-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Planning to invest in Multi cap fund? Here are 5 factors that you need to consider

Apr 23, 2021

2 mins

4 Rating

As the name suggests, multi cap funds invest in stocks across various market caps such as large cap, mid-cap and small-cap. As per SEBI’s regulation, multi cap funds have to invest at least 25% of the investment portfolio in large cap, mid-cap and small-cap stocks, respectively.

If you are planning to invest in multi cap funds, here are a few aspects that you need to be aware of before investing in a multi cap fund.

Goals & Investment horizon

Multi cap funds are pure equity funds. Equity funds can be highly volatile in the short run. However, it has the potential to deliver reasonable returns in the long run. This makes equity funds ideal investment options for investment goals that are at least five years away. So, multi cap funds could be suitable for your long term goals with investment horizon of at least 5 years.

Risk tolerance:

Multi cap fund managers invest the funds raised from investors in equity markets. As equity investments can be volatile in the short run, you need to have a greater risk tolerance to handle the volatility.

Portfolio allocation:

As per the new multi cap fund regulations by SEBI, fund houses have to invest at least 25% of their portfolio in large cap, mid cap and small-cap stocks. You need to consider this new portfolio allocation if you want to invest in a multi cap fund. If you do not have such a fund in your existing portfolio then a multi cap fund could be good addition to your portfolio since it combines the mighty large caps with the growth potential of mid caps and large caps in one portfolio.

Expense Ratio:

Fund managers actively manage multi cap funds, and fund houses charge a fee called expense ratio covering the fund management expenses and marketing and operational costs. It is an annual expense. The expense ratio may not seem like a lot. However, the expense ratio may turn into a high cost over the long-term investment. So, compare the expense ratio before investing in a multi cap fund.

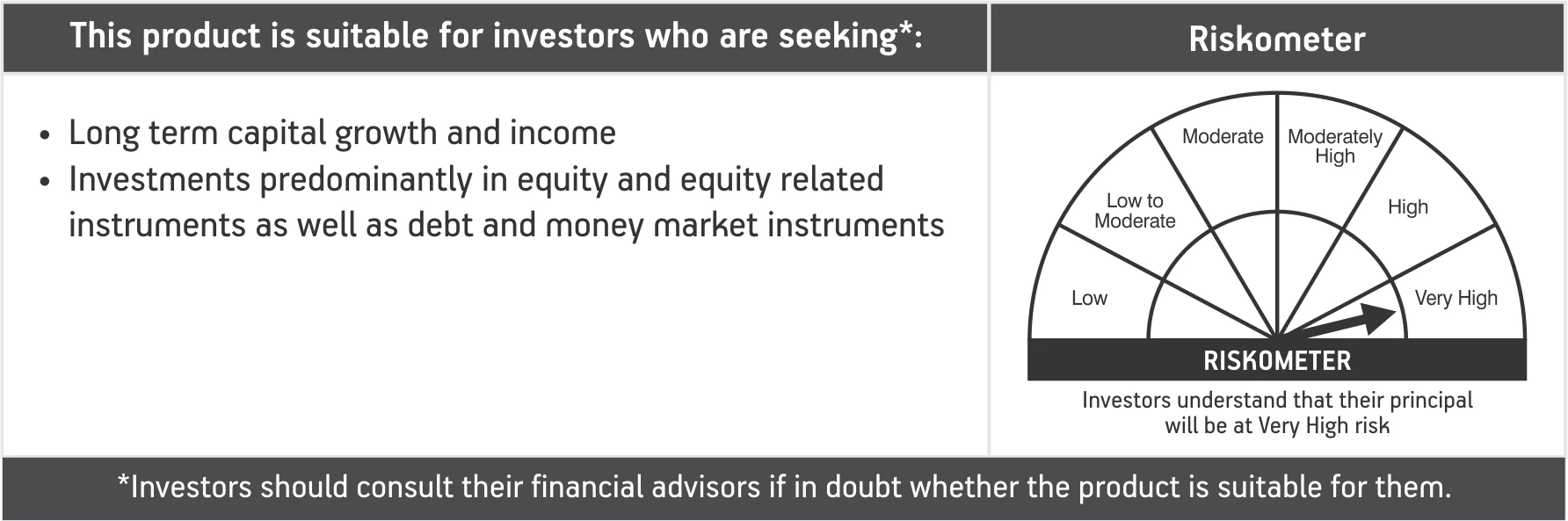

Presenting Aditya Birla Sun Life Multi-cap Fund, an open ended equity scheme investing across large cap, mid cap & small cap stocks. The fund is mandated to invest at least 25% exposure each in Large, Mid & Small Cap segments. For more information on this fund or to invest, click here: https://bit.ly/3gjl0R1

The product labeling assigned during the NFO is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

For more information on the scheme, please refer to the SID/KIM of this scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000