beat Inflation

Current inflationary pressure transitory

The evidence till now thus suggests that while the spike in headline inflation is alarming, it should not be a concern from a monetary policy making perspective. The inflation at current juncture in India is confined to either food inflation or products (gold/silver & petrol/diesel) which do not have any correlation to the aggregate demand in the economy. Any monetary policy steps to counter such an inflation rise could hence be futile as it will only serve to hurt the aggregate demand and by extension growth prospects of an already fragile economy.

One counter to such an interpretation can be that while it might be true that the current inflation might not be an issue, however there is a risk of inflation-inflationary expectations vicious cycle. The episode of 2010-2013 comes to mind. However, we should remember that the current times are vastly different from that era as in those times we saw a widespread rise in asset prices and wages growth, which were a bigger contributor in inflation. That led to an increase in consumption ability of the consumer which fed inflation.

In the current era, what we have seen in last 6 months is that spending capacity of the consumer has gone down in line with growth which has led to fall in aggregate demand. That is why despite the disruption in supply chains the core inflation has not gone up. While there is a risk of higher food inflation feeding into generalised inflation, however that is counterbalanced by two factors 1) The level of growth is bound to cause a reduction in spending ability of the consumer which pulls down aggregate demand 2) While the food prices have gone up the rentals have come down in major cities. Rentals is an important and, in some case, most important raw material in many kinds of services and an important factor when making pricing decisions. Food prices on the other hand cannot be construed to be a major factor. It can be reasonably hypothesised that rentals have perhaps a bigger role in pricing decision in various products than food inflation keeping all other factors constant. Thus, to the extent rental price inflation doesn’t spike we are a bit insulated on service inflation front.

It seems that the inflation spike which we have seen due to unique factors associated with Covid-19 should be reason to be cautious but should not be a cause of concern. It should not be a determining factor in monetary formulation and growth should be at the forefront as the risks there are far more. RBI also has come to this conclusion and hence decided to look through the current bout of inflation as transitory. We quite agree to this viewpoint by RBI but at the same time the spike in food inflation is something to be very cautious of. In conclusion we continue to hold the view that the current spike in inflation is most likely to be transitory but with small caveat of remaining cautious on food inflation.

"The author of this article is a Fund Manager at Aditya Birla Sun Life AMC Limited"

The views and opinions expressed are those of Pranay Sinha, Fund Manager and do not necessarily reflect the views of Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”). ABSLAMC/ the Fund is not guaranteeing/offering/communicating any indicative yield on investments. The document is solely for the information and understanding of intended recipients only. If you are not the intended recipient, you are hereby notified that any use, distribution, reproduction or any action taken or omitted to be taken in reliance upon the same is prohibited and may be unlawful. Wherever possible, all the figures and data given are dated, and the same may or may not be relevant at a future date. In the preparation of the material contained, ABSLAMC has used information that is publicly available including information developed in-house. Information gathered and material used in this document is believed to be from reliable sources. Further the opinions expressed, and facts referred to in this document are subject to change without notice and ABSLAMC is under no obligation to update the same. ABSLAMC or any of its officers, employees, personnel, directors make no representation or warranty, express or implied, as to the accuracy, completeness or reliability of the content and hereby disclaim any liability with regard to the same. Recipients of this material should exercise due care and read the scheme information document (including if necessary, obtaining the advice of tax/legal/accounting/financial/other professional(s) prior to taking of any decision, acting or omitting to act. Further, the recipient shall not copy/circulate/reproduce/quote contents of this interview, in part or in whole, or in any other manner whatsoever without prior and explicit approval of ABSLAMC. The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s)."

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000