-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Noticeable takeaways from Budget 2021

Feb 03, 2021

6 mins

4 Rating

Author: Maneesh Dangi, CIO – Fixed Income, Aditya Birla Sun Life AMC Limited

The Union Budget of FY2022 brings economic resurgence to the centrestage. An expansionary budget, that looks at stimulating the key levers of growth, while making way for an ideological shift in its fiscal consolidation roadmap. The message is clear, India 2.0 of the post-Covid era will prioritise growth over anything else. On a close reading of the Budget, following are the key takeaways that bears prominence in my assessment.

The ideological constraint of running tight fiscal policies has been abandoned for good

Ideological shift in public debt policy and economic policies of our economy paves way for loose fiscal policies over next five years in comparison to previous five years. The routine cut-the-capex in wake of low revenues and stiff budget targets won’t be binding constraints now. As such, over next five years, the Fiscal Deficit (FD) is likely to be 5% vs last 5 years (pre-pandemic) at 4%. So public policies will remain stimulative for many years. Government is correctly utilising the space provided by the current low interest rate regime and global fiscal consensus of higher deficit to give a strong push to growth.

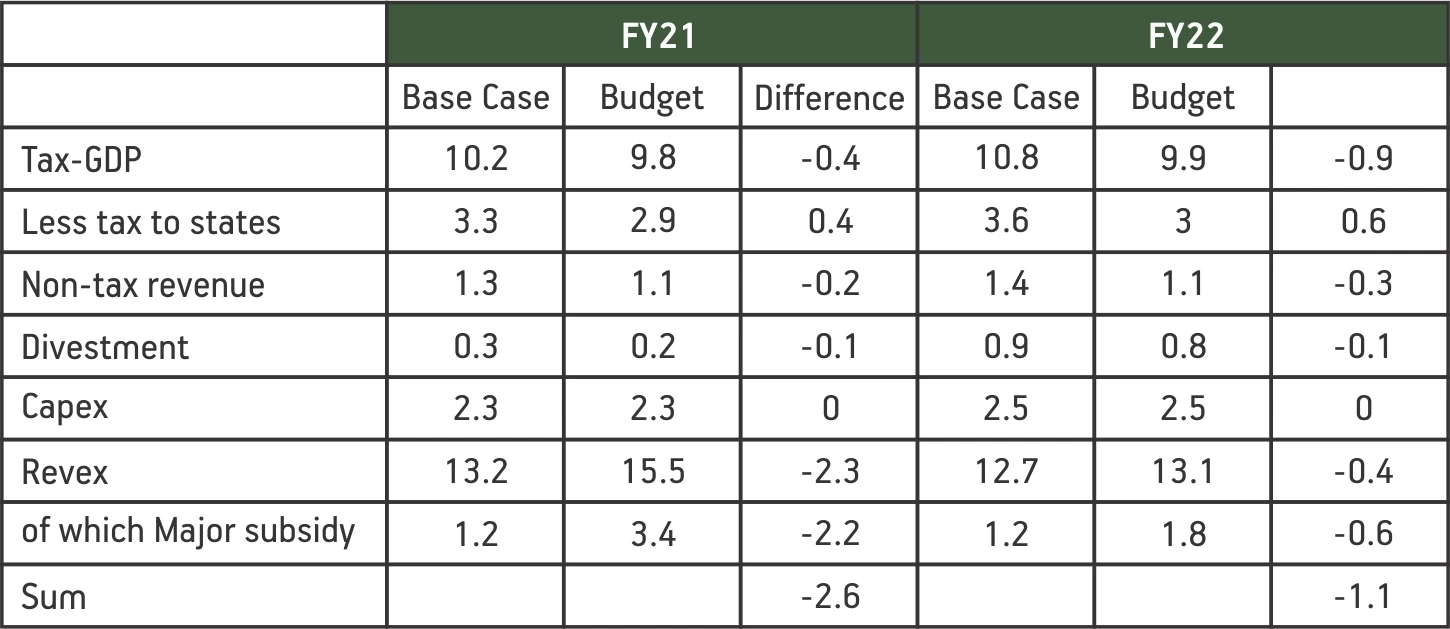

The expenditure as percentage of GDP is budgeted at 15%+ vs 12.25% in FY17-19. So what’s being told by many that Budget is giving negative fiscal impulse is incorrect. For the current year, since 60bp increase is for interest and 2% for subsidies [very large part is simply accounting entry, Food Corporation of India (FCI) 1%, Fertiliser 25bp, so only 75bp is subsidy that was stimulative]. Accounting for all of these, the expenditure as % of GDP will be (17.7% - 1.25% subsidy transfer - 0.6% interest = 15.75%). In FY22, same adjustments will mean expenditure will be 14.6% (15.6% -60bp interest – 40bp subsidy). During FY10-13, when our fiscal policies were loose, we ran 15.2% of expenditure as % of GDP, and pre-pandemic the run rate had fallen to 12.5%, but the same number is about 14.5% of GDP of previous 25 years. The likely glide path for fiscal is as following:

Source: Budget documents, ABSLAMC Research

No demand side push, so different sort of public polices

This is not a typical crisis budget which cut consumption taxes. MNREGA spend is likely to come down to 75k from 110k this year. I have written this many times that the current policies are akin to what has been followed by east Asian economies (1950-80 in Japan, 1970-90 Korea, 1990 onwards in China) which focused on supply side (targeted manufacturing and state push for hard infra). Given that India has poor infra and cost of running business is still high, it’s best to emulate east Asian developmental model, i.e. to use state money to build infra and other capital assets (directly by states or by nudge through schemes like PLIs). The Capex is rising by 25% yoy over last two years (excluding spectrum and DFI funding too). As % of GDP, it will rise from 1.7% (pre-pandemic 5 years) to 2.3% & 2.5%.

Opportunistic kitchen sinking

The crisis has been used to bring the deficit on balance sheet. Large part of FCI loans are slated to be paid back to National Social Security Fund (NSSF) in FY21 and FY22 (220k and 50k, 1% and 0.5% of GDP). FCI loan will shrink from 300k in Dec-2020 to 70k in Mar-22. Fertiliser subsidy was 133k from usual 70-80k. Most of this clean-up is happening in FY21 itself as next year’s fertiliser subsidy is 80k only. While it’s not a big deal since analyst community was well aware of these off balance sheet liabilities, yet transparently accounting for it simply suggests Government isn’t obsessed with some fictional level of right budget balance and is ready to start off with clean state. Don’t begin to imagine that there won’t be any window dressing yet again. Kitchen sinking simply gives it more space to do it yet again. The only binding constraint for public debt is inflation in near term and primary balance in medium term. I am happy that much of the impairment the country faced in the name of tight fiscal policies over past few years is being reversed in this budget.

Understated revenue growth, so scope of positive surprise exists

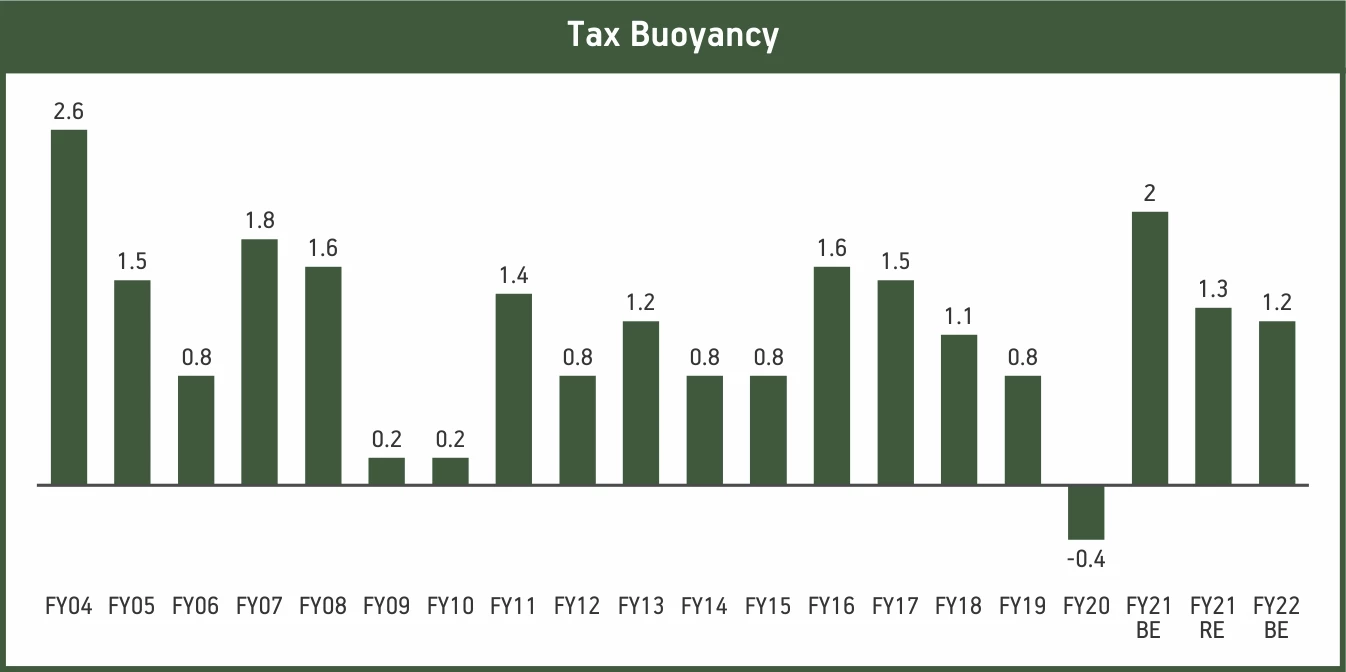

First time over past 20 years of budget watching, I can say it safely that our fiscal deficit numbers are overstated (6.8% vs 6%), revenue is understated (Gross tax is assumed at 10% vs likely 11%, no spectrum revenues have been considered), growth too has been understated (14.4% nominal vs what we think at 17%), divestment numbers are certainly achievable (BPCL privatisation and LIC IPO). Even this year’s revenue estimates are very conservative and there is a scope of surprise there (of about 50bp). Even in FY21, tax buoyancy (tax growth to nominal growth) was higher than 1. Since I think GDP growth will be 17% (nominal), I won’t be surprised if tax buoyancy rises dramatically (1.4 in FY11 = 23% growth in tax revenues vs projected at 17%).

Source: Budget documents, ABSLAMC Research

Expect a big boost to GDP in Q4 of FY1

Capex will be up 61%, revex 92% in Q4FY21. Even tax revenues are likely to be growing much faster than what is budgeted. The way our GDP is calculated, this sharp rise in govt spending will give a big boost to GDP growth. I continue to think that street is still under-appreciating the scale of rebound. The growth contraction will be lower in FY21 than what is commonly believed (our estimate -6% vs street at -8%).

Bad bank & Development Financial Institution (DFI) are great ideas

Bad bank, the way it’s envisaged, won’t release capital but will free up human resources of PSU Banks and making resolution easier. I think PSU banks will fire up retail credit like never before. Setting up a DFI with clear target of 500k book (unlike National Investment and Infrastructure Fund, which couldn’t fulfil the desired outcomes - again tells us that PPP is not a viable idea to begin with) is going to help banks vacate the infra project financing and focus on what they should do, working capital (WC) & retail loans. PSU banks can now focus on rule-based lending (retail, WC). I think, together, these two announcements can fire up credit (from PSU Banks, whose share had fallen to less than 25% in FY17 (due to AQR) and would perhaps rise to 50%+ in this year, taking it even higher in FY22). I also think the need to recapitalise bonds or equity isn’t there now. Markets will be willing to fund the PSU bank franchises if they commit to grow only retail book (along with regular WC funding & high grade corporate financing).

Privatising banks/other firms, selling spare assets, FDI policy

This is such a big ideological shift, yet again. First time, privatisation word is being used unabashedly by any government (it was used as divestment even by most liberal govt ever in early 2000s). Remember the ruckus that was created during 2001-03 for such a move? No such resistance exists today. India is on its way to privatise most of the legacy assets (Banks, state land). The asset rotation strategy is being embraced today. FDI in insurance has moved to 74%. That makes us the most open country for FDI. My view remains that India is likely to get 3-4% of GDP as FDI (vs less than 2% over past 5 year).

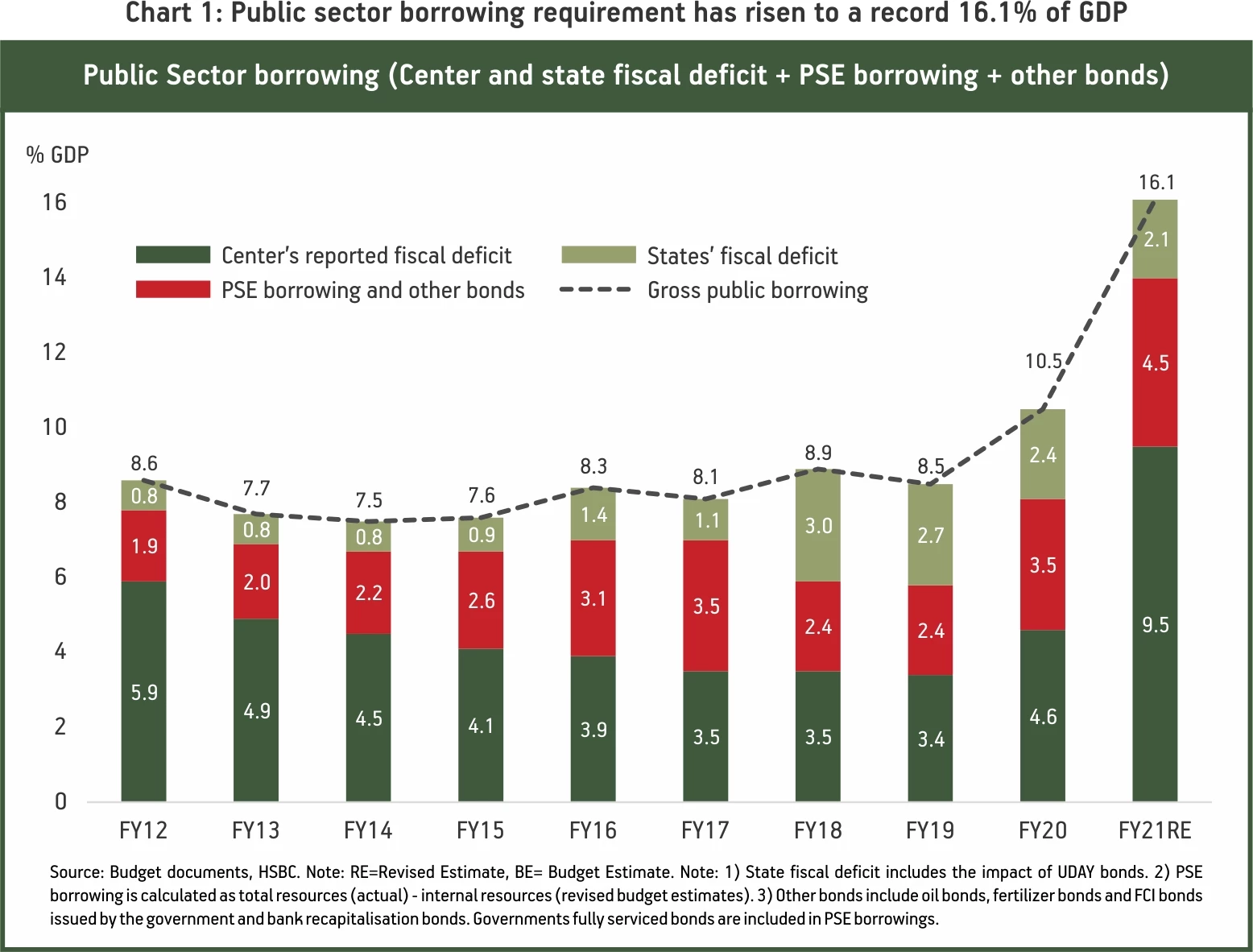

Borrowing is going to be a challenge, but it is left to RBI to manage it

Total centres’ borrowing is pegged at 12 lakh crore (more or less same as this year) and net at 9.25 lakh crore (vs 10.50 lakh crore). States will borrow about 9 lakh crore (4% of GDP). Together, 21 lakh crore of borrowing in next fiscal year. More or less the same but not in such a benign condition (RBI isn’t likely to be as dovish next year). So this means that Indian curves will stay steep and path of least resistance is going to be higher bond yields.

Source: Budget documents, ABSLAMC Research

To conclude, an expansionary fiscal policy in times of crisis will boost GDP through direct and indirect multiplier effects leading to higher GDP growth which in turn will facilitate buoyant revenue collection in the medium term, and thereby enable a sustainable fiscal path. A loose policy complemented by new ways of spending (PLIs, low corporate taxes) and appropriate/targeted tariff structures could usher in a new wave of growth in our country.

The views and opinions expressed are those of Maneesh Dangi, CIO – Fixed Income and do not necessarily reflect the views of Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”). ABSLAMC/ the Fund is not guaranteeing/offering/communicating any indicative yield on investments. The document is solely for the information and understanding of intended recipients only. If you are not the intended recipient, you are hereby notified that any use, distribution, reproduction or any action taken or omitted to be taken in reliance upon the same is prohibited and may be unlawful. Further, the recipient shall not copy/circulate/reproduce/quote contents of this document, in part or in whole, or in any other manner whatsoever without prior and explicit approval of ABSLAMC.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000