-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

Plan for your Retirement like a Pro

Jun 24, 2019

6 mins

5 Rating

We all know the famous story of the ant and the grasshopper. The grasshopper delayed storing food for winter, as it seemed too far away when the sun was shining nice and bright. Retirement planning could suffer a similar fate as we tend to prioritise near term goals like child’s education, buying a house over planning for retirement. However, if we want to live independently and maintain our lifestyle in the post retirement years, careful planning is necessary.

Here is an easy guide to help you retirement comfortably.

-

What are your monthly expenses?

Analyse your monthly expenses and identify those, which will continue post retirement. For e.g. if your current monthly expenses include your son’s school fees, you can exclude them. However, grocery expenses, electricity and gas bills are expenses, which will continue after you retire too. In addition, some expenses like medical bills increase, as we grow older. So make a list of all your likely expenditures post retirement.

-

When do you plan to retire and your life expectancy?

This helps you determine the amount of money you need to save for your retirement. For e.g. your current age is 40, you will retire at 55 and expect to live until 70. Then you need to determine the amount you need to save to manage your expenses for 15 years post retirement.

-

Amount you will need to maintain a similar post retirement lifestyle?

The amount of money you need post retirement will be higher than your current expenses due to inflation. Assuming the rate of inflation in non-discretionary expenses is 7%, if your monthly expenses are Rs. 20,000 currently and you will retire after 15 years. Then you will need Rs. Rs. 55,180 to meet your monthly expenses post retirement.

(Monthly expenses post retirement=Current expenses * (1 + Rate of inflation) ^ Number of years till retirement)

These monthly expenses are assumed to grow every year at 7%. Use this formula to gauge how much you need to save for your retirement years.

Alternatively, you can use Aditya Birla Sun Life Mutual Fund’s Retirement calculator available to understand the increase in expenses and the retirement kitty you need to save. Please find its link below:

https://mutualfund.adityabirlacapital.com/Investor-Education/RetirementCalculator.html -

How much to save?

Calculate how much savings do you currently have earmarked for retirement. Make a rough estimation of expected investment returns based on how much you would be investing in equity and debt products. Use the expected return values to arrive at approximate future value of your investments. You can use Aditya Birla Sun Life Mutual Fund’s retirement calculator to calculate the monthly savings required for you to meet your goal. Please find its link below:

https://mutualfund.adityabirlacapital.com/Investor-Education/RetirementCalculator.html -

Where can you invest?

Your investment decisions depend upon your risk appetite and time for retirement. If you have started retirement planning early (you are in 20s), you can invest in 100% equities in the initial few years and gradually reduce your equity exposure. If your retirement is only five to 10 years away, you may have higher or all allocation to debt.

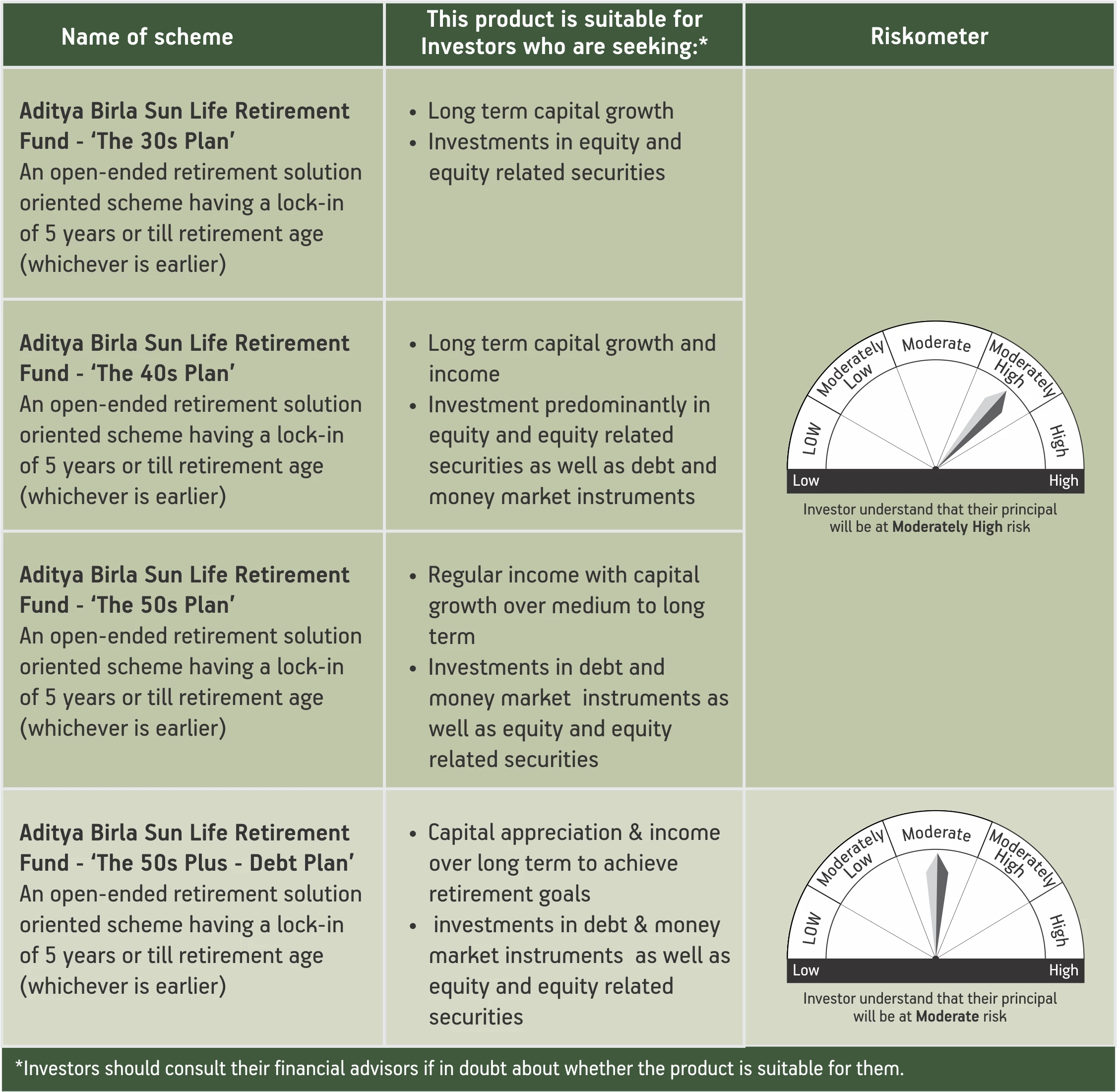

Aditya Birla Sun Life Mutual Fund offers a Retirement fund named Aditya Birla Sun Life Retirement Fund*, an open-ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier), which provides a trigger facility to automatically change the equity and debt allocation based on your age. The fund offers four investment options customized for different age groups and risk profiles. The 30s plan has 80-100 % of the corpus invested in equity while the remaining amount is invested in debt. The 40s plan has a flexible equity exposure between 65-80% and the 50s plan has a flexible debt exposure in the range of 75-100%. In addition to these, there is a 50s Plus Debt Plan, which invests 100% in debt and money market instruments. You may start an SIP in this fund to automate your retirement investing.

*For further details, refer SID/KIM of the Scheme

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000