-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Tips for Portfolio diversification with Multi Asset Allocation Fund

Jan 14, 2023

4 min

4 Rating

‘Balance’ is a much-sought criteria by all of us and in all aspects of life. From balancing work life and personal life, balancing family, and friends to balancing our incomes with our expenses. Balance is truly one of the key mantras for a happy successful life!

Our investing life is no different, we always seek out balance – balance of returns via-a-vis risk, balance amongst asset classes, balance amongst investing time frames and so on.

Diversification is the key for investing balance!

Diversification is essential to achieve balance in investing. Portfolio diversification means spreading your investments across various asset classes – i.e.: your portfolio should have a mix of equity, debt, commodities, real estate, and the likes.

As famously said, ‘strength lies in differences not in similarities!’; this summarises the importance and advantages of diversification.

It is because different asset classes have unique and different features, characteristic and performance cycles that make it beneficial to diversify.

Tips to achieve portfolio diversification

Portfolio diversification is a critical part of investment planning. Let’s run you through some tips to achieve this in a simpler manner than you think!

1. Leave it to the experts

Choosing the right mix of assets and continuously monitoring and adjusting it as per changing market conditions can be an arduous task. In fact, most investors lack the experience to do this. This is where fund manager expertise can help. Opting to invest via a mutual fund where a fund manager takes investment decisions solves this complex task for you.

2. A single fund to meet your diversification needs

A unique hybrid fund, a multi-asset allocation fund is a single mutual fund that can be a simple solution for your diversification needs. This fund invests in a minimum of 3 asset classes, ensuring the portfolio has diversified representation across equity, debt, commodities etc. Essentially a one-stop solution for portfolio diversification!

3. Maintain discipline in diversification

For true diversification, your portfolio must consistently represent all asset classes. Individually managed portfolios may not achieve this always.

On the other hand, a multi-asset allocation fund which must follow SEBI mandate to invest at least 10% of its assets in 3 different asset classes can ensure discipline in diversification.

4. Rebalancing is important

Simply allocating to assets and maintaining a status quo may not work well, especially in a dynamic ever changing investing environment. Periodic rebalancing of the portfolio in line with new opportunities is the real need. Once again, a multi-asset allocation fund that gets reconstituted and rebalanced by fund managers periodically can work..

So, a multi-asset allocation fund could be the answer to your diversification prayers! And the icing on the cake is that it is a simple, hassle-free means of achieving your desired portfolio diversification. Aditya Birla Sun Life Multi Asset Allocation Fund NFO is just around the corner. Now that you know about the portfolio diversification, take this opportunity to strengthen your portfolio with Aditya Birla Sun Life Multi Asset Allocation Fund.

Aditya Birla Sun Life Multi Asset Allocation Fund

(An open ended scheme investing in Equity, Debt and Commodities.)

This product is specially designed for investors seeking

- Long term capital appreciation

- Investment in equity and equity related securities, debt & money market instruments and Commodities.

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

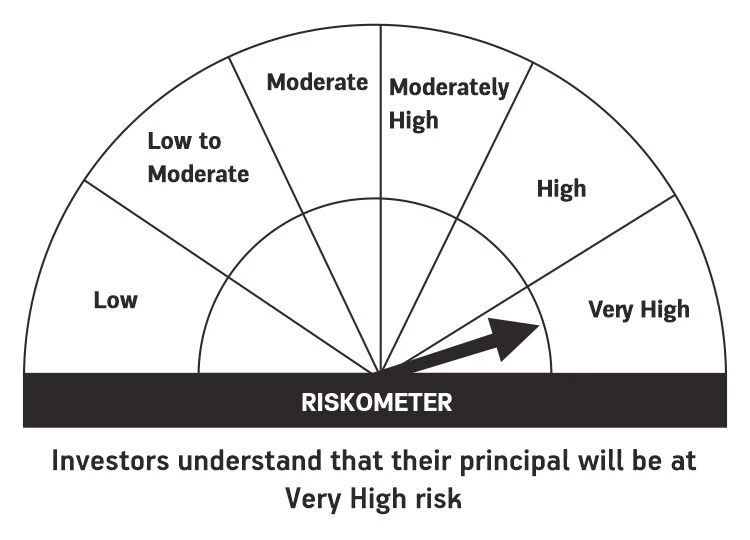

The product labelling assigned during the NFO is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

For more information on the scheme, please refer to SID/KIM of the scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000