-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Thing big, sleep easy. A simple strategy for first time investors

Feb 25, 2025

5 min

4 Rating

A well-known and successful investor once said:

“if you don’t find a way to make money while you sleep, you will work until you die.”

This very idea of making your money work for you is an exciting one, and it is no surprise that it often sparks people’s interest in the world of equity investing. However, for first-time investors, the journey can feel like a maze. With thousands of stocks to choose from, constant market news, and real-time data at your fingertips, it is easy to feel overwhelmed. Add to that the worry of tracking your portfolio and reacting to every market dip; it is no wonder then that many shy away!

So, how can investing be simpler and stress-free for a beginner investor?

Start simple: trust the big names

When diving into something new, it is natural to look for things that feel reliable and familiar. Whether you are choosing a restaurant, a product, or an investment, you tend to gravitate toward names that have a solid reputation. The stock market is no different!

Why large-cap stocks are perfect for first-time investors

A smart way to start investing is by focusing on large-cap stocks—the established players of the market. Large cap companies are the top 100 listed companies by market capitalisation. They are typically the leaders in their industries.

But why are large-cap stocks an ideal starting point for newcomers?

Proven success record

Large-cap companies have been around for years, sometimes decades, and have a history of adapting, surviving, and thriving through various market conditions. Their longevity is proof of their resilience. Many of these companies operate well-established, trusted brands that we have relied on for years as consumers, making them equally dependable when it comes to our investments.

Solid financial foundation

These companies often have strong, steady revenue streams, solid balance sheets, and profitable business models. This financial strength makes them more resilient during downturns—something that can bring peace of mind to first-time investors who may be anxious about market volatility.

Tough in a crisis

Because of their size, large-cap companies can handle economic storms better than smaller, less-established firms. With the resources to weather downturns and diversify their operations, these companies are less likely to collapse under pressure.

Steady growth potential

Large-cap stocks benefit from their scale and established market position, allowing them to take advantage of growth opportunities in a faster and more efficient way. This provides substantial room for growth, especially in the long term. Their ability to capitalize on emerging trends and expand their market share means they can deliver reliable, steady returns over time, offering investors both peace of mind and opportunity.

What are large-cap mutual funds?

Large-cap mutual funds pool money from multiple investors to buy shares of a variety of large-cap stocks. Rather than investing in individual companies, you are buying into a fund that offers exposure to a diverse range of top-performing firms.

Why should new investors consider large-cap mutual funds?

Instant diversification

Instead of buying several individual stocks, a large-cap mutual fund gives you access to a wide array of industry-leading companies, instantly diversifying your portfolio and lowering the risk that comes with investing in just a few firms.

Professional management

With mutual funds, fund managers handle everything—buying, selling, and balancing your investments. This takes the pressure off you, allowing you to focus on other aspects of your life while your investments are in capable hands.

Simple and flexible

Mutual funds are beginner-friendly with lower initial investment amounts, and you can easily enter or exit whenever you need. They offer flexibility and simplicity, making them a great choice for those just starting their investment journey.

Sleep easy with large-cap stocks!

Large cap stocks can offer a combination of growth and stability. Investing in large-cap stocks offers a unique peace of mind. You are investing in companies with established track records, strong finances, and the ability to weather market storms. With a long-term mindset, you can sleep easy knowing your investments are backed by solid, dependable companies.

The ideal strategy to invest in this market segment

You might be thinking, “how could i possibly manage a portfolio with a hundred large-cap stocks?” The answer: large-cap mutual funds!

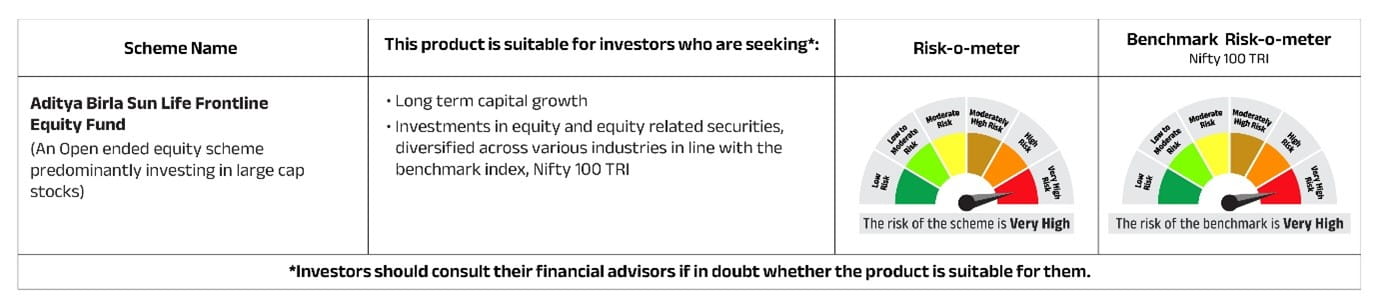

What Aditya Birla Sun Life Mutual Fund has to offer:

At Aditya Birla Sun Life Mutual Fund, we offer a large-cap mutual fund- Aditya Birla Sun Life Large Cap Fund. We believe it is for first-time investors. Managed by experienced professionals, our fund is designed to deliver sustainable long-term growth while minimizing risk. Whether you are new to investing or looking for a potentially stable, long term growth-oriented option, the Aditya Birla Sun Life Large Cap Fund can provide a reliable, accessible way to invest in some of the market’s most established players.

Risk-o-meter as on 31st January 2025.

The Risk-o-meter(s) specified will be evaluated and updated on a monthly basis. For updated Risk-o-meters kindly refer to latest factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000