-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

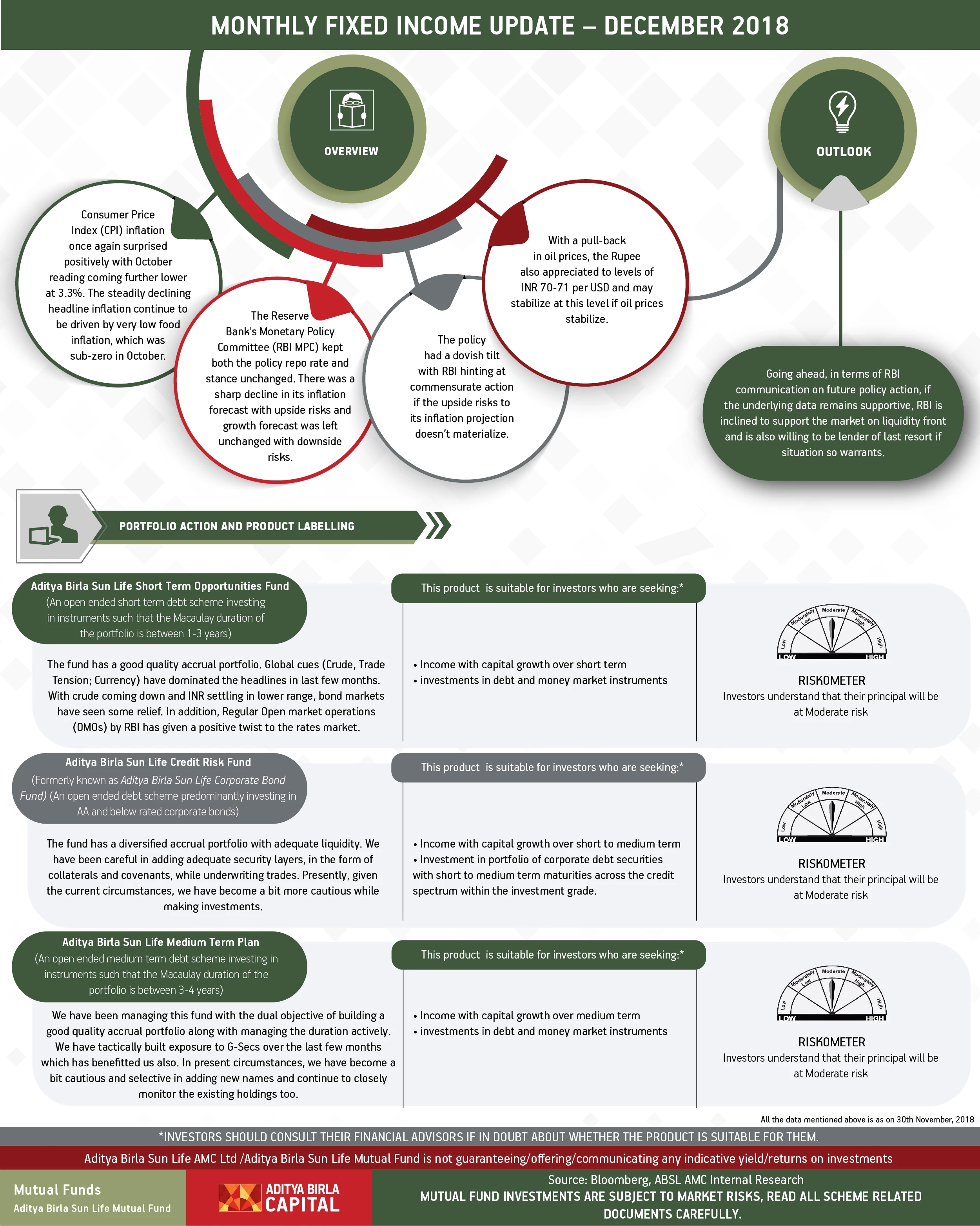

Monthly Fixed Income Update – December 2018

Dec 28, 2018

5 | Views 983

Consumer Price Index (CPI) inflation once again surprised positively with October reading coming further lower at 3.3%. The steadily declining headline inflation continue to be driven by very low food inflation, which was sub-zero in October.

The Reserve Bank's Monetary Policy Committee (RBI MPC) kept both the policy repo rate and stance unchanged. There was a sharp decline in its inflation forecast with upside risks and growth forecast was left unchanged with downside risks.

The policy had a dovish tilt with RBI hinting at commensurate action if the upside risks to its inflation projection doesn’t materialize.

With a pull-back in oil prices, the Rupee also appreciated to levels of INR 70-71 per USD and may stabilize at this level if oil prices stabilize.

Outlook

Going ahead, in terms of RBI communication on future policy action, if the underlying data remains supportive, RBI is inclined to support the market on liquidity front and is also willing to be lender of last resort if situation so warrants.

Source: Bloomberg, ABSL AMC Internal Research

Portfolio Action

Aditya Birla Sun Life Short Term Opportunities Fund (An open ended short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1-3 years):

The fund has a good quality accrual portfolio. Global cues (Crude, Trade Tension; Currency) have dominated the headlines in last few months. With crude coming down and INR settling in lower range, bond markets have seen some relief. In addition, Regular Open market operations (OMOs) by RBI has given a positive twist to the rates market.

Aditya Birla Sun Life Credit Risk Fund (formerly known as Aditya Birla Sun Life Corporate Bond Fund) (An open ended debt scheme predominantly investing in AA and below rated corporate bonds):

The fund has a diversified accrual portfolio with adequate liquidity. We have been careful in adding adequate security layers, in the form of collaterals and covenants, while underwriting trades. Presently, given the current circumstances, we have become a bit more cautious while making investments.

Aditya Birla Sun Life Medium Term Plan (An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3-4 years):

We have been managing this fund with the dual objective of building a good quality accrual portfolio along with managing the duration actively. We have tactically built exposure to G-Secs over the last few months which has benefitted us also. In present circumstances, we have become a bit cautious and selective in adding new names and continue to closely monitor the existing holdings too.

All the data mentioned above is as on 30th November, 2018

Aditya Birla Sun Life AMC Ltd /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Rate this

Rate this Article

Our Experts

Our Experts

Tools and Calculator

Tools and Calculator

RSS News Feed

RSS News Feed

Archives

Archives

Close

Hover to Zoom

1800-270-7000

1800-270-7000

Thank You

Message will change according to your requirement.