-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Top 5 Things to Look for Before Investing in a Flexi Cap Fund

Jan 31, 2025

5 min

4 Rating

Flexi funds have gained significant popularity in recent times, largely due to their flexibility and potential for meeting diverse financial needs. These funds are often touted as some of the best options for investors seeking to diversify their equity portfolio. What makes Flexi Cap funds unique is their ability to invest across market capitalizations—large, mid, and small caps—without any specific cap on exposure, as long as at least 65% of the fund’s allocation is in equities. This allows the fund manager to adjust their strategy based on market conditions, making these funds dynamic and highly versatile.

However, the flexibility that makes these funds appealing also means that they can vary greatly from one Asset Management Company (AMC) to another.

Before diving into a Flexi Cap fund, it is crucial to verify certain aspects to ensure that the fund aligns with your financial goals. Let us take a deeper look into the five key factors to consider:

Fund Strategy: Does it align with Your investment goals?

Every Flexi Cap fund follows a different investment strategy. Some funds might focus on growth stocks, while others may lean more towards value investing. When evaluating a fund, check its investment philosophy—does it align with your own risk appetite and objectives? For example, some funds might have a more aggressive stance, focusing on high-growth stocks, while others might adopt a conservative approach. Compare strategies across different AMCs and assess which one matches your investment style, whether you are looking for a more balanced portfolio or one that targets high growth.

Portfolio composition over the years

Flexi Cap funds provide a diverse allocation across various market caps, but this allocation can shift over time. Some funds may favour large-cap stocks, while others may tilt towards mid and small-cap stocks. It is important to review the historical portfolio composition of the fund over a few years. Has the fund consistently maintained a balance, or has it significantly shifted its strategy towards one market cap segment? Understanding how the portfolio has evolved will help you decide whether it matches your risk tolerance and expectations.

Fund manager’s track record: what is their expertise?

A Flexi Cap fund’s performance is largely dependent on its fund manager’s expertise. A skilled manager can navigate market cycles effectively and identify opportunities in both large-cap and small-cap segments. It is essential to evaluate the fund manager’s background—how long have they been managing the fund, and what is their track record with other funds? You can also assess the performance of other funds they manage to gauge their ability to consistently deliver returns. A strong, experienced manager can be a significant driver of success for your investment.

Performance history: a gauge of management expertise

While past performance is not necessarily an indicator of future results, it does provide insights into how the fund has been managed during different market conditions. Look at the fund’s historical performance and compare it to its benchmark index. How has it performed during market downturns and periods of growth? A fund that consistently outperforms its benchmark, even in volatile market conditions, suggests that the fund manager has a solid strategy and can potentially navigate future market shifts effectively.

Expense ratio and costs: what will it cost you?

An often-overlooked but critical factor is the expense ratio and associated costs of the fund. Even small differences in management fees can have a significant impact on long-term returns, especially for equity funds. Be sure to review the expense ratio and any other fees that may apply. Lower costs can help improve overall returns over time, making it an important aspect to factor in when selecting a Flexi Cap fund.

Flexi Cap funds offer an excellent opportunity for investors seeking flexibility, diversification, and potential growth. With the ability to invest across all market capitalizations, they can dynamically adjust to changing market conditions, allowing skilled fund managers to capture opportunities wherever they arise. Whether you are looking for growth, stability, or a blend of both, Flexi Cap funds can be an ideal choice for diversifying your equity portfolio.

By understanding the key factors to evaluate—such as fund strategy, manager expertise, and performance history—you can make an informed decision and position yourself for long-term success.

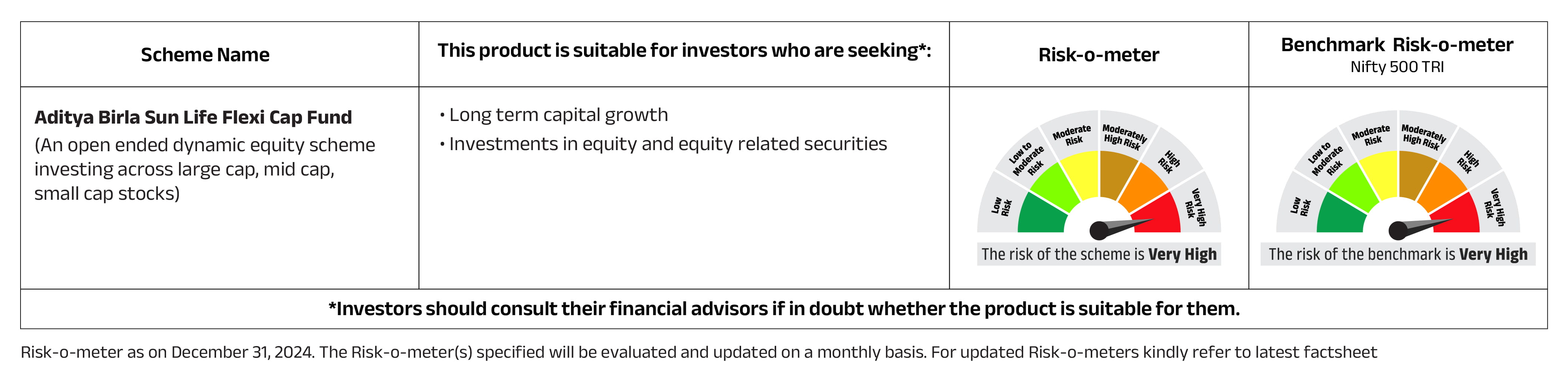

Ready to invest in a Flexi Cap fund that fits your goals? Click here

SIP does not assure a profit or guarantee protection against loss in a declining market. The illustration mentioned above is not based on any judgements of the future return of the debt and equity markets / sectors or of any individual security and should not be construed as promise on minimum returns and / or safeguard of capital.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000