-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Which mutual funds to buy in market correction?

Jun 09, 2022

3 min

3 Rating

Investors across the globe try to ‘time the market’ in a bid to invest when prices are low to accumulate gains and even book profits when prices are high. Market timing though is easi-er said than done. In fact, investment mavens will universally advise against trying to time the market.

That said, market correction is a reality, and one should look to capitalise on that. In fact, market correction is a good time for value investing.

What is this market correction we are referring to?

Market correction is essentially a decline and could be a rapid one in stock prices. Stock prices fall and rise each day, but typically a benchmark of price fall of greater than 10% from recent highs, is considered a market correction.

While market correction can be restricted to a single stock or extend to the market as a whole, in India typically frontline indices such as the NIFTY 50 or the SENSEX are considered to identify market correction.

Indian market in a ‘market correction’ phase

The NIFTY 50 breached its all-time highs in October 2021, crossing the 18,000 mark. Since then, it has seen a sustained fall hovering around the 16,000 mark. This nearly 10% decline in price of the index indicates that the market is correcting! Be it a new pandemic wave or the Russia-Ukraine conflict, there can be several factors prompting this correction.

The fundamental rule of stock markets though remains – what goes up will come down and what is down will rise!

So, it may be wise to invest in times of such market correction. But where?

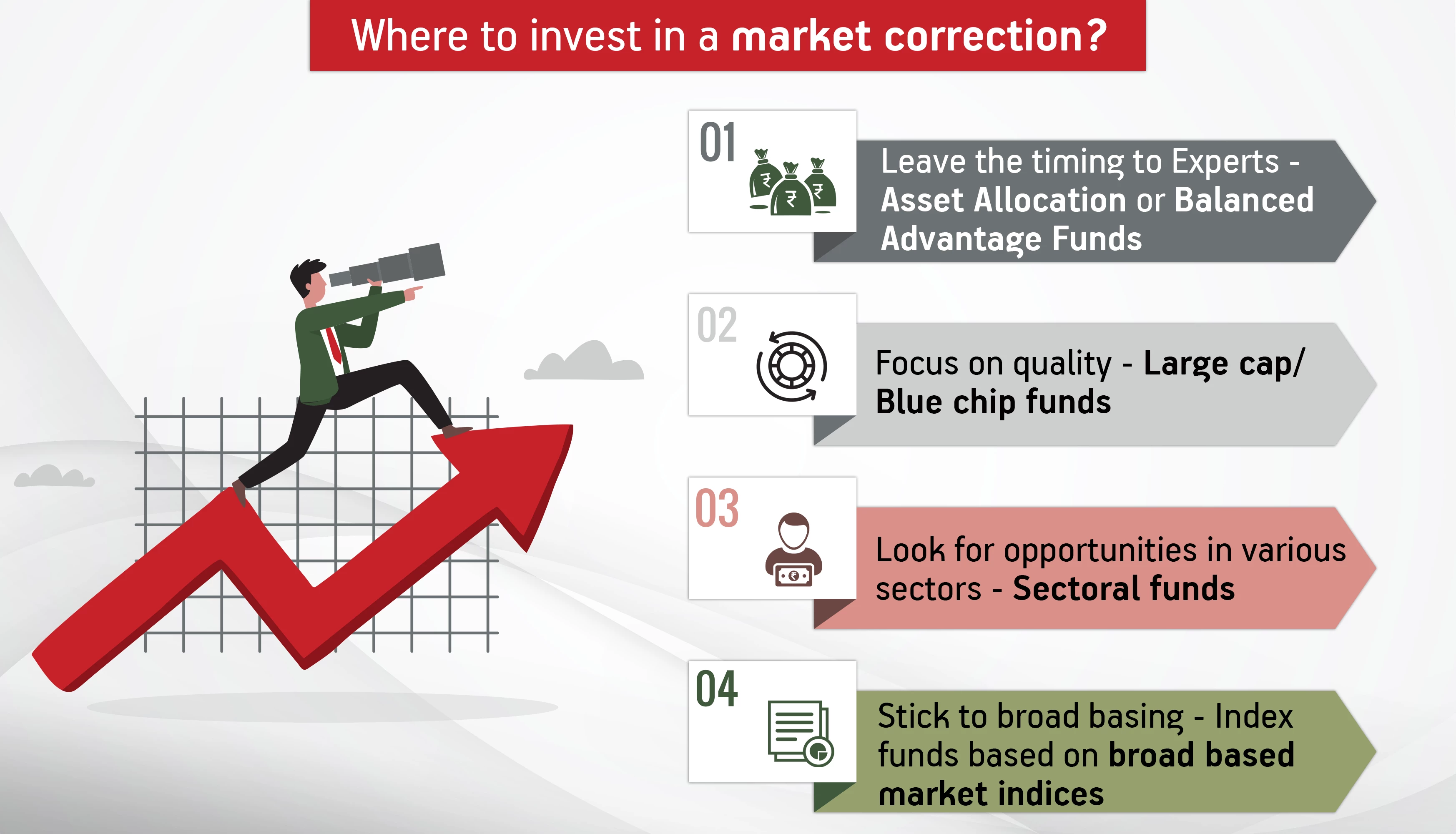

Where to invest in a market correction?

There are a wide range of equity mutual funds offered by AMCs today. In a phase of market correction, you can opt for some of these:

Leave the timing to Experts -Asset Allocation or Balanced Advantage Funds

These funds essentially track economic conditions and churn the asset allocation, to maximise returns for investors. In a market correction phase, the fund manager may follow a value investing strategy - seeking out equity available at good prices that has potential for growth once the market correction tides out.

You can leave the complex decision of choosing out investable opportunities to an ex-pert fund manager of such funds.Focus on quality - Large cap/Blue chip funds

Investors who continue to remain relatively risk averse can opt for large cap funds. These funds invest in fundamentally strong, established blue-chip stocks. These can be amenable to a market correction phase as - a future upside exists with relatively low-er potential downside.

Look for opportunities in various sectors - Sectoral funds

Sector performance tends to be cyclical, so certain sectors may be hit harder by mar-ket correction than others. If you have a good outlook for one or more sectors, mar-ket correction may be a good time to invest in them at lower prices.

Stick to broad basing - Index funds based on broad based market indices

Market correction across the board impacts broad based market indices. Index funds that follow a passive investing style can be considered to take advantage of a broad-based market correction. As the market recovers from the correction and begins ris-ing, scaling new highs so will your investment in index funds.

Also Check - What are Index Funds?

Also Check out - What is mutual fund

Remember a few more things:

Acting swiftly is key

Market corrections do not have any defined time period. They may continue for weeks or months depending on what’s primarily causing them. A market correction for example caused by political unrest may recover once peace talks begin or truce is reached.

So, acting swiftly and grabbing the opportunity of lower prices is key.

Can opt for SIPs for their averaging out benefit

The USP of SIPs is that they work well in volatile times. Even through a market correction an SIP mode can help you average out your investment cost – accumulating more units at low-er prices through the correction.

Also Check out - What is sip investment

Stay long

Remember no matter how the stock market is performing - the basic fundamental of equity investing continue - remain invested for the long term!

So, while market corrections may be a good time to accumulate investments at lower pric-es, they certainly should not prompt you to hit a panic button and begin liquidating existing investments. Hang on to your investments, to tide out this wave and eventually gain!

Also read about the Mutual Fund Switch Rules

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000