-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

The FOMO Trap - are you chasing trends instead of building wealth?

Apr 05, 2025

5 min

4 Rating

In today's world of Instagram, Twitter, and 24/7 social media updates, it is easy to fall into the FOMO (Fear of Missing Out) trap. You see a friend vacationing in the Maldives, and suddenly, you are scrambling to book a trip. Someone posts about the latest gadget, and before you know it, you have added it to your cart. A new food trend emerges, and you are at the hottest restaurant trying it out.

While some of these indulgences might be harmless, the real danger begins when FOMO seeps into your financial decisions—especially investing. Chasing trends without a plan can leave you stuck with investments that do not align with your long-term financial goals.

The risk of chasing trends in investing

Just like fashion or travel, investing has its trends too. Some days, cryptocurrency is all the rage; other days, its tech stocks, gold, or real estate. Social media is filled with influencers promoting “hot” investments, and even your neighbourhood jeweller might suggest that gold is about to skyrocket.

But here is the catch: blindly following trends without a strategy is a financial trap. When you invest out of FOMO rather than a well-thought-out plan, you risk getting stuck with assets that may not deliver the returns you expect. A viral stock tip might lead to losses, and a hyped-up investment might not align with your risk appetite or financial goals.

The secret to avoiding the FOMO trap

Let us rebrand FOMO from Fear of Missing Out to Focus On Meaningful Opportunities

Understand that every asset class plays a role

Different investments serve different purposes. Equity offers growth potential, Debt provides stability, gold can be a hedge against inflation, and real estate brings tangible value. In fact, even different market conditions effect performance of different asset classes differently. No single asset class is always the best. The key is to diversify across multiple asset classes so that your portfolio remains balanced and adaptable.

Focus on wealth building, not just trends

True financial success comes from building wealth over time, not chasing short-term market trends. Instead of jumping from one trending investment to another, creating a sustainable investment strategy that aligns with your financial goals, risk tolerance, and time horizon is important.

How to build wealth without FOMO

Timing the market is nearly impossible. Even the best investors cannot predict which asset class will perform the best at any given time. The solution? Multi Asset Allocation Funds.

What are Multi Asset Allocation Funds?

Multi Asset Allocation Funds are hybrid mutual funds that invest across multiple asset classes—such as equity, debt, gold, and real estate. As per SEBI (Securities and Exchange Board of India) classification, these funds must invest at least 10% in a minimum of three different asset classes.

How Multi Asset Allocation funds work

Instead of just reacting to market trends, professional fund managers allocate investments based on concrete factors, such as:

Economic growth trends (e.g., investing in equities during expansion phases)

Fundamental analysis of equity across sectors and market caps

Interest rate movements (e.g., increasing bond allocation when rates are attractive)

Inflation and currency fluctuations (e.g., hedging with gold in times of uncertainty)

How Multi Asset Allocation Funds help build wealth

Diversification for better risk-adjusted returns – Spreading investments across asset classes reduces exposure to any single market downturn, leading to more stable returns.

Expert-driven strategies – Fund managers actively adjust asset allocation based on in-depth market analysis, helping investors capture investable opportunities across asset classes for better overall performance

Dynamic rebalancing – The fund automatically adjusts its asset mix to capitalize on market opportunities and mitigate risks, so your money is always optimally allocated for better returns

Long-term growth potential – A combination of asset classes helps capture returns across different market cycles. Potentially leading to better long term wealth accumulation.

Invest smart, not fast

Do not let FOMO dictate your financial future. Instead, adopt a disciplined, well-diversified approach that ensures long-term wealth creation over short-term hype. With the right mix of diversification, expert management, and adaptability, Multi Asset Allocation Funds serve as a smart and balanced approach to wealth creation

So, the next time you feel the urge to chase the latest investment trend, take a step back and ask yourself: Are you following a strategy, or just following the crowd? The choice can determine your financial future.

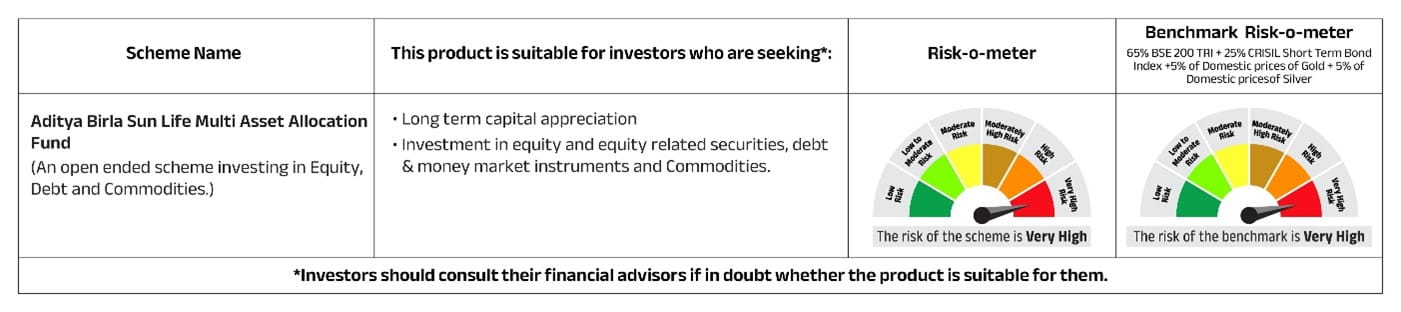

Risk-o-meter as on 31st January 2025.

The Risk-o-meter(s) specified will be evaluated and updated on a monthly basis. For updated Risk-o-meters kindly refer to latest factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000