-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

The Tailwinds for Indian Health & Pharma Industry

Jun 18, 2019

6 mins

5 Rating

India is set to become the 5th largest economy in the world1, one of the sectors contributing to India’s growth success story is its Health and Pharma industry.

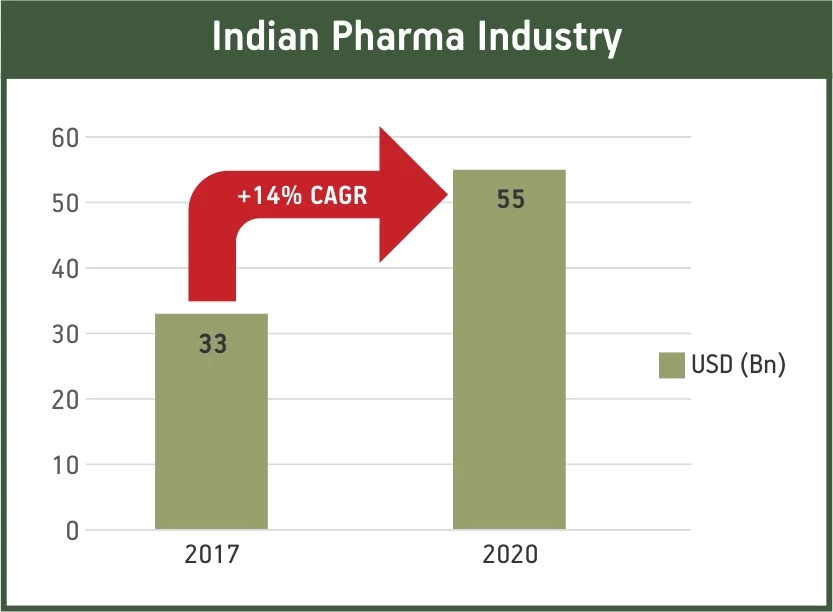

The Indian Pharmaceutical Industry having grown almost 3 times, from USD 12.6bn in 2009 to USD 33bn in 20172, constitutes a network of over 3,000 pharma companies housing about 10,500 manufacturing facilities.

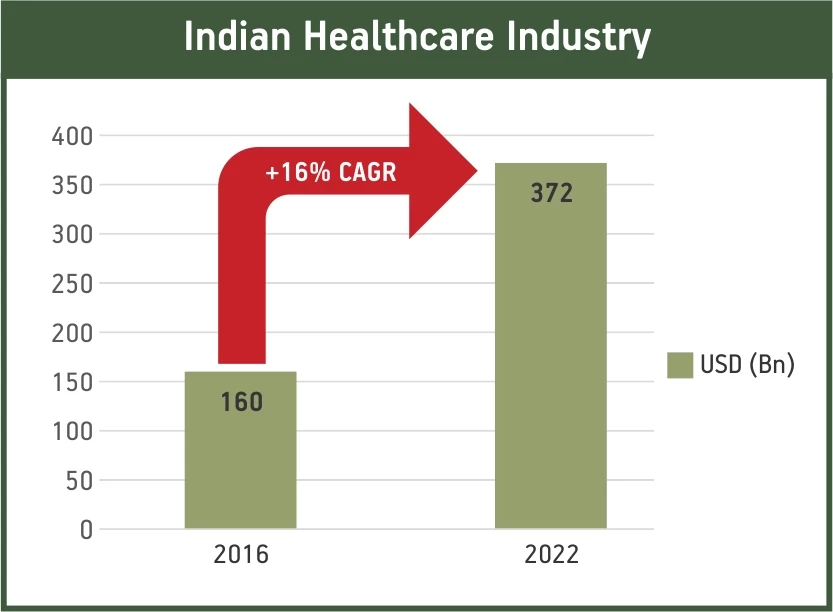

The Indian health care industry which stood at USD 160bn in 2016, includes in its ambit a wide network of hospitals, labs and diagnostics, medical equipment and supplies, medical insurance and emerging segments such as wellness products, contract research and biotechnology services.

Globally as well the Indian pharma and healthcare sector holds a pivotal position – being the largest producer of generic drugs globally.

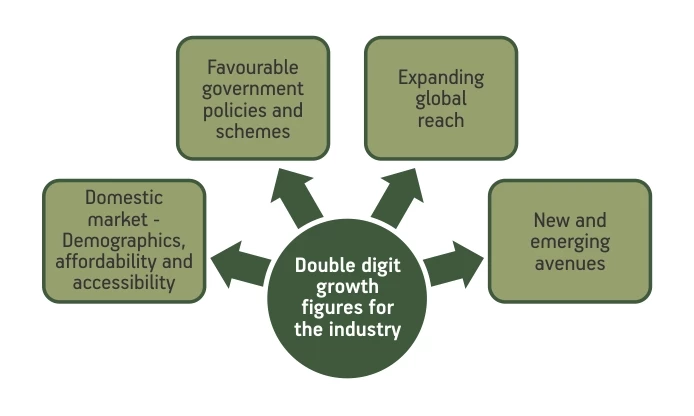

The Indian pharmaceutical and health sector is expected to achieve double digit growth figures in the years to come. 3 & 4

At the projected scale, India is expected to be 9th largest country in pharma spending by 2023.5

So, what are the tailwinds in favour of this industry that pegs its growth in double digit figures?

Domestic market - Demographics, affordability and accessibility

The demographic situation of the country today can ensure a sustained growth of this sector. Steady population growth in India; with the share of population over the age of 60 set to increase from 8 per cent in 2015 to 19 per cent in 20506, coupled with increase in lifestyle diseases can cause a significant increase in the patient pool in India.

Moreover, rising incomes in India and increase in affordability of average Indian household means there will be more takers for both medical treatment as well as for medical insurance. It is estimated that the health insurance penetration in India will rise to 45% by 2020 vis-a-vis 26% in 2010, with private players growing 3 times.2

Favourable government policies and schemes

The Indian government has expressed its commitment towards strengthening the healthcare sector in India. The government has increased the total public health expenditure from INR 1.49 lakh crore in 2014-15 to INR 2.25 lakh crore in 2017-187.

Touted to be the world’s largest publicly funded insurance scheme -The government has allocated INR 31,745 crore to Ayushman Bharat Yojana - which provides for health insurance of up to Rs 5 lakh per family per year to 10.74 crore families (or 50 crore population).

The Government’s ‘Pharma Vision 2020’ plan aims to make India a global leader in end to end drug manufacturing. FDI up to 100 per cent is now allowed under the automatic route for manufacturing of medical devices

These steps by the government are likely to provide a significant boost to the growth of the healthcare sector in India.

Expanding global reach

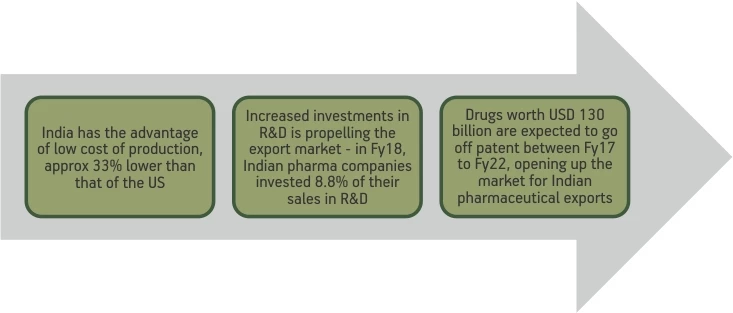

India is the world’s largest provider of generic medicines; accounting for 20% of global generic drug exports. India’s pharmaceutical export market is expected to reach USD 20 billion by 2020.8

India supplies 50 to 60 percent of global demand for many vaccines, 40 percent of generics consumed in the US and 25 percent of all the medicines dispensed in the UK.9 Two-thirds of the global AIDS treatments drugs are supplied by India.10

Pushed by the following conducive factors, India today has a competitive edge over other emerging economies and is well on its way to become a global supply destination for pharmaceuticals:

Sources: PwC, McKinsey, Pharmaceuticals Exports Promotion Council of India

The increasing number of patent filings by Indian companies in the US, are testament to the expanding global reach of the Indian pharma sector.

India is also fast becoming a hub for medical tourism. It has been estimated that by 2020, India’s medical tourism industry could be worth USD 9 bn, and account for 20% of the global market share.11

New and emerging avenues

The industry has also forayed into new and emerging avenues such as contract research and manufacturing services, clinical trials, manufacture of high-end patented drugs and wellness products and services. Increasing investments by Indian companies and growing domestic and global demand for these niche segments is also likely to provide a boost to the sectors growth.

India’s pharmaceutical and healthcare market has grown confidently and can be seen to be on an accelerated growth path. Even the markets have responded positively to this, with the BSE Healthcare Index having outperformed the BSE Sensex, grown by 16.72% over the 10-year period from 2008 to 2018.12 Backed by solid fundamentals and considerable domestic and global drivers, the industry is likely to see a string of varied business opportunities in the years to come.

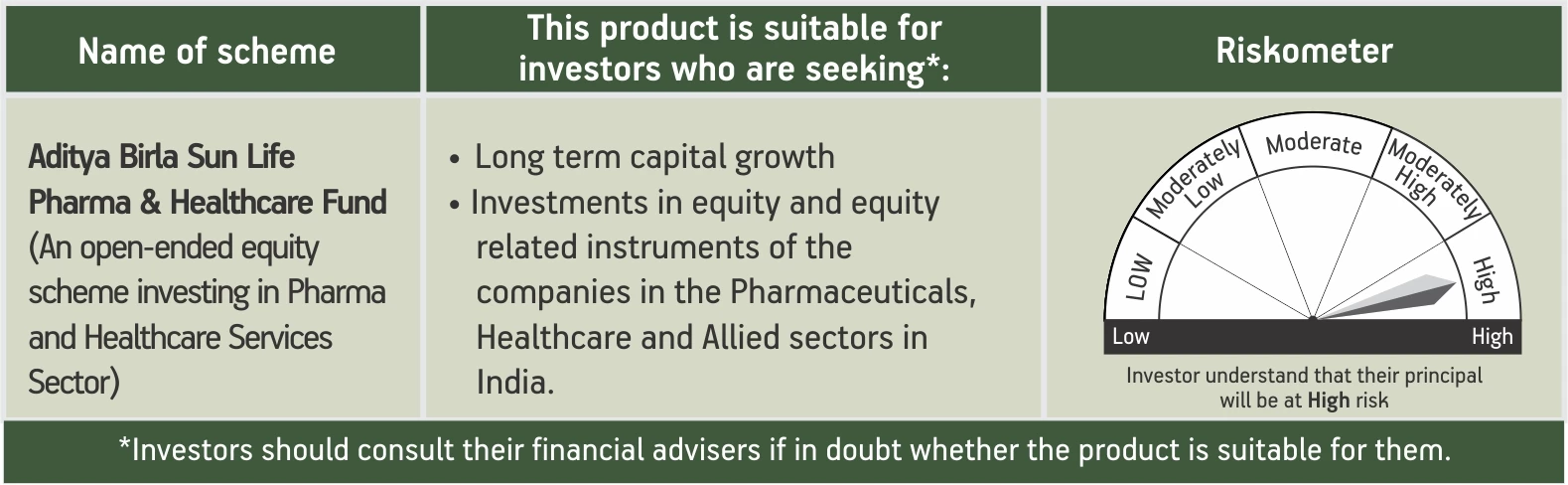

As an investor wanting to take advantage of this burgeoning sector, you may consider investing in a mutual fund scheme dedicated to pharma and healthcare companies. The Aditya Birla Sun Life Pharma & Healthcare Fund (An open ended equity scheme investing in Pharma and Healthcare Services Sector) seeks to give you a chance to be part of and gain from this sector.

Sources:

1PwC report

2McKinsey report on India Pharma 2020

3McKinsey report on India Pharma 2020

4 https://www.investindia.gov.in/sector/healthcare

5Global Information Inc report

6India Ageing Report 2017” by the United Nations Population Fund

7Economic survey 2017-18

814th Annual Report (2017-18) of Pharmaceuticals Export Promotion Council of India

9India Pharma 2020 – Mckinsey Report & FICCI and Mckinsey Report – February 2018

10United Nations sources

11Report by FICCI and IMS, a health industry information firm and ASSOCHAM-IITTM study

12Calculated based on historic index price data from BSE India website

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000