-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

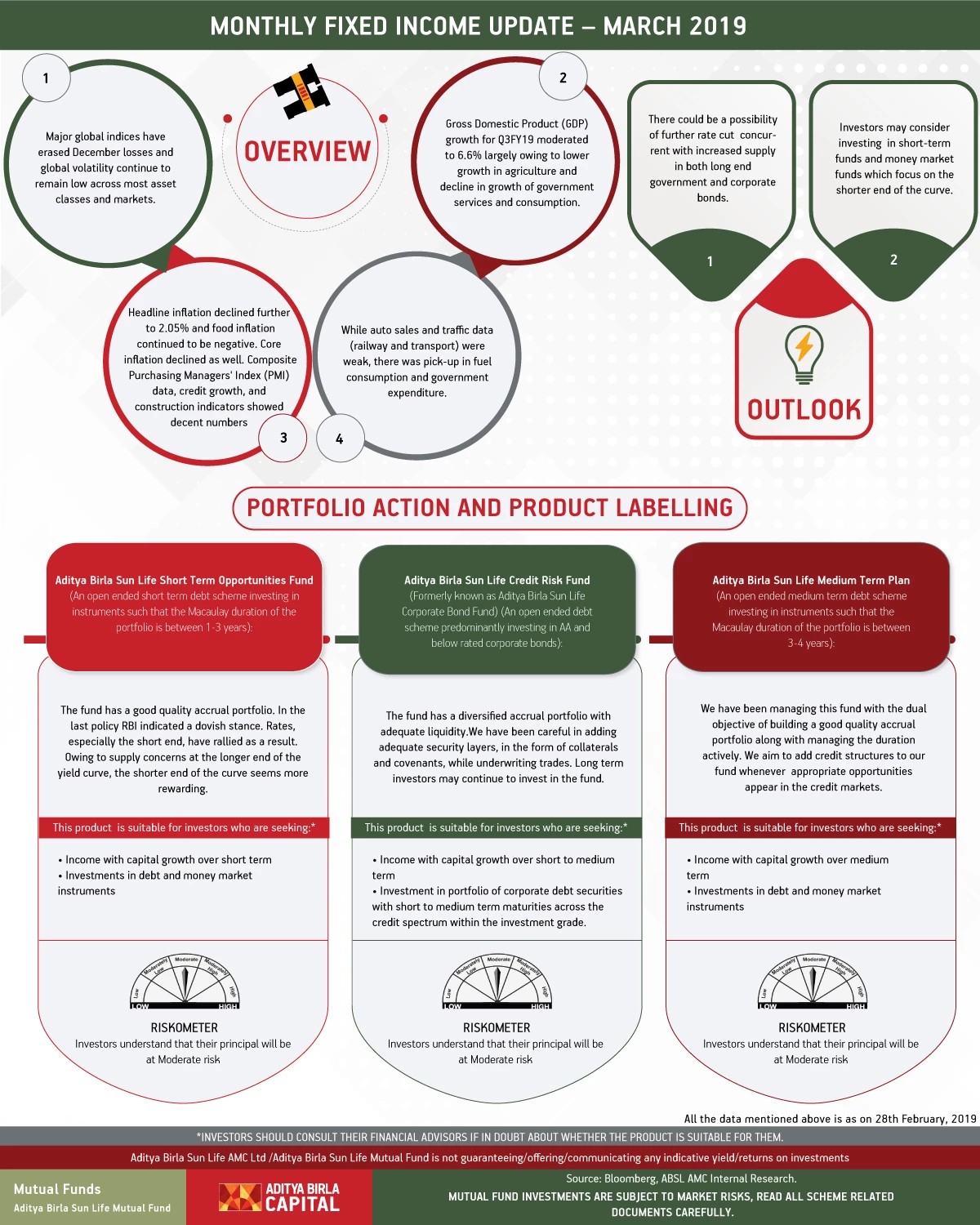

Monthly Fixed Income Update - March 2019

Mar 28, 2019

4 mins

5 Rating

Major global indices have erased December losses and global volatility continue to remain low across most asset classes and markets.

Gross Domestic Product (GDP) growth for Q3FY19 moderated to 6.6% largely owing to lower growth in agriculture and decline in growth of government services and consumption.

Headline inflation declined further to 2.05% and food inflation continued to be negative. Core inflation declined as well.CompositePurchasing Managers' Index (PMI) data, credit growth, and construction indicators showed decent numbers

While auto sales and traffic data (railway and transport) were weak, there was pick-up in fuel consumption and government expenditure.

Outlook

There could be a possibility of further rate cut concurrent with increased supply in both long end government and corporate bonds.

Investors may consider investing in short-term funds and money market funds which focus on the shorter end of the curve.

Source: Bloomberg, ABSL AMC Internal Research

Portfolio Action

Aditya Birla Sun Life Short Term Opportunities Fund (An open ended short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1-3 years):

The fund has a good quality accrual portfolio.In the last policy RBI indicated a dovish stance. Rates, especially the short end, have rallied as a result.Owing to supply concerns at the longer end of the yield curve, the shorter end of the curve seems more rewarding.

Aditya Birla Sun Life Credit Risk Fund (formerly known as Aditya Birla Sun Life Corporate Bond Fund) (An open ended debt scheme predominantly investing in AA and below rated corporate bonds):

The fund has a diversified accrual portfolio with adequate liquidity.We have been careful in adding adequate security layers, in the form of collaterals and covenants, while underwriting trades. Long term investors may continue to invest in the fund.

Aditya Birla Sun Life Medium Term Plan (An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3-4 years):

We have been managing this fund with the dual objective of building a good quality accrual portfolio along with managing the duration actively. We aim to add credit structures to our fund whenever appropriate opportunities appear in the credit markets.

All the data mentioned above is as on 28th February, 2019

Aditya Birla Sun Life AMC Ltd /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

1800-270-7000

1800-270-7000