-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Pharma Funds - Meaning, Advantages & How to Invest

Jul 11, 2024

5 min

4 Rating

Pharma and healthcare are two important sectors of the economy. Whether discussing an emerging country or a developed one, a well-structured healthcare system plays a crucial role in its economic development. This also explains the ever-evolving nature of the healthcare and pharma sector, representing an engaging opportunity for investors. To tap into these opportunities, pharma mutual funds have been established, offering a specialised investment avenue in this vital sector.

What are Pharma Funds?

A pharma fund is a sectoral fund that invests in companies related to the pharma and healthcare sectors. As per the Securities and Exchange Board of Indian regulations, a sectoral fund must invest around 80% of its entire assets in equity-related and equity instruments of the specific sector.

For instance, an equity scheme, Aditya Birla Sun Life Pharma and Healthcare Fund, invests in the Pharma sector to create returns by investing in equity-related and equity or fixed-income securities of pharma and the associated companies.

Pharmaceutical companies are recognised for generating profits and revenues, even during economic uncertainties. This is so because the need for essential medicines is constant, irrespective of market fluctuations. As a result, pharma funds can be a stable and safe investment choice for investors seeking long-term income and growth.

Pharma Funds: Advantages

Some of the key advantages explored by investors of Pharma mutual funds are as follows:

Exposure to the Evolving Sector

Rising diseases, changing lifestyle patterns, medical science advancement, and growing demand for new vaccines and medicines are among the key reasons for the growth of the pharma and healthcare sector. In addition, the combination of low production costs with strong R&D has popularised India as an important medical export destination. Acknowledging all of these factors, investing in Pharma funds is a major step toward participation in the rapid growth of the sector.

Investment in Top Pharmaceutical Companies

Pharmaceutical mutual funds offer an opportunity to invest in major pharma and healthcare industry companies, which are otherwise inaccessible to the average retail investor. You must be clear with the fact that a mutual fund pools money for investment in a basket of securities. This means the fund's portfolio includes stocks from various companies. By purchasing a single unit of the mutual fund, you gain exposure to all the underlying stocks in the portfolio. Therefore, by investing in a pharmaceutical mutual fund that targets the top five pharma companies on the stock exchange, you can benefit from the growth of these companies even with a small, systematic investment plan.

Higher Returns Possibility in the Long Run

The Pharma funds can have the ability to create higher returns when they stay invested for a longer time. Hence, making regular investments in a disciplined way might help you build a corpus for your long-term motives, such as your child's future or retirement.

Pharma Funds: Who Should Invest?

If you're confused about whether you must invest in Pharma funds or not, consider the points listed below to get the answer to your question.

Long-Term Investment Horizon Investors

All the sectors and the economy rotate in a cycle, meaning any sector underperforming today can outperform later. These fluctuations are inevitable in each sector, but the key is to stay invested and patient in facing multiple phases and fluctuations of the economic cycle. Thus, if you have the power to invest for a longer duration in the pharma sector, the Pharma funds can be the right investment scheme for you.

High-risk Tolerance Investors

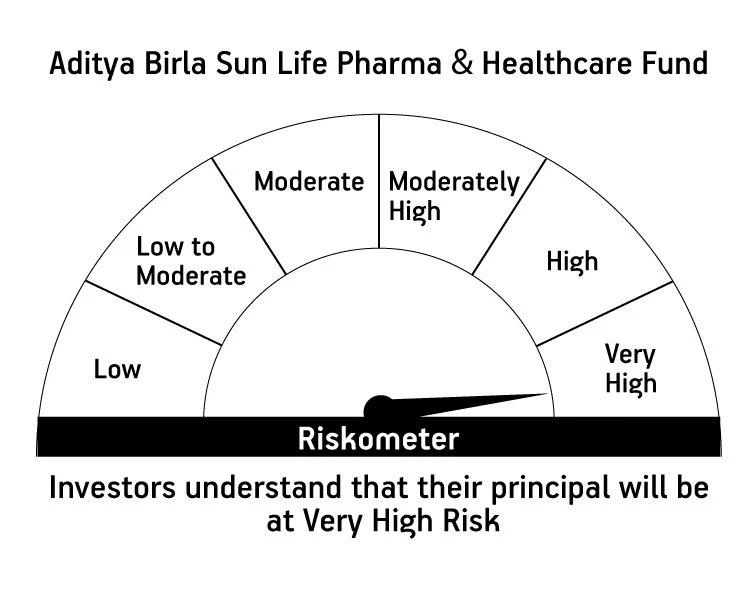

As though pharma funds stand as sector funds, they come along with a concentration risk. Hence, the complete portfolio can suffer from volatility if the sector acknowledges a downturn because it focuses on only one specific sector. As there is no diversification in the portfolio of the funds, the losses might not be offset by the other sectors' performance. Hence, investors who can confidently face high risk and still stay invested, ignoring the underperformance of the sector, must decide to invest in the Pharma funds.

Investors Who Believe in the Pharmaceutical Sector's Growth

If you believe that the Pharma and healthcare sectors are capable of growing the country's economy, you can invest in the Pharma Funds.

How to Invest in Pharma Funds?

You can begin investing in mutual funds in the pharma sector online via a mutual fund website offering pharma funds or by communicating with a mutual fund distributor. Once your KYC verification is done, investing in pharma funds is a quick and simple process. When investing via a mutual fund distributor, you get to invest in regular schemes, which are slightly expensive. However, if you invest directly through an online website, you will not be charged any commission, and you will need to pay a comparatively lesser expense ratio while making a scheme investment.

If you find growth potential in your country's pharmaceutical companies and healthcare sector, purchasing mutual funds in the pharma sector could be the right investment option. However, you must be ready to face the market fluctuations and other risks associated with staying invested in the long run.

Final Thoughts!

Making investments in Pharma funds can be a stable and relatively safe investment option for investors seeking long-term income and growth. However, it is crucial to acknowledge the risks associated with these funds, such as patent risk, regulatory risk, concentration risk, and economic risk. Investors must carefully review the associated fees with Pharma funds, as well as its management team and historical performance. By doing this research, investors can make informed decisions and increase their returns over the long term.

Aditya Birla Sun Life AMC Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. This document represents the views of Aditya Birla Sun Life AMC Limited and must not be taken as the basis for an investment decision Neither Aditya Birla Sun Life Mutual Fund, Aditya Birla Sun Life AMC Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

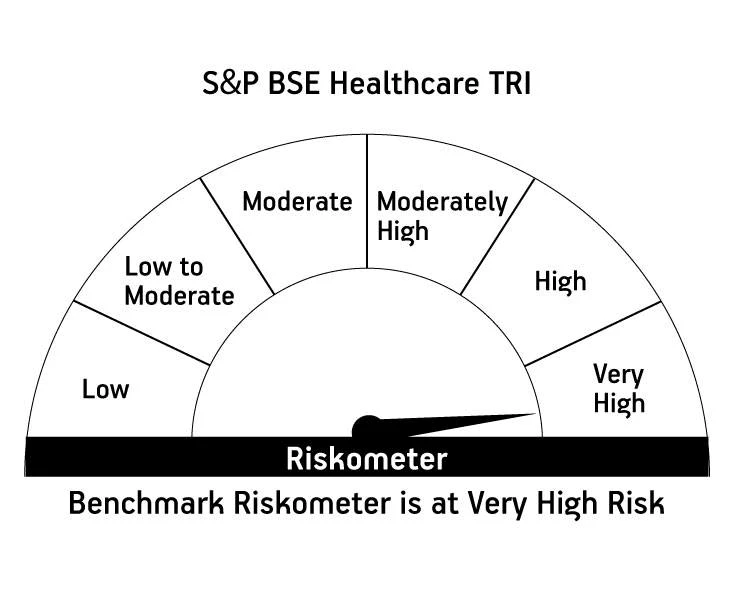

| Aditya Birla Sun Life Pharma and Healthcare Fund | ||

| (An Open Ended equity scheme investing in Pharma and Healthcare Services Sector) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000