-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Silver Funds: A Shining Opportunity for Diwali Investments with ABSLMF

Oct 27, 2024

5 min

4 Rating

Silver and gold are crucial elements of festivals in India. However, several individuals do not step beyond buying jewellery. In the past few years, certain investors have proposed the idea of investing in silver funds. Hence, this Diwali, several mutual fund houses, including Aditya Birla Sun Life Mutual Fund (ABSLMF), are offering silver and gold ETFs, making it easier for investors to diversify their portfolios.

Silver funds track the price spot of silver in the open markets. Any fluctuations in the silver price might change the NAV of the funds. Fund managers of silver funds purchase silver and keep them in secured vaults. SEBI protects investors' rights by regulating these silver funds.

What Are Silver ETFs?

An investor in the silver ETF invests in physical silver. As a precious and industrial metal, silver establishes stability for investors during market volatility. Silver mutual funds offer higher liquidity and can be easily traded. Silver ETFs track the same price as silver and are, at times, more liquid than physical silver.

Silver ETFs are funds that invest in physical silver of the highest purity. Therefore, when you invest in a silver ETF, you actually invest in silver without purchasing it physically.

In addition, according to the Securities and Exchange Board of India, a silver ETF should invest at least 95% of its net assets in silver or silver-related assets. This means the primary focus of these funds is holding silver.

Why Invest In a Silver ETF This Diwali Season?

Silver is an auspicious metal in India. Several households in India purchase silver on festive occasions like Diwali and Dhanteras. It is also a popular gift amongst Indians. In the developed market, silver is considered an asset class from an investment perspective. Silver exchange funds are a recent phenomenon in the financial market and are the best investments for this Diwali season. You must prefer investing in silver because:

Silver holds good economic value and is an amazing investment option over the long-term horizon. Under longer periods, due to the purchasing power of silver, it has been considered one of the safest investments in India.

Silver can be used to diversify your portfolio's risk in your asset allocation because it has a lesser correlation with equities. It helps add stability to your portfolio, especially when equity valuations are overstretched.

Investors can easily enter and exit the silver market compared to physical silver.

Apart from purchasing silver coins and jewellery, the demand for silver has also increased in the industrial field due to its multiple applications. However, it comes in limited supply and investing in it eventually makes more sense. It generates better returns over longer periods.

Why Choose Silver Funds Over Physical Silver For Investment Purposes?

Traditionally, silver in India has been purchased in the form of silver jewellery, coins, biscuits, or bars. Even though physical silver is great for decorative or jewellery purposes, it is unsuitable for investment. Impurities are the major reason why you cannot use physical silver as an investment. Silver coins and jewellery often contain impurities, which is why the cost of silver is reduced when you sell it. The other basic problem is that silver jewellery needs constant maintenance in terms of shining and pollution. Finally comes the cost of storage to keep your silver in safe custody, which can be higher than gold because silver is a bulky commodity as compared to gold.

Benefits Of Silver ETFs

Multiple advantages make silver ETFs an amazing option for investors who want to gain exposure to silver without owning any physical silver. Some of the major benefits of silver ETFs include:

Liquidity

Silver ETFs are quite easy to purchase and sell as they are traded on stock exchanges. You can sell or purchase shares at any time at market prices during the trading day. On the other hand, it can be more time-consuming and difficult to purchase and sell physical silver.

Cost Efficiency

It is cheaper to purchase a silver ETF than physical silver. When buying physical silver, you need to pay for insurance, storage, and security. However, you can completely avoid these additional expenses with a silver ETF.

Dividend Potential

Certain silver ETFs pay dividends. These dividends are generated from the profits of the mining companies. Not every silver ETF pays dividends; however, those that do provide an additional income source.

Flexibility

Silver ETFs are used for multiple investment strategies. You can purchase them to bet on short-term changes in silver cost, protect yourself from currency fluctuations or inflation or include silver in your investment portfolio. This flexibility lets investors use silver ETF in multiple ways than physical silver.

Points To Consider Before Investing In Silver Funds

There are certain major aspects that you must consider before investing in silver ETF:

Expense Ratio

Investors should compare the expense ratios of multiple ETFs before making the final decision. A higher expense ratio means lower returns, and vice versa.

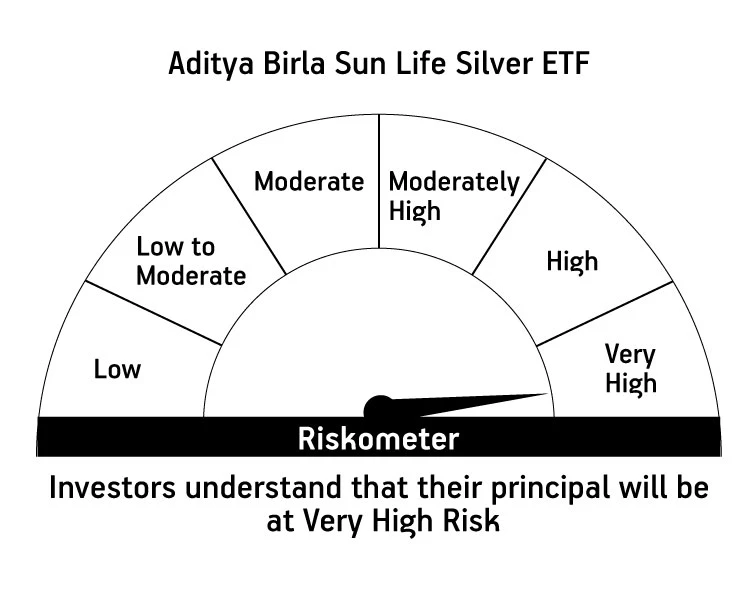

Risk Appetite

An investor should analyse their risk appetite before making investments. Bullions are riskier as their prices depend on demand and supply. Silver is highly volatile compared to gold.

Tracking Error

Investors should consider the tracking error of different silver ETFs before choosing one. They must select a silver ETF with minimal tracking error.

Conclusion

This Diwali season, switch to silver ETF investments rather than purchasing physical silver. It serves as an amazing alternative to investing in silver coins, jewellery, and bars. Not only does this investment provide you with a better level of liquidity and safety, but it also benefits you from the rising movements in silver prices.

If you are willing to invest in a silver ETF that offers optimal returns rather than physical silver of 99.9% purity, here’s an option. Invest as little as Rs. 100 with the Aditya Birla Sun Life Silver ETF fund!

| Aditya Birla Sun Life Silver ETF | ||

| (An open ended exchange traded fund tracking physical price of Silver) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000