-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

The Big Decode: How Monetary Policy Impacts Us?

May 16, 2019

7 mins

5 Rating

The recent monetary policy announcement, being the first of the 2019 fiscal year has seen a lot of media buzz. You must have read or heard of the recent rate cut in the RBI’s monetary policy. Are you wondering how does all of this impact you as the ‘aam aadmi’? Let’s decode the ‘monetary policy’ and understand what it holds for you.

First things first - what is the ‘Monetary Policy’?

The Monetary Policy is the macroeconomic policy announced by the Reserve Bank of India (RBI), the central bank of India. It is announced bi-monthly i.e.: once every 2 months.

The Monetary Policy involves use of several tools by the government to manage the supply of money in the economy to achieve its dual macro-economic goal of boosting growth yet controlling inflation.

What are the tools deployed? – Jargon decoded

While the Monetary Policy covers several developmental policies, it broadly encompasses certain tools:

Repo rate and reverse repo rate

Repo rate is the interest rate at which the RBI – the central bank – lends to commercial banks. Banks in turn lend to corporates and end consumers, so any change in this rate can impact the bank loan rates.

Reverse repo rate is the rate at which RBI ‘borrows’ from banks. A higher reverse repo rate would mean that banks may prefer to park their excess funds with the RBI rather than lend to customers.

Changes in Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR)

CRR is the percentage of money that banks have to maintain in their current account with RBI. SLR is a percentage of money that banks must mandatorily maintain a reserve through investment in gold reserves and Government mandated securities.

These rates and ratios impact the flow of money in the economy. So by tweaking these rates in its Monetary Policy, the RBI seeks to manage the supply of money.

Apart from this, the monetary policy also encompasses measures to regulate the banking and financial sector to ensure banking customers and investors are better served.

How do monetary policy changes impact you?

Do you think that these changes only impact large multinational companies, well that’s not true. These changes have far reaching impact especially on the ‘aam aadmi’ of India.

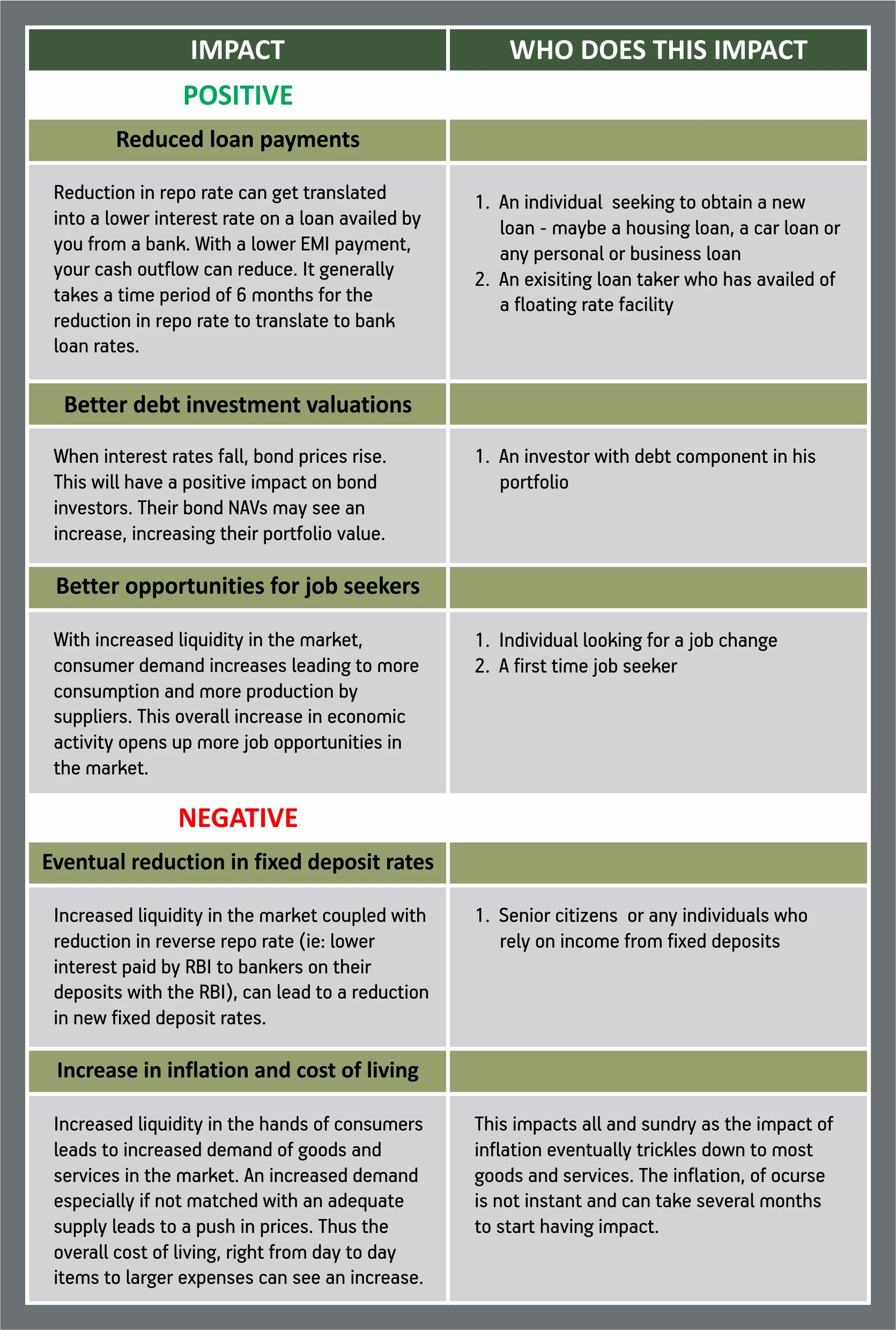

A reduction in the repo rate will mean that banks are able to avail funds from the RBI with a lower interest cost. Banks in turn can pass on the benefit of lower interest cost to you as an end consumer in the form of cheaper loans.

Reduction in CRR and SLR also means that there are more funds available with banks for giving on credit. This leads to overall increase in liquidity in the market.

This can mean a positive or a negative impact for you depending on where you stand as a consumer.

While the table considers the positives and negatives of a rate cut, the inverse could happen in the case of a rate increase by the RBI.

Do you need to track the monetary policy?

The Monetary policy aims at controlling the finances of the country as a whole and will definitely trickle down to each one of our individual finances. So yes, the monetary policy impacts the ‘aam aadmi’ and you should be aware about it.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000