-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Markets are down. Know what is a bear cycle?

Oct 03, 2019

4 mins

5 Rating

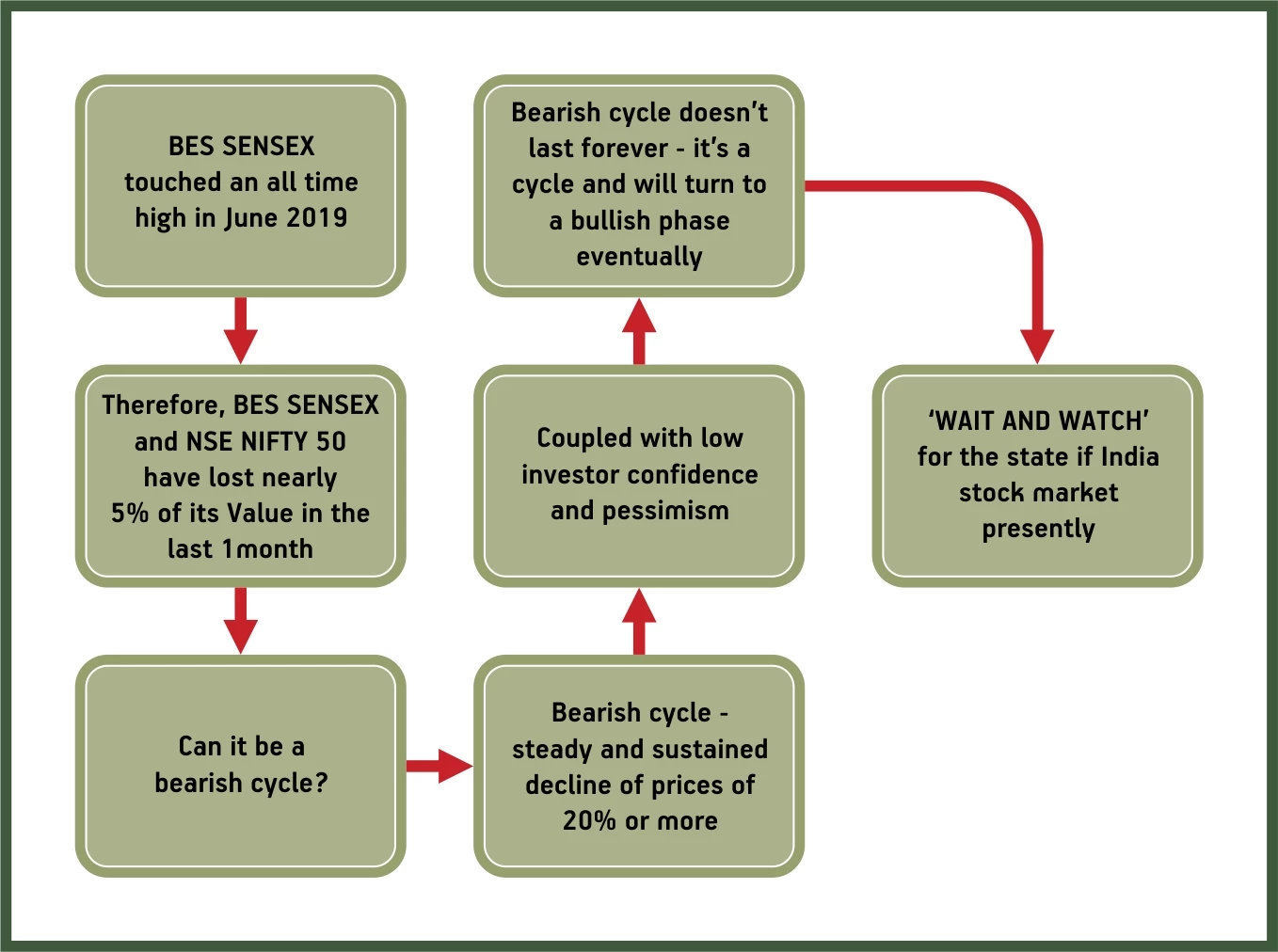

If you have been following the stock market recently you may have noticed a steady fall in its price levels, especially over the last couple of months. The market reached an all time high with BSE SENSEX touching 40312.07 in June this year1. Thereafter the market has been steadily declining.

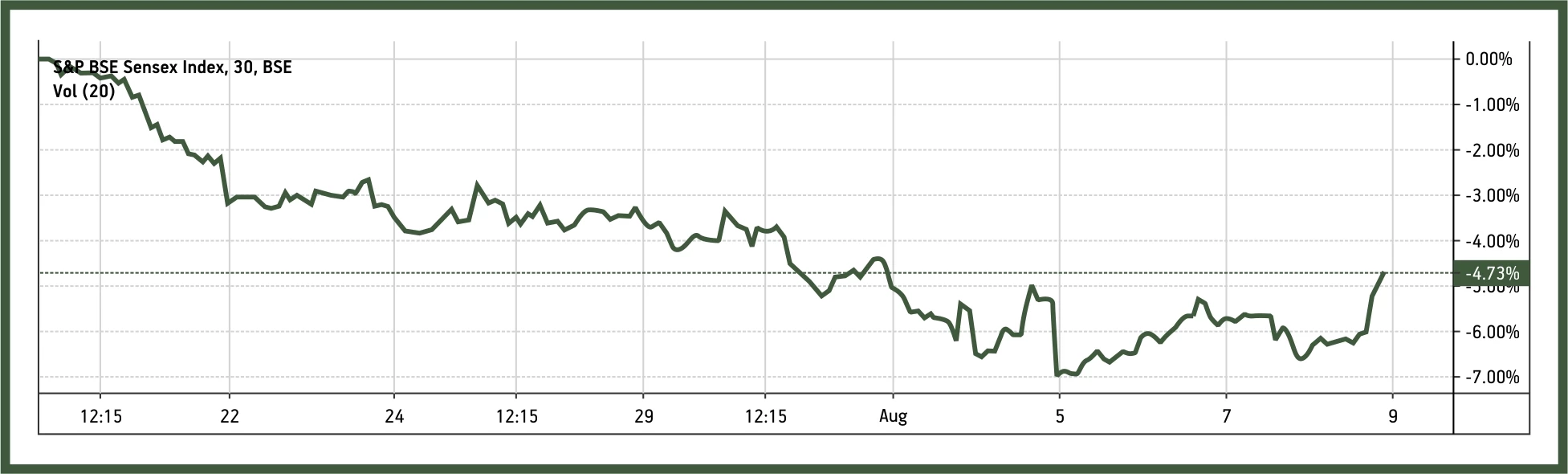

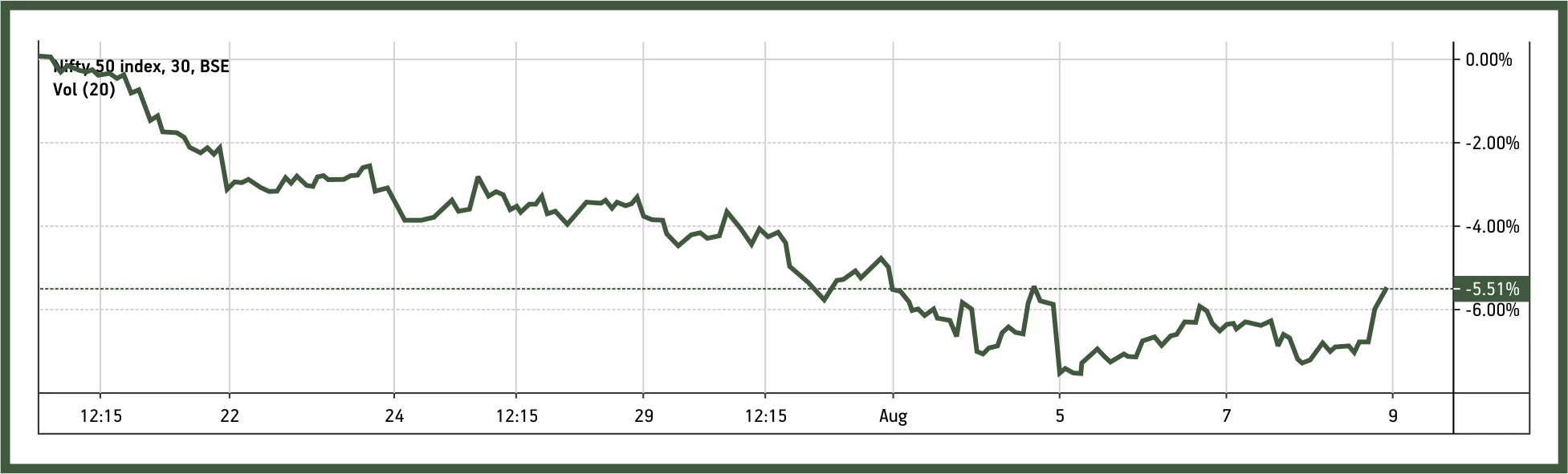

The markets have not reacted well to the Budget announced on 5th July with both the BSE SENSEX and NSE NIFTY 50 having seen a sharp decline, losing 4.73% and 5.51% of their respective values over the last 1 month2 (July 9 to August 8, 2019).

You have probably heard a lot of speculation around with several industry experts being quoted as saying that the market is entering its bearish cycle. So what is a bearish market?

-

Bearish market

A bearish market is a phase of the stock market where the prices of its stocks are steadily declining or expected to decline. While there is no hard and fast rule, it is widely accepted that a market enters its bearish cycle when stocks decline by more than 20% after reaching certain highs.

A bearish market is typically accompanied by pessimistic investor sentiment with investors anticipating a further and further decline. This generally causes fearful investors to liquidate their holdings in an attempt to cut losses which further pulls the market down in its bearish cycle.

-

How does a market enter a bearish cycle?

There are several factors that can trigger a bearish market such as:

- Recession in the economy leading to low income levels and consequently low demand and low production levels

- Low employment levels

- Uncertain political climate

- Unfavourable government policies

These factors coupled with weakening investor confidence can accelerate a market’s entry into a bearish cycle.

-

Can a bearish market last forever?

A bearish market however does not remain forever, it is cyclical. Once prices fall to a certain level, investors begin to pick up stocks they believe are undervalued. This triggers a flurry of purchasing activity which begins pushing the stock prices back up to end the bearish phase.

-

A bearish market is different from a market correction

A bearish market should not be confused with market correction, which is more a temporary fall in prices to correct overvalued stocks. A cyclical bearish market will have a more sustained decline in prices over a longer period of time.

-

Is the Indian stock market in a bearish market today?

While it may be too early to conclude whether the Indian stock market is facing a bearish phase or just a market correction, as it is yet to see a 20% decline in prices but the recent steady decline of stocks may indicate that it may just be well on its way there.

The key for you as in investor is to not panic and not go on a streak of liquidating your stock holdings. A wait and watch strategy may be more suitable to gauge where the market is headed. As a popular quote goes – ‘After every dark night there is a brighter day’, in the same way a bearish market cannot and does not last forever and will eventually be followed by a brighter phase of positivity and rising prices.

Sources:

1https://tradingeconomics.com/india/stock-market

2 https://in.tradingview.com/chart/nRSvk8wK/

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000