-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

What is recency bias in investing?

Jul 31, 2020

3 mins

4 Rating

Human psychology and investor sentiment play a vital role in any individual’s investing journey. This in turn impacts market movements as well. One such key psychological phenomenon that has a bearing on investing decisions is 'recency bias'.

What does ‘recency bias’ mean?

Let us look at a real-world example to understand 'recency bias'. Most of us make lists before heading out for grocery shopping – some items listed beforehand, and often extra items noted down at the very last minute before stepping out. While shopping you would probably find that you seem to remember all the extra items listed last minute and may find it difficult to recollect the items noted beforehand.

This is ‘recency bias’ - the tendency to remember or recollect more recent events or things as compared to older events.Now let us apply this to investing behaviour

It is common for investors to be guided (and often misguided) by the most recent economic and market events. This tendency of investors to take investing decisions based on the most recent economic/market incidents is indicative of ‘recency bias’ in investing. This causes investors to believe that the most recent events in the stock market will continue to happen in the future causing them to be biased and their perspective skewed while taking decisions.

Example: While browsing through some financial news you come across an article that reported that equity mutual funds in the international funds’ category have earned returns more than 18% in the last year (2019). You get excited by this and quickly liquidate units in your existing investment to invest in an international fund. If you do this without calculating the profit/loss you are making by liquidating your existing investment and without assessing the future outlook of these funds, just on a knee jerk reaction to the news you just read means you have succumbed to ‘recency bias’.

What does it lead to and why you should avoid ‘recency bias’?

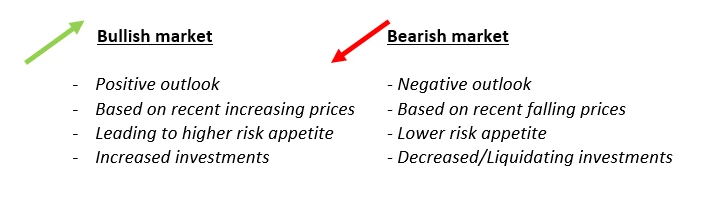

Simply put recency bias leads to ignoring past events in favour of recent events irrespective of their respective merit. Let’s look at the two market cycles and how they impact investor sentiment that is influenced by recency bias:

It’s considered a general rule of thumb that investing decisions should be based on a value analysis. ‘Recency bias’ is contrary to this where your sentiments tend to take over your investing decisions irrespective of the merit of the fund and its investment portfolio. All in all, being guided solely by recency bias can lead you to incurring losses.

How to counter this?

Recency bias is nothing but a basic human tendency. We all are swayed by our emotions while taking decisions especially when faced with tough decisions, investing behaviour is no different. But is there a way you can keep recency bias at bay in your investing journey? Definitely, if you keep a few of these things in mind:

Understand that recency bias is very much prevalent

Each time the market takes a turn prompting you to make investment changes – pause and think before you act. Ask yourself what is prompting your investing decision – a devised investing strategy or just a knee jerk reaction to a market swing?Always keep the focus on a value-based analysis while analysing investments

Maintain a holistic view – focus on the bigger picture of your overall investment goals and fitting your investments within this framework

It is often said ‘to err is human’ – so accepting that recency bias exists and you may be swayed by it is necessary. The key thing to remember is that markets will always go through phases of dips and rises – what is important is the fundamental strength of your portfolio. Well managed, well researched mutual funds investing in fundamentally strong stocks have the potential to tide over most investment cycles providing reasonable returns over the long term. So long as you can keep recency bias at bay!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000