-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Why does a one-size-fits-all approach to investing no longer work?

Mar 16, 2025

5 min

4 Rating

Is a one-size-fits-all approach outdated? Find the right investment path for you in this comprehensive guide.

We live in a world where no two things are the same. All five fingers are of different sizes. Even identical twins have different personalities. Every person is different, their financial situation and personality are different. Similarly, every company is different, its challenges and opportunities, growth potential, and crisis-handling capacity are different. In such a dynamic world does a one-size-fits-all approach work?

In the early days when investing was new, most people followed a 60-40 ratio of equity and debt. However, this strategy no longer works. The capital markets, businesses, and our financial needs have evolved. There are multiple ways to approach an investment and mitigate risk to reach a financial goal. Let us understand with a few examples.

Different approaches to investing

Every person’s financial situation is different. Some may be in the high-income bracket with ample cash to invest, while some may have a limited surplus to invest. Having a surplus is not enough if they are not investing and are happy to keep it in the bank. Someone with a limited surplus might be a savvy investor willing to invest in equity and diversify across asset classes.

Individuals may also have different investment horizons and financial goals. Two people with the same investment amount, horizon, and financial goal might choose different approaches to investing.

The growth approach invests in companies that are growing rapidly and have the potential to beat the market.

The value approach invests in companies whose stocks are trading below their true worth and have the potential to recover as the value is realized in the long term.

Active approach actively buys and sells stocks to make the most of the opportunity and generate market-beating returns.

The passive approach replicates the index and strives to generate index returns.

There are many approaches to achieving the same goal.

What investing approach works for you?

In every approach one thing is common - diversification. Diversification can be done at various levels, investing in multiple countries, asset classes, sectors, and market capitalization. Taking the example of market caps, the market has large, mid, and small-cap stocks.

How you allocate your assets to these caps depends on your investing approach.

There are mutual fund schemes that invest only in large-cap, only in mid-cap, or only in small-cap.

There are also multi cap fund schemes that allocate a minimum of 25% in all three caps.

And there are mutual fund schemes that use a flexible approach to allocate assets where they see an opportunity.

There is no right or wrong on how you allocate your money. Your investing approach is tailored to your risk appetite and investment time horizon. Hence, before investing in a mutual fund scheme, read the scheme’s investing approach and see if it aligns with yours.

Flexi cap approach to investing

A Flexi cap fund is a dynamically managed mutual fund scheme with no rigid allocation structure. The only requirement is to invest at least 65% in equity and the remaining 35% can be allocated to debt and money market instruments. The fund manager has the flexibility to invest in large, mid, and small caps in the proportion they want.

A fund manager may be aggressive about the market opportunity and invest all the assets in mid and small-caps. In volatile times, the fund manager may shift allocation to large-cap, debt, and money market instruments. The fund manager actively allocates the assets depending on their research about the market.

Each Flexi Cap fund follows a different investment approach. You could swipe right to Flexi cap fund whose investment approach matches the most with your approach.

Is a Flexi-cap mutual fund your go-to investment?

A one-size-fits-all approach may not work in this dynamic world, but is flexi cap the way forward for you? To determine this ask yourself the following questions:

Are you pressed with time to monitor large, mid, and small-cap funds separately?

Do you want to grab opportunities across all market caps and mitigate risks?

Do you have a high-risk appetite?

Do you have a long-term investment horizon?

Are you comfortable with active investing?

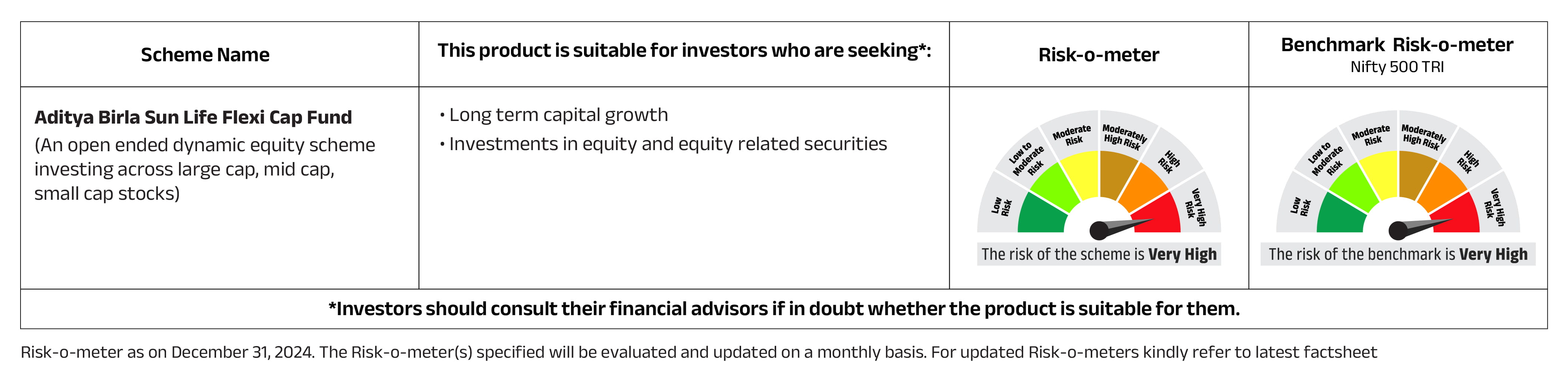

If the answer to all five questions is yes, Aditya Birla Sun Life Flexi Cap Fund can be a good investment option for your core long-term portfolio. You could consider starting a long-term SIP in the scheme and navigating the stock market dynamics with the expertise of the fund managers.

Risk-o-meter as on February 28, 2025.

The Risk-o-meter(s) specified will be evaluated and updated on a monthly basis. For updated Risk-o-meters kindly refer to latest factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000