-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Patience is a significant virtue for investors

Dec 02, 2019

4 mins

5 Rating

Chetan Lakhotiya

Chetan Lakhotiya

You, as an investor, will always look for a one-stop-shop for all your financial needs and rightly so. What you should opt for is a portfolio manager who helps you diversify your investments and at the same time takes care of needs like life and medical insurance, tax exemption etc. You can start with a Term plan for your dependents, and then invest in a good medical insurance. These two must be the beginning of your financial journey, if not already started. These are necessities, while the rest of investing is about profits.

First things first

Are you clear on your goals?

What are your goals for which you are planning to invest in mutual funds? Chalk them out and stick to them. If you started investing with the goal of buying a house, you must not change the goal mid-way to higher education.

How long do you want to invest for?

Define an investment period along with the goal. I want to buy a house in 15 years or I want to buy a car in 5 years. The advisor will then recommend you mutual fund schemes on the basis of your investment term.

Have you considered inflation?

Owing to inflation, hypothetically speaking, a cup of ice cream that costs you Rs 100 today may cost you Rs 112, 15 years from now. Is there any use of an investment vehicle that fetches you Rs 105 in return? No.

Similarly, if you plan for retirement and plan to retire at 65, the generated income and returns must be such that they provide for you comfortably for the remaining 20-25 years while taking the inflation into consideration. You must always factor in inflation.

Can you stay invested?

What investors today lack the most, is patience. Each time the market goes through a lull, there are so many of them wanting to redeem investments. If you look at the market, the Sensex has grown from 100 points (1st April 1979) since its inception to 40,000 today (30th October 2019). Do you think that happened without volatility? Yes, you will see negative returns from time to time but the market will bounce back, always. You shall see relatively stable returns in the longer term always.

Where and how to invest?

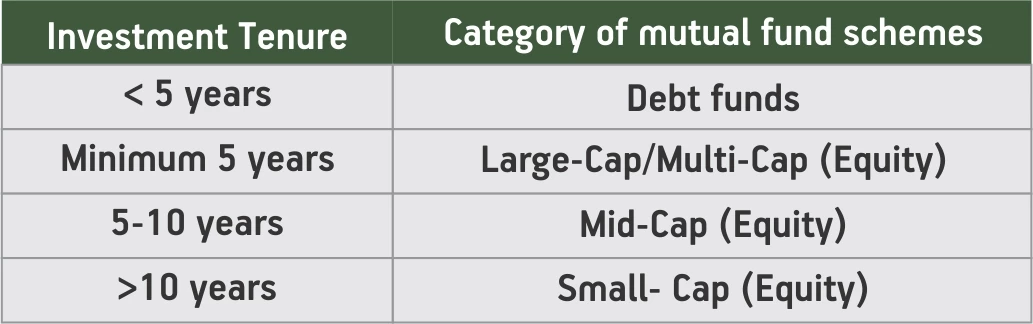

If you are investing in mutual fund schemes, below are the guidelines you can follow -

These are, of course, only suggestive of a certain type of portfolio and can vary depending on your risk appetite. Having said that, a bit of exposure to equity mutual fund schemes can be considered even for the risk-averse investors since pure debt might not help you in beating inflation.

A systematic investment plan (SIP) is one of the ways of leveraging the returns while still averaging out your risks/costs. If you want to invest a lump sum amount, it is better to invest it in a debt fund and start a systematic transfer plan (STP) to the equity scheme of your choice. This helps you in countering the market fluctuations to a certain extent.

Last bit of advice

Give your investments at least 2-3 years before you decide to monitor and reshuffle your portfolio. It takes that much time for you to be able to gauge the performance of various schemes. And when you do, make sure you have considered all the macro and microeconomic factors before deciding to pull out.

Lastly, this debate about direct Vs indirect investments is a moot point. If you are self-medicating, you have to be aware of all the risks before you do it. Else, you must see a doctor. Similarly, advisors advise you on wealth creation. Whichever medium and vehicle you choose, it is important to be fully aware of the risks and outcomes. Remember, investments are about probabilities, not certainties.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000