-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Why the Defence Sector Should Be Part of Your Investment Portfolio?

Aug 17, 2024

5 min

4 Rating

Evolving geopolitical landscapes emphasize the need to strengthen the country’s defence to safeguard its national and economic integrity. The reasons may be temporary, but the global uncertainty remains constant. Hence, investing in the country’s defence sector remains more relevant than ever. One way you can contribute is through mutual funds. This blog delves into the compelling reasons why investors should choose defence mutual funds as part of their portfolio.

Why invest in the defence sector now?

The Union Budget 2024 locked a significant budget allocation for the defence sector, contending to invest in high-quality defence-related products. The rise of advanced technology has propelled many companies in the defence sector to revamp their manufacturing and operational processes. Seeing the government’s commitment to strengthen our defence sector and the companies’ will to incorporate improved procedures further increase the relevance of investing in the defence sector. The rise of mutual funds investing in the defence sector in India attributes to this genuine commitment that may further bolster the defence industry.

All companies that directly or indirectly contribute to the production of military weapons, equipment, vehicles, or provide defence-related services fall under the purview of defence sector. The sector presents a unique opportunity for investors to capitalize with its growth.

Reasons to invest in mutual funds investing in Defence Sector in India

High-growth potential of the defence sector

Defence sector underwent major growth in recent years, positioning itself for a potentially better future. Many companies are actively playing an integral part to boost the sector’s economy. Not to forget, current escalating global matters poise for a renewed focus on prioritizing the defence sector. Investors can bank on these growth opportunities for reasonable returns.

Can boost economic expansion

Rising global tensions and political palpations ask for the production of high-quality defence products. This may resoundingly benefit the local companies, as the increased demand can improve their production efficiency. Plus, various government policies and initiatives are further aimed at strengthening the defence sector. All these effects can culminate in an overall economic expansion of the country.

Can provide a hedge against market volatility

A mutual fund scheme investing in defence sector can act as a good market hedge. The sun on the defence industry won’t set anytime soon. Adding a long-term investment plan with a mutual fund scheme investing in defence sector might be for individuals looking to add a sector with a low correlation to the broader market. Therefore, it acts as a natural hedge during geopolitical conflicts.

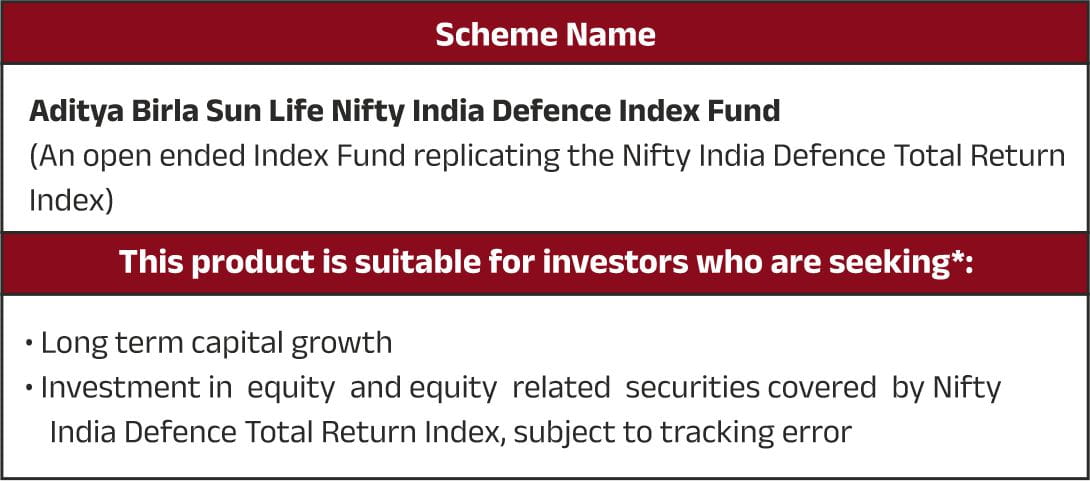

Aditya Birla Sun Life Nifty India Defence Index Fund: why choose this index offering?

The narrative of the defence industry is changing the landscape of India. The sector is adorned with a fresh investment perspective from investors as they aim to tow in bigger numbers. Hence, launching Aditya Birla Sun Life Nifty India Defence Index Fund right now becomes more relevant.

Positioning it as an index fund encourages exposure to many prominent companies in the defence sector rather than investing in individual stocks. The Indian defence sector is ready to transform, as it is presently equipping with the latest tech-associated weapons. As we speak, the companies in the defence sector are already gearing for a revolutionary outlook, positively trying to improve their efficiencies. So, let us conclude by saying that adding defence mutual funds to your portfolio can be game-changing.

Defence budget source: Defence Budget 2024 Highlights. The Financial Express. July 23, 2024.

The sector(s)/stock(s) mentioned herein do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stocks(s).

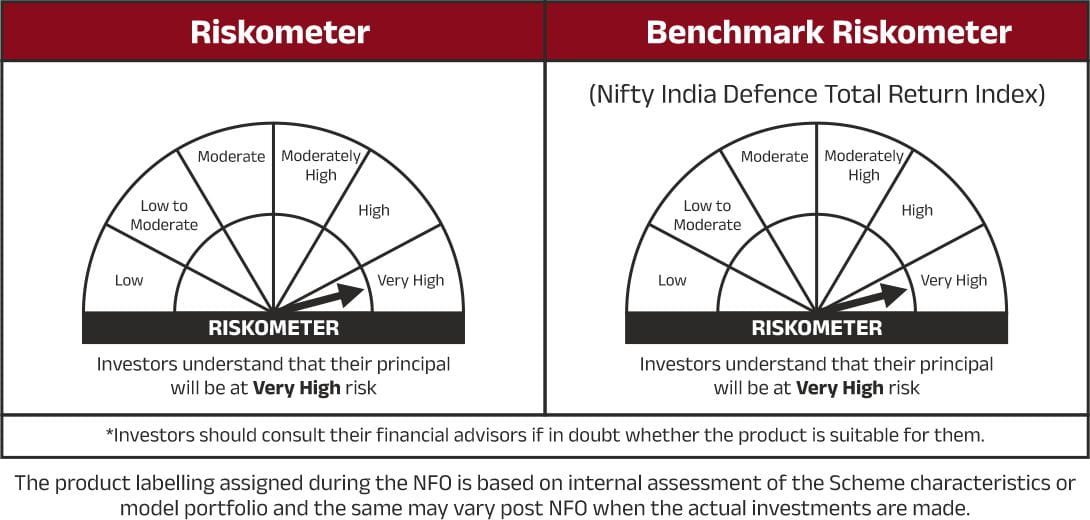

The Scheme does not guarantee/indicate any returns. There is no assurance or guarantee

that the investment objective of the Scheme will be achieved.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000