-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

The Mutual Fund Advantage in Tax Saving

Jan 21, 2019

5 mins

5 Rating

The financial year is drawing to a close and the tax season is about to kick in when most of you would be planning to invest in tax-saving avenues to save your tax outgo. When it comes to choosing tax-saving avenues which also give good returns, mutual funds are the first thought which may hit many investors’ minds. Tax efficiency of the portfolio increases the efficacy of the overall portfolio and the total yield.

After all, mutual funds are affordable (when you choose SIP investments), have varied investment tenures (ranging from short-term to long-term) and have the potential to provide better market-linked returns. Moreover, you can reduce your taxable income by investing in tax saving mutual funds or Equity-Linked Savings Scheme (ELSS). With a combination of these factors, mutual fund could be a decent investment option. Especially where tax saving is considered, mutual funds aim to provide comparative advantages.

Tax efficiency of Mutual Funds

The tax efficiency of mutual funds is because of the following 3 reasons:

LTCG Tax Calculation for equity mutual funds is quite less even after it being taxed at 10%:

Gains made from the sale/redemption of equity oriented mutual fund, held for more than a year, are termed as long term capital gains (LTCG). In budget 2018, government decided to levy a tax of 10% plus cess if such long term capital gains exceed Rs. 1lakh subject to certain conditions/criteria.

However, the taxation of 10% (plus applicable surcharge/cess) for capital gains above Rs 1 lakh per financial year is less when compared to the tax efficiency of other investment products. This is because it is unrelated to your income, total investment corpus, etc.span>

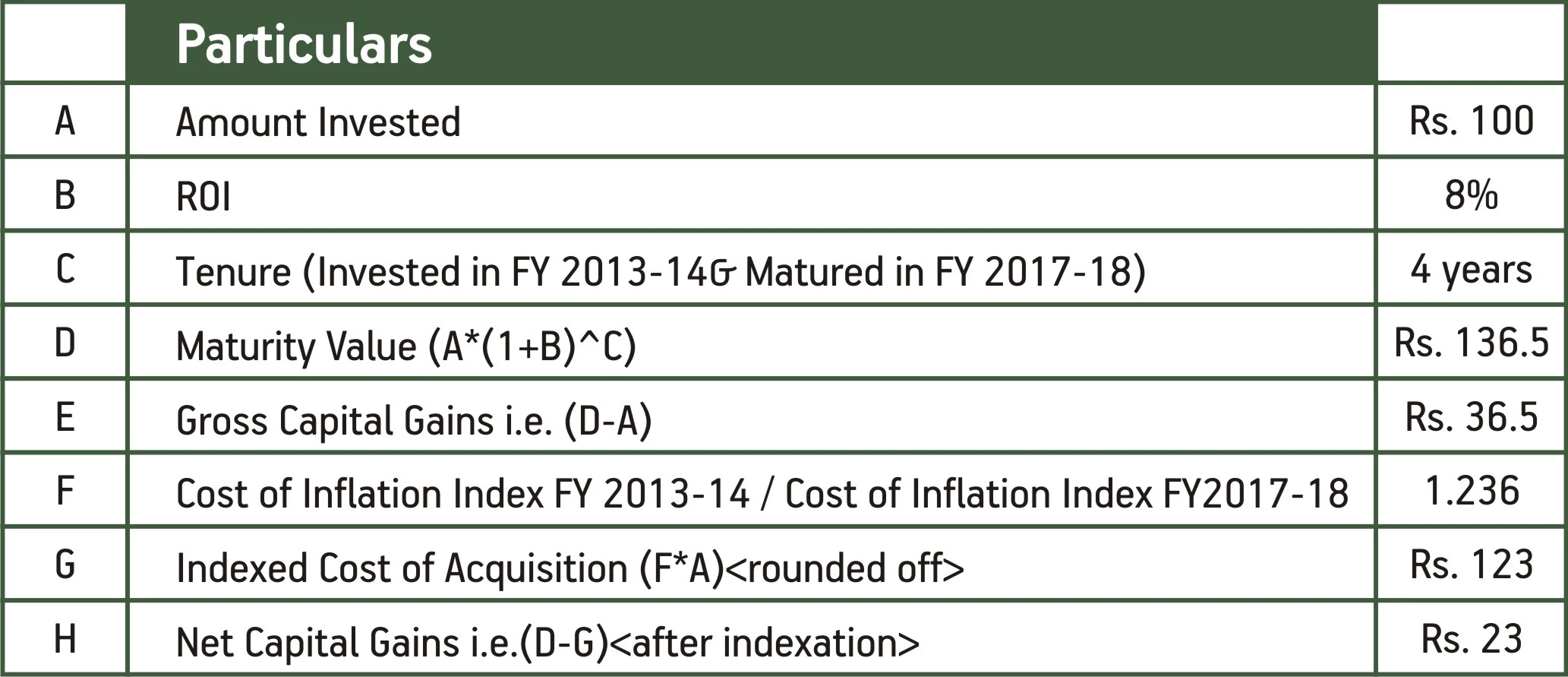

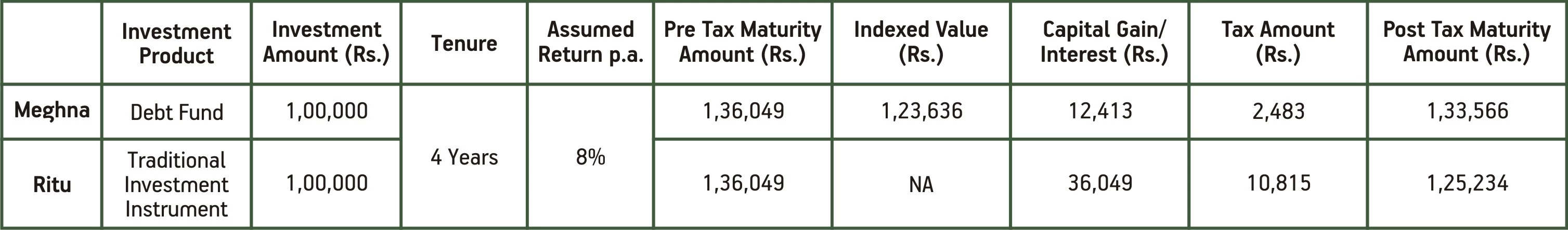

Also, LTCG of 10% (plus applicable surcharge/cess) is calculated only on redemption with no TDS, unlike traditional savings products. Let us check the taxation of returns of an equity oriented mutual fund with an example: Above example is for illustration purpose only & does not assure or guarantee any returns. *Assumed rate of return # Tax rate considered is exclusive of any applicable surcharge/cess for simplicity of calculation. Actual tax amount may vary due to applicable surcharge/cess And of course, historically equity Mutual Funds have given better returns over the long term as compared to other traditional investment products. But, that’s a completely different story as the asset classes and their risks involved are completely different and hence cannot be evaluated! Debt Mutual Funds have clear tax efficiency as compared to other traditional savings instruments for a holding period of 3 years or more, which is called Indexation Benefit! What is indexation Benefit and how does it work? Indexation lets you index your cost of acquisition with inflation i.e. you inflate your purchase cost with the inflation for the holding period to bring it to the present market value. Depending upon the type of asset the indexation benefit is available after 2 years or 3 years. Let us understand how indexation works with the help of an example: Indexation Benefit cannot be availed in all types of assets. It can be used in products like Real Estate, Debt Mutual Fund and Gold. But it is not applicable in direct equity or equity oriented mutual fund and conventional saving products like Bank Fixed and Recurring Deposit, National Saving Certificate (NSC), Interest on Saving Bank Account, etc. Let us now understand the tax advantage provided by Debt funds with an example of two friends Meghna & Ritu: Assumption: Both fall under highest income tax bracket (30%) CII figures source: https://www.incometaxindia.gov.in/charts%20%20tables/cost-inflation-index.htm Tax rate considered is exclusive of any applicable surcharge/cess for simplicity of calculation. Actual tax amount may vary due to applicable surcharge/cess The difference in the tax on debt mutual fund and a traditional investment instrument is substantial as is illustrated in the case above. So, Debt Mutual Funds, if held for a period of 3 years or more can avail the benefit of indexation and thus avail a much lower rate of taxation since the cost of acquisition rises! So, it becomes way more tax efficient than other similar investment products wherein indexation benefit is not available.

In order to encourage investors to invest in the equity market the government introduced ELSS as one of the instruments under which tax deduction can be claimed u/s 80C of the Income Tax Act,1961. These funds haveminimum 80% exposure in equity/equity related securities. Like some other tax saving instruments in the market that have high lock in period, ELSS has a lock in period of 3 years. However, unlike other mutual fund schemes, ELSS funds cannot be withdrawn during the tenure of 3 years, even with an exit load. After the recent changes in Budget 2018, tax treatment of an investment in ELSS is categorized as ‘EET’ i.e. “Exempt- Exempt- Taxable”. Meaning, these instruments are given tax benefit in first two stages and taxed at the last stage of investment process: Thus, ELSS has an additional tax benefit from other mutual funds, which is 80C benefit. It means that the amount of money invested in ELSS funds till Rs 1.5 lakhs p.a. is exempted from Income Tax U/S 80C. Conclusion Thus, Mutual funds are a good option of investment which help in wealth maximization and also provide tax benefits. If you are looking to plan your taxes and want to save taxes, mutual funds are the only logical choice. ELSS is good as you get tax deduction even on your investments and returns are also taxed at a lower rate. So, consider tax efficiency as an important aspect of your investment portfolio and choose wisely. Happy investing! Information and computations mentioned in the working are on a broad level and investors are advised to consult their tax advisors for their individual tax implications. Mutual fund investments are subject to market risks, read all scheme related documents carefully.

With Indexation Benefits, Debt Mutual Funds can become highly tax efficient in the long term!

What is an Equity Linked Saving Scheme (ELSS)?

1800-270-7000

1800-270-7000