-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Saving for your child’s education can be tricky

Jan 25, 2019

4 mins

5 Rating

Education is the key to make a difference to our lives, to reach out for bigger opportunities and to create a name for self in the world. One thought that remains on top of the mind of every parent is to provide quality education to the child.

Harish & Anjali echo the same thoughts. Their daughter Navya is 2 today. They want to ensure that Navya gets the best education in the field of her choice.

In order to prepare for the future, they go about researching various education options and the costs of each. The world seems to have changed a lot.

Cost of education, be it Medicine, Engineering or MBA, are significantly up. Gone are the days when their education was done from a University at costs which can’t even provide for a semester fee today.

When Navya reaches the stage to receive higher education, the costs will have at least doubled, if not more.

Assume that the cost of education formedicine or engineering or MBA is about Rs. 25 lakhs today (a conservative estimate). Further, the rate at which the cost is increasing (inflation) is at 5-6%. In the next 16 years, when Navya turns 18, she would need Rs. 63 lakhs for the same education.

And if they plan to send her to another country then the costs can easily be multiplied by 3.

This has set Harish and Anjali thinking.

How should they go about providing for Navya’s education?

They listed 2 options:

- Take a education loan, which Navya and Harish can pay together

- Save diligently now over the next 16years

Option 1 is of course available but why burden the child?

Option 2 could mean a lot of stretch on existing finances since the scope in savings is not large.

However, it is the right path to pursue for now, given that there is time (16 years) and the commitment (both Harish and Anjali want to make it happen).

A quick use of the calculator tells them that to reach 63 lakhs in 16 years; they need to save Rs. 13,400 every month. If their investments can deliver about 10% per year on an average, this is possible.

In fact, if Harish plans to increase his savings towards Navya’s education by a 10% every year, the requirement to save in the first year is a mere 7,500 per month. That takes away a lot of stress.

The next big question on the mind is where to invest.

Harish started his research and came across several investment options including Government schemes, Post office schemes, Bank Deposits and Mutual Funds.

The one that caught his attention was by Aditya Birla Sun Life Bal Bhavishya Yojana (An open ended fund for investment for children having a lock-in for at least 5 years or till the child attains age of majority (whichever is earlier)), a mutual fund as an investment solution for Children’s needs.

During the early years, one can invest in the wealth plan option of the fund and allow the money to grow with the power of equity. As the goal comes closer, the savings plan option could be used to protect the money.After attaining age of 18, Navya can also withdraw from it to pay for her education related expenses.

The fund has a lock-in of 5 years or 18 years of age of child, whichever is earlier. Moreover, it had an option that anyone, related or unrelated can invest for the child in this scheme hence it can be given as a gift to his sister’s children or someone who is less privileged.

Harish was satisfied with this approach. However, to see real results, it needs to be put into action.

Harish discussed this with his wife, Anjali and together they planned to invest in Aditya Birla Sun Life Bal Bhavishya Yojna.

With this decision they have prepared the ground with an aim to build Navya’s bright future. What can be more satisfying for the parents!

Note: Aditya Birla Sun Life Bal Bhavishya Yojana is a Solutions Oriented scheme for children’s needs. Please consult your investment advisor to make an informed decision.

For Further details refer SID /KIM

Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

|

Name of scheme |

This product is suitable for Investors who are seeking:* |

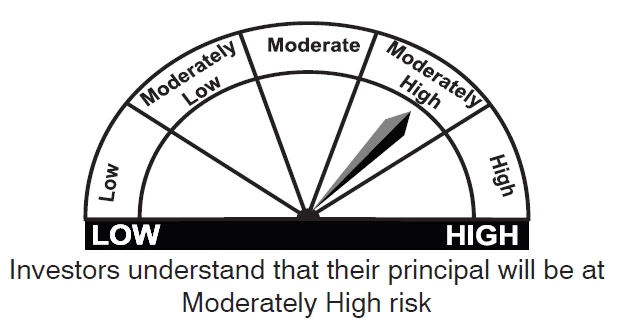

Riskometer |

|

Aditya Birla Sun Life Bal BhavishyaYojna – Wealth Plan

|

• long term capital growth

• investments in predominantly equity and equity related securities as well as debt and money market instruments |

|

|

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them. |

||

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000