-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

What is the Aditya Birla Sun Life Digital India Fund?

May 06, 2024

6 min

4 Rating

India's digital transformation presents a high-growth investment opportunity. Aditya Birla Sun Life Digital India Fund aims to offers concentrated exposure to digital economy leaders, with adequate diversification to mitigate risks.

What is the Aditya Birla Sun Life Digital India Fund?

As a niche sector fund focusing explicitly on the technology, media and telecommunications sphere, the Aditya Birla Sun Life Digital India Fund seeks to predominantly funnel investor capital into industry leaders within segments including:

How are 30 Companies Selected in Sensex?

To better understand Sensex's meaning, one should also know the factors BSE takes into consideration when selecting the 30 stocks that make up the index. The selection is primarily based on these five factors-

-

Telecom Services Firms

-

Diversified Software Majors

-

Digital Platform Operators

-

Electronic Goods Manufacturers

Spanning B2B to consumer-facing models, portfolio selections emphasize sustainable competitive strengths alongside scalability attributes to fully capture outsized growth compared to traditional economy sectors over forthcoming years as Digital India plans snowball into action.

How Does an Aditya Birla Sun Life Digital India Fund Work?

Aditya Birla Sun life Digital India Fund operates similarly to any actively managed sector fund. It This fund pools investment capital from a large base of retail and institutional investors to construct a concentrated portfolio focusing explicitly on technology and telecommunications and aim to select new-age digital platform companies with sizable competitive strengths or exemplary financial metrics.

By investing in the Aditya Birla Sun Life Digital India Fund , underlying investors derive returns directly correlated to the aggregate performance from around 25-30 constituents from India's burgeoning digital economy. Tactical participation in the sunshine tech sector proves viable to moderate portfolio volatility while capturing upside from disruptors on a growth trajectory.

Factors to Consider Before Investing in Aditya Birla Sun Life Digital Mutual Fund

Given below are some factors that should be considered before investing in this scheme -

First and foremost lies in analysing historical fund performance across metrics like absolute and risk-adjusted returns over various periods. Studying periodic sectoral and style rotation volatility impact allows for gauging the amplitude of potential drawdowns.

After that, assessing portfolio concentration levels and market cap exposure presently, along with intended future pivots, can prove vital to determine how efficiently risks can get cushioned in the concentrated construct.

Lastly and most critically, investors must sincerely gauge individual risk appetites and potential return expectations over intended investment horizons before exposure. The dynamic technology sector demands patience to ride interim headwinds before long-term value creation occurs. Those having higher resilience levels with the ability to ignore short-term mark-to-market fluctuations stand a better chance of harnessing the sector fund potential over full cycles. So, self-awareness helps ensure portfolio alignment.

How to Invest in Aditya Birla Sun Life Digital India Fund Direct Growth ?

Given below are the steps to invest in the Aditya Birla Sun Life Digital India Fund

Firstly, interested investors must complete a one-time KYC registration process furnishing identity and address proof either online via AMC Website or other digital assets or physically at the nearest branch. After that, create an investment account on the ADITYA BIRLA SUN LIFE Mutual Fund platform, providing bank details and preferred mode of holding information.

Next, navigate towards selecting the Digital India Fund under the sector funds tab and confirm the intended investment amount based on minimum lumpsum or SIP thresholds. Specify a direct plan for lower costs. Carefully provide bank particulars for seamless debits either via net banking, UPI or bank transfers.

The system confirms the submission of investment applications into the Digital India Fund Direct plan along with expected timelines for the allotment of fund units based on prevailing NAVs on a T+3 basis. Investors subsequently gain login access for tracking portfolio valuation and managing existing as well as fresh investments. Investors save on costs by opting for a direct plan and avoiding distributor commission fees, thus enhancing portfolio returns over the long run.

Thus, efficient access pathways now promote wider investor participation in promising thematic mutual funds like the Digital India asset class.

Conclusion

The Aditya Birla Sun Life Digital India Fund is a well-structured thematic solution granting tactical exposure to India's high-conviction technology revolution underpinning social and economic progress over the next decade. By harnessing best-of-breed innovators into a concentrated sector portfolio construct benefiting from a trillion-dollar Digital India policy push, the fund strives to participate in structural upside with adequate risk calibration through basket diversification. Thereby, it helps investors seeking participation in sunrise industries and get good potential returns on their investments.

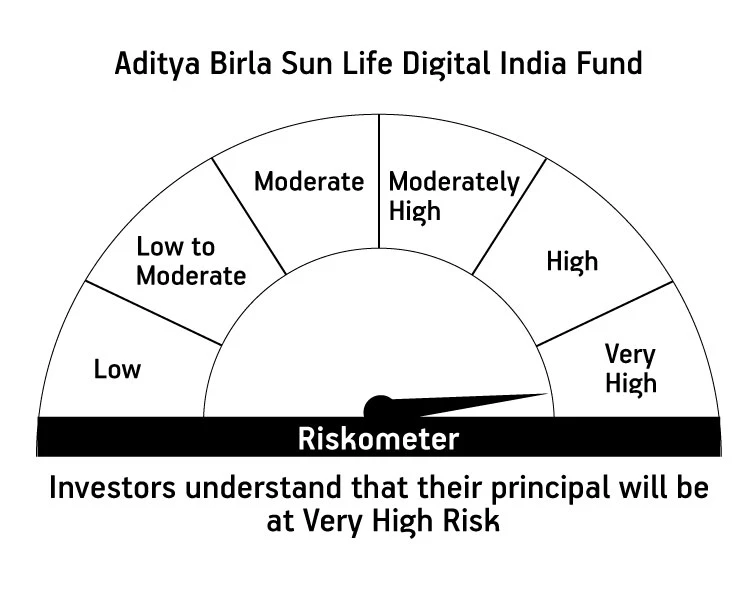

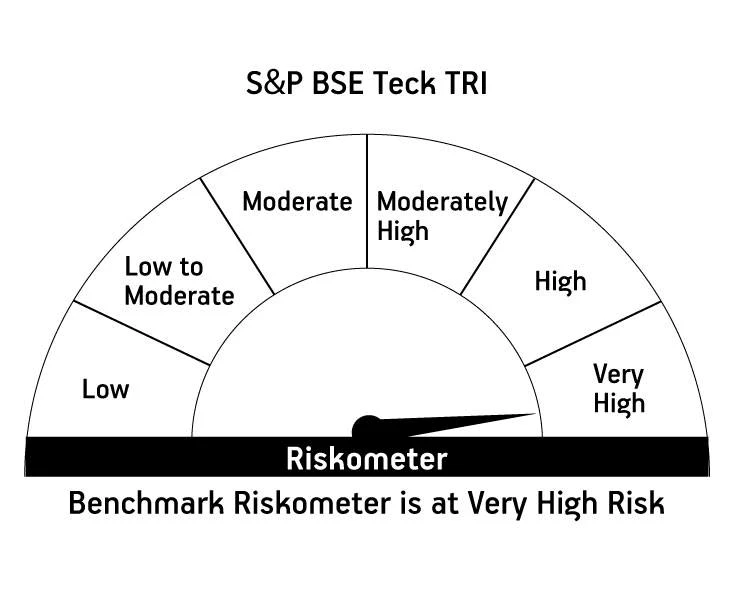

| Aditya Birla Sun Life Digital India Fund | ||

| (An open ended equity scheme investing in the Technology, Telecom, Media, Entertainment and other related ancillary sectors) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000