-

Our Products

Our FundsTop Performing Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

This Akshaya Tritiya, invest in ABSL Gold Fund

Confused About Sector Investing? Discover the Power of Sector Mutual Funds

Aug 05, 2024

5 min

4 Rating

Sector and thematic mutual funds have been trending lately. They received the highest inflows in FY24, according to the Association of Mutual Funds in India. [1] While we often talk about diversification in investments to mitigate risks, sector investing is the opposite. It concentrates your investments in a particular sector or theme that is garnering a lot of attention.

Understand the difference between Sector & Thematic mutual fund

What is Sector Investing?

Some sectors do well and outperform the market, while some underperform the market. This is because sector investing is more volatile than the market and is subject to sector-specific risks. For instance, the banking sector is influenced by interest rates and FMCG by monsoons. The pandemic made healthcare and pharma trending sectors. If these trends reverse, the entire sector could take a hit and you might have to wait until the next cyclical upturn.

Timing plays a crucial role in sector investing. A sectoral fund is like a trend or fashion that begins, surges, reaches its peak, and then fades. This cycle, from downturn to upturn and back, makes sector investing risky and confusing. Hence, it is ideal only for investors who are tactical and strategic in their investments, have done detailed research on the sector and have an opinion about it. If you are bullish on a sector for a few reasons and believe it to grow significantly, a sectoral mutual fund could be a good addition to your portfolio.

Discover the power of sector mutual funds

Investing in a theme or sector in itself is risky and needs thorough research at the industry level as well as the stock level. That is where sector mutual funds come in. The fund manager aims to capitalize on the growth of a particular sector or theme. Hence, he/she selects stocks based on their fundamentals, growth potential and management’s vision and position in the industry. While you do your sector-specific research, you could leave the stock-specific research to the fund manager.

Recently, Infrastructure and Public Sector funds have been in the trend with strong double-digit growth. But past returns do not guarantee future returns. Sometimes, the past performance might also indicate the cyclical rally.

You should be updated about the economy and business through news and have the knack to conclude how the news will impact your investments.

Should you invest in sector mutual funds?

While diversification helps mitigate risk, concentration increases risk but also returns. You might wonder if sector mutual funds are for you.

Consider it this way. A flexicap mutual fund is like a meal. It has a mix of several sectors and market caps, and the fund manager is actively managing the cyclicality of these sectors. But sometimes, you only want to have a chocolate doughnut. While you can have that doughnut once in a while, it cannot replace your meal.

A sector/thematic fund is like a doughnut. If you want the chocolate doughnut, you should be aware of the risks (calories) and the sweet returns. You should have a core portfolio of diversified mutual funds where a significant chunk of your money is invested. Sector funds could form a small part of your portfolio with not over 5-10% asset allocation.

Here again, it is better to invest in the long term instead of the short term. Sector funds are about timing, and no one can time the market.

Discover the power of sector mutual funds with Aditya Birla Sun Life Mutual fund. It offers several sector and thematic funds like the Aditya Birla Sun Life Digital India Fund. It invests in stocks that are the key beneficiaries of that theme. You get a holistic exposure to the supply chain of that theme with some degree of sector diversification.

The strong volatility of sector funds could add some flavour to your portfolio. You may or may not succeed in the first attempt. But with patience, practice, and observation, you may see growth in sector investing.

Reference links:

The Economic Times -

https://economictimes.indiatimes.com/mf/analysis/thematic-mf-receive-highest-inflows-of-rs-46000-crore-in-fy24-whats-your-play/articleshow/109680183.cms

Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/ offering/ communicating any indicative yield/returns on investments.

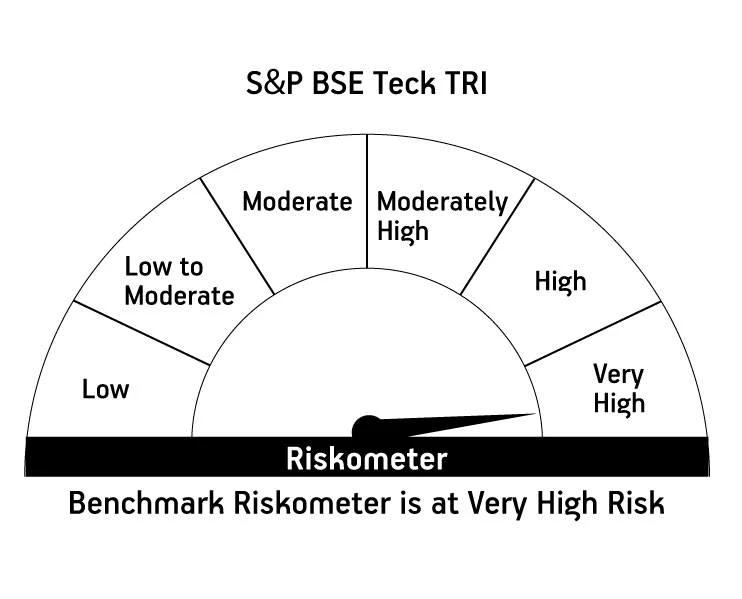

| Aditya Birla Sun Life Digital India Fund | ||

| (An open ended equity scheme investing in the Technology, Telecom, Media, Entertainment and other related ancillary sectors) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000