-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

What are you doing for your child's dream?

Mar 08, 2019

5 mins

4 Rating

Do you often dream that your child climb up the ladder of success? You are not the only one. It is one dream that every parent can sacrifice their all for, without even flinching once.

Indian parents are amongst the most involved in their child’s education and ensuring their career success*. Research shows that they rate child’s successful career higher than child’s happiness. This perhaps explains the anxiety, sleepless nights, extended home tutoring by parents. They want the best for their child’s future.

But the best comes at a cost.

We all know the cost of good education is increasing exponentially. Even government backed management schools have hiked their fee from Rs. 5.5 lacs in 2008-09 to Rs. 22 lacs in 2018-19, a hike of 15% per annum***. Assume if we take even 10% inflation for the next 20 years, then IIM education could cost upwards of Rs. 1.35 crores! If anyone plans an international education for their child, then cost plus depreciation of rupee makes it a double whammy.

Parents are increasingly aware of the cost of raising a child but forget to plan for it separately. Many still use traditional savings instruments and gold for planning. Some common mistakes parents make while planning for their child’s future are:

-

Not having a separate child plan for their key milestones like global degrees, marriage etc.

-

Not planning for peripheral costs like books, laptops, hostel fees etc.

-

Forgetting the impact of inflation on savings & involved costs

-

Unmindful of the advantages of compounding and starting early

-

Unawareness of the superior capital generation capability of equities over long term

-

Not taking advantage of the tax efficient returns of equity and modern debt based products over traditional saving products

-

Mixing insurance and investment

Due to rising cost and sub optimal financial planning for child’s future, 80% of parents have to pay for the education from their day to day income or general savings. Overall, lack of planning can impact the future through loans and depletion of savings.

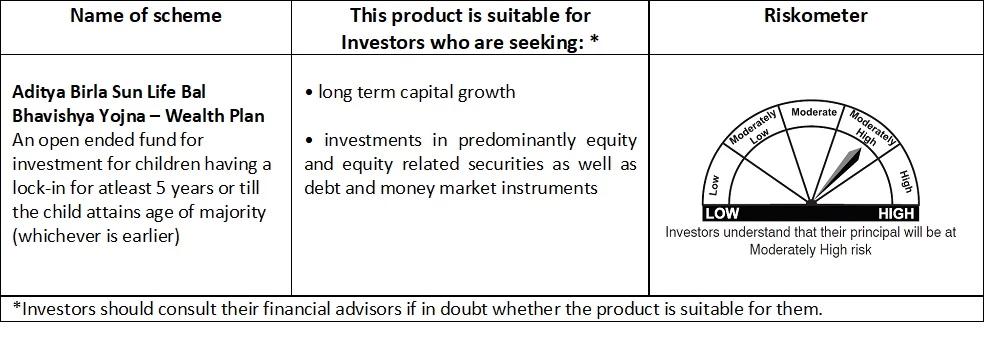

Keeping the above in mind, Aditya Birla Sun Life Mutual Fund has introduced Aditya Birla Sun Life Bal Bhavishya Yojna – Wealth Plan (An open ended fund for investment for children having a lock-in for at least 5 years or till the child attains age of majority (whichever is earlier)). In this scheme anybody can invest on behalf of the child for the child’s future. Yes anyone - parents, grandparents, paternal and maternal uncles & aunts, close friends, even company or community trust!

What better for grandparents who see their legacy in their grandchildren, or favorite uncle who wishes to ensure his niece is next astronaut? The ideal plan for very young child, could be this scheme which predominantly invests minimum 65% in equities & equity related instruments, 0-35% in Fixed Income Securities and 0-10% in Units issued by REITs and InvITs. If a monthly SIP is started when the child is a year old, then by the time he is ready for his post-graduation and cracking his CAT for MBA, the fees could be ready.

Another plus is less volatility of investment. There is a lock in period of 5 years or child attaining maturity whichever is earlier. This not only gets in discipline & less volatility for child’s goals but also gives your money ample time to appreciate meaningfully. All the units are in the name of the child and he is the sole beneficiary. It also makes for a good financial gift by others among friends and family.

The ease of investment and transferring of benefits is unique. Apart from systematic investment plan (SIP) and systematic transfer plan (STP) #, this scheme offers Systematic Withdrawal Plan (SWP) #. Say when the child starts going to college, this can be used to provide for his monthly expenses like hostel, canteen charges, local travel, and other living expenses.

#this facility is subject to Lock in period

This is surely a plan made keeping a child’s best interest and actual needs in mind. They say it takes a village to raise a child. With this plan, the village can actually chip in to financially the child’s future.

For Further details refer SID /KIM Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

SOURCE:

*World Economic Forum via The Varkey Foundation.

https://www.statista.com/chart/13838/where-parents-help-their-kids-with-homework/

** The Value of Education Learning for life, published in 2015 by HSBC Holdings plc.

***https://www.iima.ac.in/web/pgp/apply/domestic/expenses

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000