-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Thoughts on Rates

Mar 06, 2019

6 mins

5 Rating

Following the move that started in Oct, the rally in rates has continued, however, the experience has not been uniform across the curve. Multiple positives since then – such as the sharp drop in headline inflation along with change in the thought process of the monetary policy committee (which gave way to a 25bp cut in Feb and another 25-50bp cut in the offing) have supported the rally. The most meaningful change has been the dovish tilt in the stance of the US Fed followed by other major central banks.

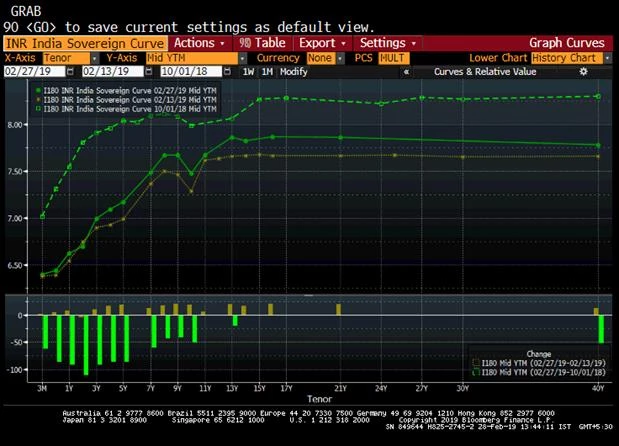

However, this has been soured by the increased supply of government bonds, state development loans and corporate bonds on account of the anticipated populist tilt of public policy going into the national elections. As a result, the rally in rates has been a tad erratic for most investors with meaningfully lower gains at the longer end of the curve and the short end yields reaching a low on 13th Feb after the most recent inflation print. The outperformance of the short end is evident in the chart below.

Yield Curve of Central Government securities

This rally saw a sharp reversal over the past 2 weeks because of low appetite for duration assets and rising crude price. However, the most important factor has been the ongoing military escalation between India and Pakistan. This has hit risk assets across the spectrum with INR and rates bearing the maximum brunt. Indo-Pak relations may continue to be the key driver for rates in the weeks to come.

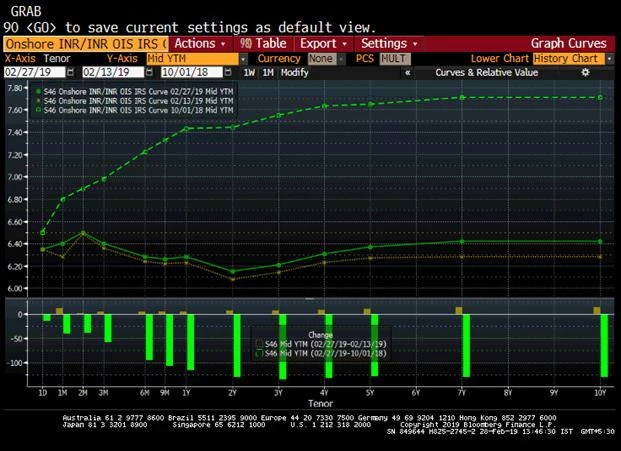

Yield Curve of interest rate swap

Unhindered by the supply concerns, the interest rate swaps curve has seen the biggest gains. The 5yr swap has fallen by over 150bp from early October. It is now pricing in another 25bp cut within the next 6 months and a second 25bp cut in the next 18 months. This optimism may be justified as the MPC’s thought process with respect to the relationship between the level of repo rate and concurrent headline inflation is seeing a shift.

Crude (in INR) & 10yr GSec India

The 5yr+ tenors seem very cheap across GSec / SDL / AAA rated Corp when looking at the OIS curve. However, given the domestic political risks and potential for global growth indices to post a rebound - if the US-China trade spat goes through a swift and amicable resolution - the steepening seems justified. The above chart suggests that this is already being priced by the crude oil to some extent and is the primary reason for the longer duration securities not performing after a rate cut.

RBI bond purchases have played a crucial role in helping market absorb the large supply in long tenor corporate bonds and SDLs thus far. There has been a continuous debate with respect to the total amount of open market bond purchase operations in FY19 and FY20; and the residual net issuance that would have to be absorbed by the market. This should ensure that duration investors continue to be tentative.

After the skirmishes along the Indo-Pak border, the 5yr+ portion of the curve has unwound all the post policy gains, stretching the losses for duration even higher. While our underweight duration stance has helped thus far, we see an opportunity in the ensuing volatility.

What we have done:

Portfolio Duration:

We took our duration to over 4 year starting Oct reaching a peak of ~5 year in December. While the change in external macro warranted an even sharper increase in duration, we were mindful of the fiscal concerns and the shifting sands in the domestic political climate going into elections. Cognizant of these risks, the scheme’s duration was reduced to 2.3yr before the interim budget for FY20. This helped to control volatility in the performance as the large borrowing plans for FY20 surprised the markets. However, the RBI policy decision in February and accompanying commentary have introduced a meaningful change in the potential trajectory of benchmark rates. Domestic inflation data has also surprised on the downside in the recent prints.

This has resulted in substantial steepening of the yield curve with the 10yr vs. 5yr spread reaching historical levels in the sovereign securities segment. The 5 year securities have continued to rally through the past few months even as 10yr GSec found it difficult to breach the low of Dec. The Aditya Birla Sun Life Income fund (An open ended medium term debt scheme investing in instruments such that Macaulay duration of the portfolio is between 4-7 years) has been overweight the sub 5yr part of the curve in this period. Apart from security selection, by actively going overweight and then underweight duration at opportune moments, the scheme aims to create a meaningful alpha for the investors.

Sectoral Allocation:

The fund had adopted an overweight stance on government securities shunning corporate bonds. Over the past few months the exposure to Gsec has been reduced meaningfully in favour of short tenor corporate bonds. Simultaneously, the position in long tenor SDLs has been trimmed in favour of longer end corporate bonds. The fund has added to the short tenor SDL position taking it to ~14% of the fund.

Way forward:

The argument for rates is not very potent through the lens of valuation as well as domestic macro. The fiscal concerns are alarming especially given the low room for manoeuvring after the spate of reforms over the past few years and the national elections in the next quarter. This is already being reflected in the government bond and corporate bond auctions which have seen very weak bidding interest in the past few weeks. However, the global macro is currently in favour of rates with multiple growth and trade indicators suggesting a decline in momentum. With the change at the helm of RBI, anybody running an underweight duration position is wary of a paradigm shift in the central bank’s reaction function to retail inflation. So a neutral position on duration seems most opportune for the time being. However, geopolitical tension in the region along with an accommodative central bank will produce multiple opportunities to add good quality risk at an appropriate valuation.

With the liquidity being added by the central banks, the case for spread assets at the cost of the sovereign securities is very strong. So we are more comfortable owning duration via corporate bonds. With this in mind, the scheme has increased allocation to AAA rated corporate bonds at attractive spreads.

Case for the Income Fund (Medium to Long Duration Category):

Analysis of the average long term return (1Y/2Y/3Y) from the category suggests that the performance is comparable to the returns from the Dynamic and the Credit Risk categories. While sometimes volatile in the short term, the Aditya Birla Sun Life Income Fund (An open ended medium term debt scheme investing in instruments such that Macaulay duration of the portfolio is between 4-7 years) offers an opportunity to earn returns similar to other categories over the medium term with minimal credit risk. There is a strong case for allocation to income funds across investor categories given the high real rate in the economy as well as better risk adjusted performance.

Aditya Birla Sun Life Income Fund (formerly known as Aditya Birla Sun Life Income Plus) An open ended medium term debt scheme investing in instruments such that Macaulay duration of the portfolio is between 4-7 years

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000