-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

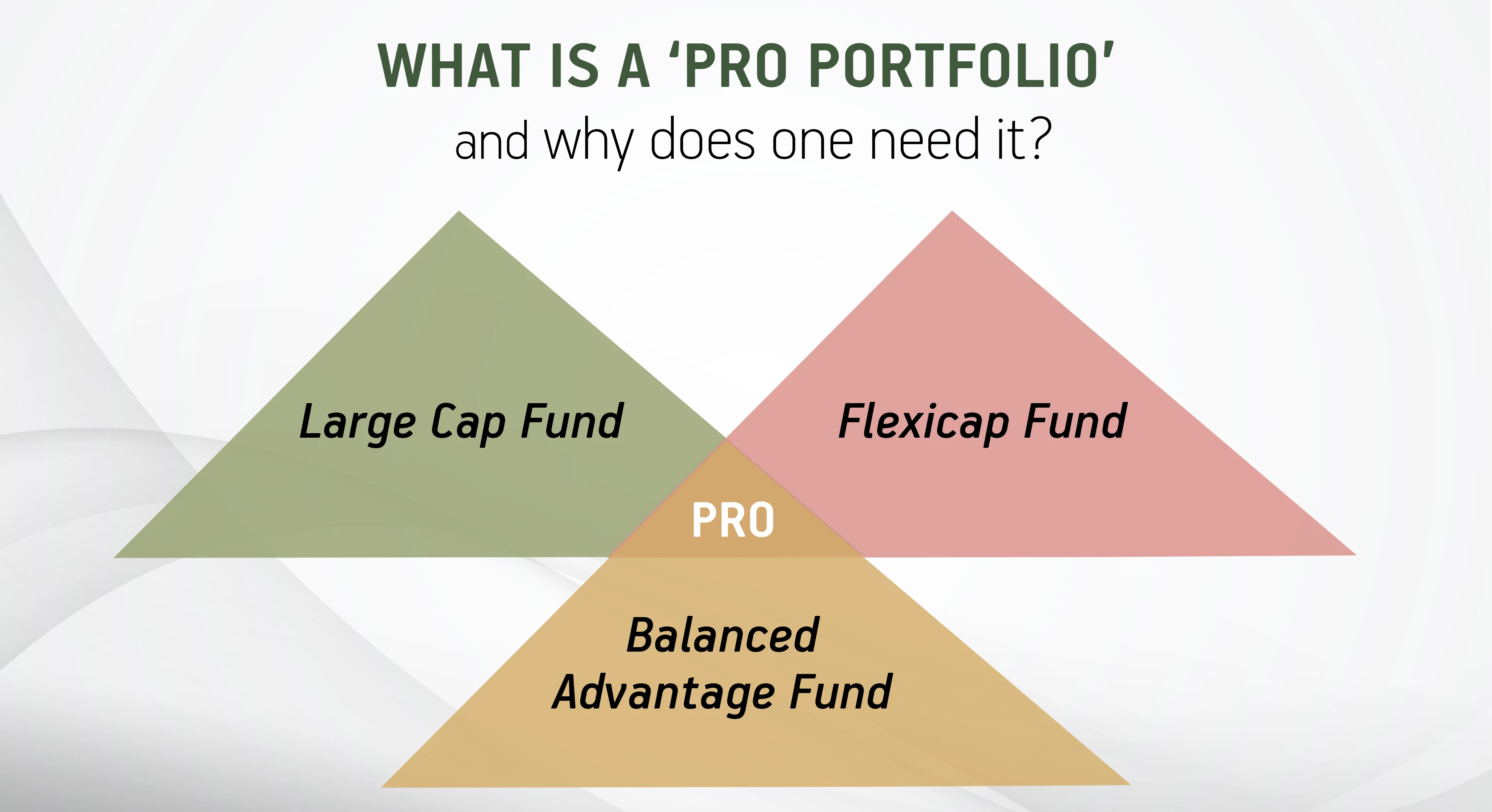

What Is A Pro Portfolio And Why Does One Need It?

Jul 20, 2022

4 Min

4 Rating

Be it any subject, activity, even sport, giving it a professional touch makes a world of a difference. A professional is well-versed with the nitty-gritties of the subject at hand, and can adapt, align and adjust expertly to any challenges that come their way.

Investing is no exception. While there is a lot of information, tips and advice available on how to invest, giving it a professional touch can give your portfolio a real lift. What is a professional portfolio, you may ask? It is a package of investment products that enhances your returns in a bullish market and reduces the downside in a bear market, giving you a complete package of well-managed risk and return.

But how does one transform his or her simple portfolio into a ‘Pro Portfolio’?

What it takes to build a Pro Portfolio?

To make a professional portfolio, all you need is to start Pro portfolio. Pro portfolio is combination of three types of mutual funds: large-cap, flexi cap and balanced advantage funds. These three kinds of funds act as a wholesome, balanced diet for your investments.

Large-cap companies are the market leaders. They are time-tested and reliable. Thus, investing in large-cap funds is considered to give relatively stable returns even during volatile times. Flexi cap funds invest in all three market caps, giving your investments the advantage of diversity as well as flexibility. They bring to your investments the power of large caps combined with the growth opportunities of mid and small caps. As for balanced advantage funds, they dynamically allocate your money in both equity and debt instruments, negotiating the fluctuations in each market to cut down on risks.

Pro Portfolio: Why it matters?

One harsh reality about the stock market is that it is volatile and ever-changing. There is no saying which side the scales of market movement will tilt. Every global and national event reflects in its movements, often changing its trend abruptly.

Now, every fund may not perform well in every market situation. Very often, it is not the market itself, but the investors’ reactions to the market movements that affect the performance of a fund. Sometimes, investors tend to go aggressive with their investments in a bullish market. Inversely, a bearish market may bring forth the investors’ risk aversion. These reactions lead to large scale buying and selling on the market, causing various funds to adjust themselves accordingly.

So, is there a way of ensuring your portfolio doesn’t bear the brunt of such upheavals, and stays more or less stable even in bearish times?

Yes. That is where having a pro portfolio helps.

A pro portfolio brings together the combination of all three funds . With its diversified approach at every step, from diversifying among market caps, to covering equity and debt markets as well, a pro portfolio gives your investments scope to strategise and adjust.

If the equity markets are in hot water, your debt market investment will keep you afloat. If there is a sudden increased interest in a particular sector, your flexi cap investment can also be directed towards it, making the best of the opportunity. Any friction in the market can be mitigated by your large cap, “stable” investment.

Do you really need a Pro Portfolio?

While professional portfolios are particularly attractive for new investors who are yet to identify and polish their own individual investing style, they still hold a lot of opportunities for seasoned investors as well.

In times like these when the international geo-political situation is in turmoil, and is greatly affecting domestic markets worldwide, having a pro portfolio can be helpful. No matter which way the market swings, your investments will have the choice and power to make the most of it.

The essence of having a pro portfolio lies in its ability to be strong-rooted, flexible and balanced at the same time. Each of these qualities acts as a strength under different market conditions, making your portfolio stronger in the process.

In a nutshell, having a pro portfolio is a good strategy at any point in your investment journey. The sooner you invest in it, the longer your portfolio will get to grow. You need not wait for the ‘right moment’; your pro portfolio will adapt itself to the current market conditions by itself.

All you have to do is take the first step.

An Investor Education and Awareness Initiative of Aditya Birla Sun Life Mutual Fund. All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link: bit.ly/Birla_KYC for further details.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000