-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABSL BSE India Infrastructure Index Fund is Live Now

Plan for Retirement: Solving the Puzzle Piece by Piece

Oct 05, 2024

5 min

4 Rating

Spending time with friends on a Saturday evening, we often talk about how lovely it would be to retire after a week of hard work. Some want to live near a beach or mountain, away from the city’s hustle and bustle. Some want to learn guitar, sell ladoos and snacks, travel the world, or read all those books they couldn't in their busy schedule. While we all dream of a lovely and peaceful retirement, the fact remains that you still need money to meet your expenses. And with old age, medical expenses will only grow.

While planning on how you will spend your time during retirement, it is also important to plan out the financial puzzle piece by piece.

How to begin retirement planning?

Determine your retirement corpus: Any financial planning begins with a pre-determined goal, put down in rupee terms. Think aloud, take a pen and paper and try to come up with a figure that you would need to retire comfortably.

To arrive at this figure, consider looking at your current monthly expenses and add the effect of inflation and medical expenses to account for old age. Make sure you have at least 70-80% of your current income coming as passive income from your investments to maintain a comfortable lifestyle during retirement. And this is only for your retirement income. You also need an emergency fund and some amount for recreation.

Determine your retirement age and investment tenure: Once you know the amount you need to retire comfortably, determine your current financial standing. Try answering these questions: How much money have you saved for retirement? What is your current age and planned retirement age? The bigger the gap, the smaller the amount you need to invest monthly to achieve your retirement corpus.

Plan an investment strategy: There is no specific age to start investing for retirement. Your investment strategy will depend on how much money you need and your investment tenure. The earlier you start, maybe in your 20s, the more freedom you have to experiment with risky investments and build a larger corpus to retire wealthy. Suppose you plan to retire at age 60, you will have 40 years to invest and build wealth. You could consider investing a large portion in equity-oriented mutual funds.

Even if you are in your 30s, you can save up a good amount towards your retirement fund. The shorter the investment horizon, the more aggressive your investment strategy. You may have to invest a larger portion of your income towards retirement.

Create multiple sources of income: While investing for retirement, ensure you build multiple sources of passive income, such as rental income from a property, dividends from mutual funds, interest on fixed deposits, annuities and pension funds. The diversification should be such that you get a minimum fixed income across all market cycles.

Solving the retirement puzzle piece by piece through SIP

Planning for retirement could be intimidating. It may seem like a complex puzzle. But you can solve this puzzle piece by piece. If you haven’t yet started saving for retirement, here is an action plan to get you started.

A Systematic Investment Plan (SIP) is a method of investing in mutual funds that allows investors to invest a fixed amount of money at regular intervals.

Start a Systematic Investment Plan (SIP) as soon as possible and diversify your investments.

If you are in your 40s or 50s and haven’t yet started planning for retirement, it is time to save those bonuses in the retirement pool rather than splurge it on a luxurious vacation. As the saying goes, better late than never.

Invest some money in equity mutual fund schemes even if you are a risk-averse. They can give you inflation-adjusted returns and help build wealth in the long term.

When determining your SIP amount for your retirement pool, you could consider the following strategies:

Investing a certain percentage of your income in SIP. Your SIP amount will grow with income, enhancing the compounding effect of mutual funds.

Create a separate SIP for every goal. For instance, one SIP could be to build a passive income pool for your household expenses during retirement. One SIP could be for emergency funds, one for medical expenses, and one for recreation.

Create a budget to invest the surplus amount left after discretionary and essential expenses. For instance, you earn Rs. 60,000/month, and Rs. 30,000 goes into monthly and Rs. 10,000 on discretionary expenses. You could allocate 60-80% of your Rs. 20,000 surplus towards retirement. It is just an example. The allocation will change for every person depending on their financial situation.

Start saving for retirement with Aditya Birla Sun Life Frontline Equity Fund

Aditya Birla Sun Life is an open ended equity scheme predominantly investing in large cap stocks. The objective of the scheme is long term growth of capital, through a portfolio with a target allocation of 100% equity by aiming at being as diversified across various industries and/ or sectors as its chosen benchmark index, Nifty 50.

There is no one-size-fits-all approach to the retirement puzzle. Instead of delaying investments just because you can’t figure out the puzzle, you can start investing and join the pieces which you can. Over time, you will be surprised to see the significant amount of the puzzle you have solved, taking things as they come.

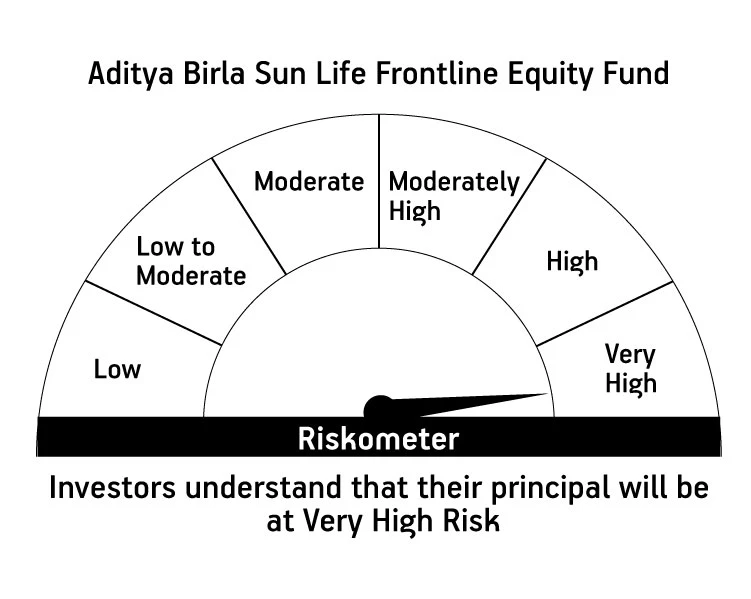

| Aditya Birla Sun Life Frontline Equity Fund | ||

| (An open ended equity scheme predominantly investing in large cap stocks) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000