-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Why investors should know This too shall pass

May 27, 2020

4mins

4 Rating

It's probably once in a lifetime that one would witness a global pandemic of the scale we are seeing today. A global pandemic that has not only unsettled life as we know it but also has the potential to rattle businesses, economies and markets across the globe. The Indian stock market has fallen by almost 25% over the last 3-4 months since news of the pandemic broke1.

While it may seem that there is no clear end to this pandemic in sight, as an investor do we have reason to believe that this "too shall pass"? Is a bounce back possible? Do we have any precedents in stock market history that can give investors’ confidence?.

Let us take a walk-through history

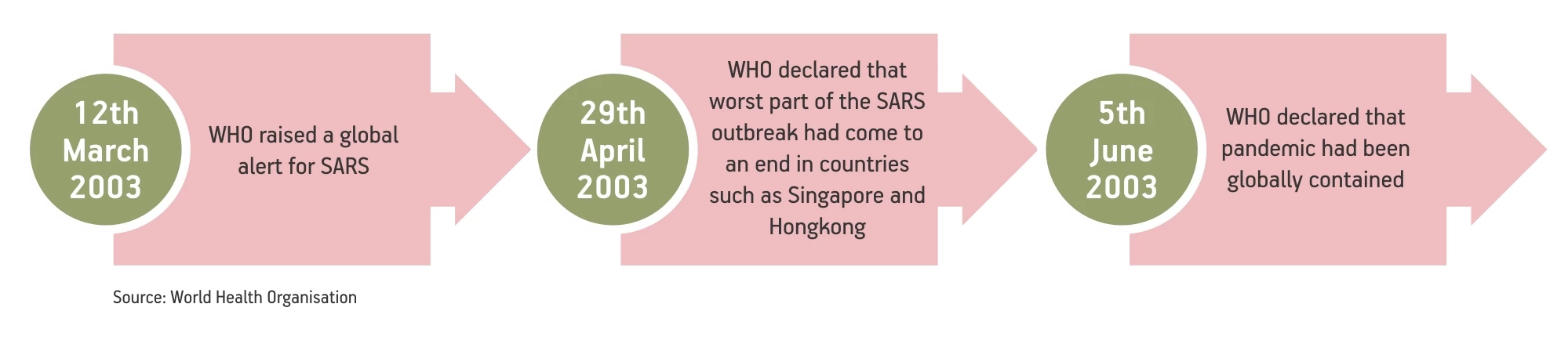

The ‘SARS crisis’ of 2002 and 2003 had significant impact on the global economy and markets. This pandemic began in China in late 2002 and quickly spread to neighbouring countries.

The pandemic ultimately saw over 8000 cases most of these coming from China and Hongkong.

Impact on global markets

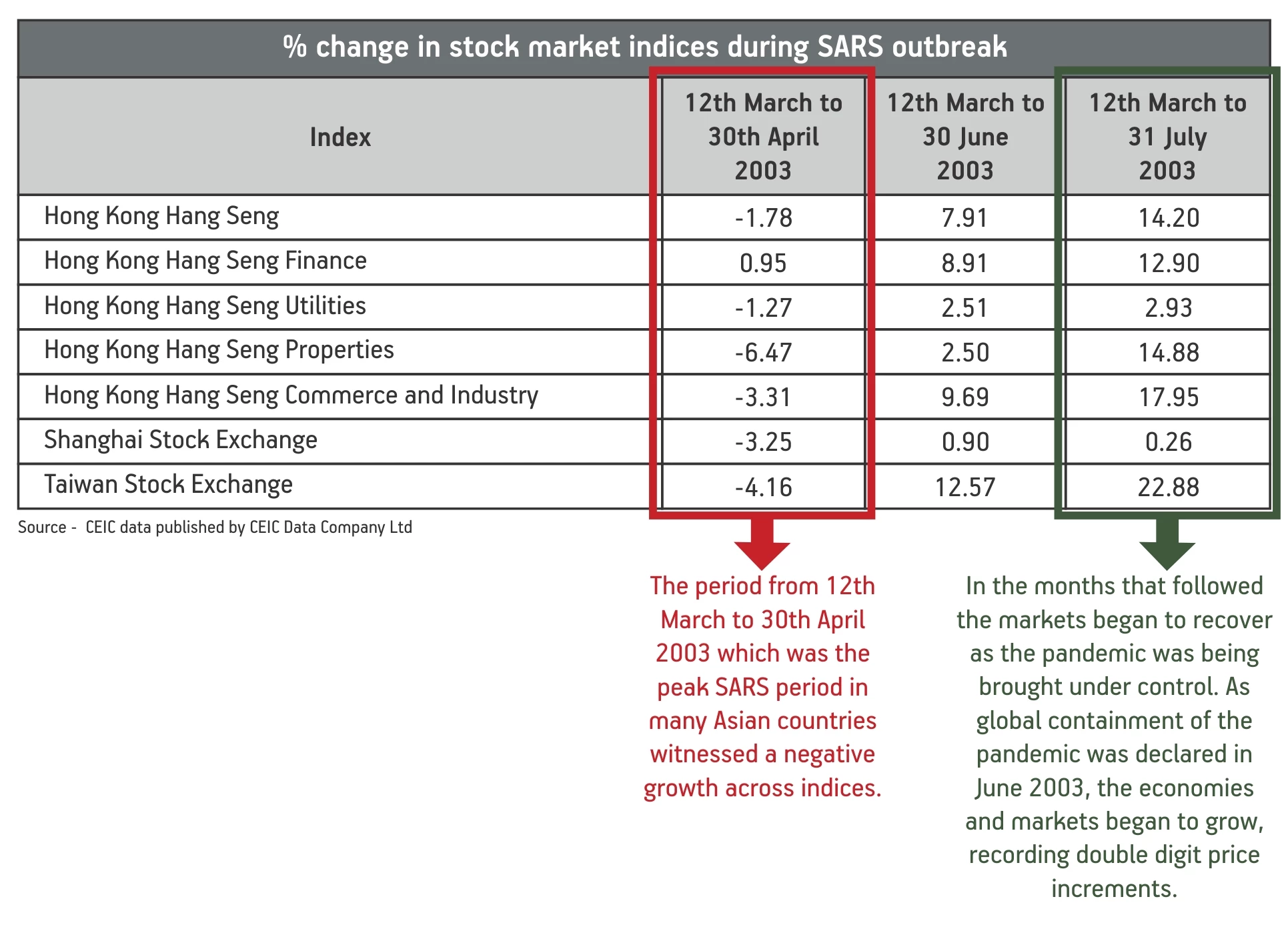

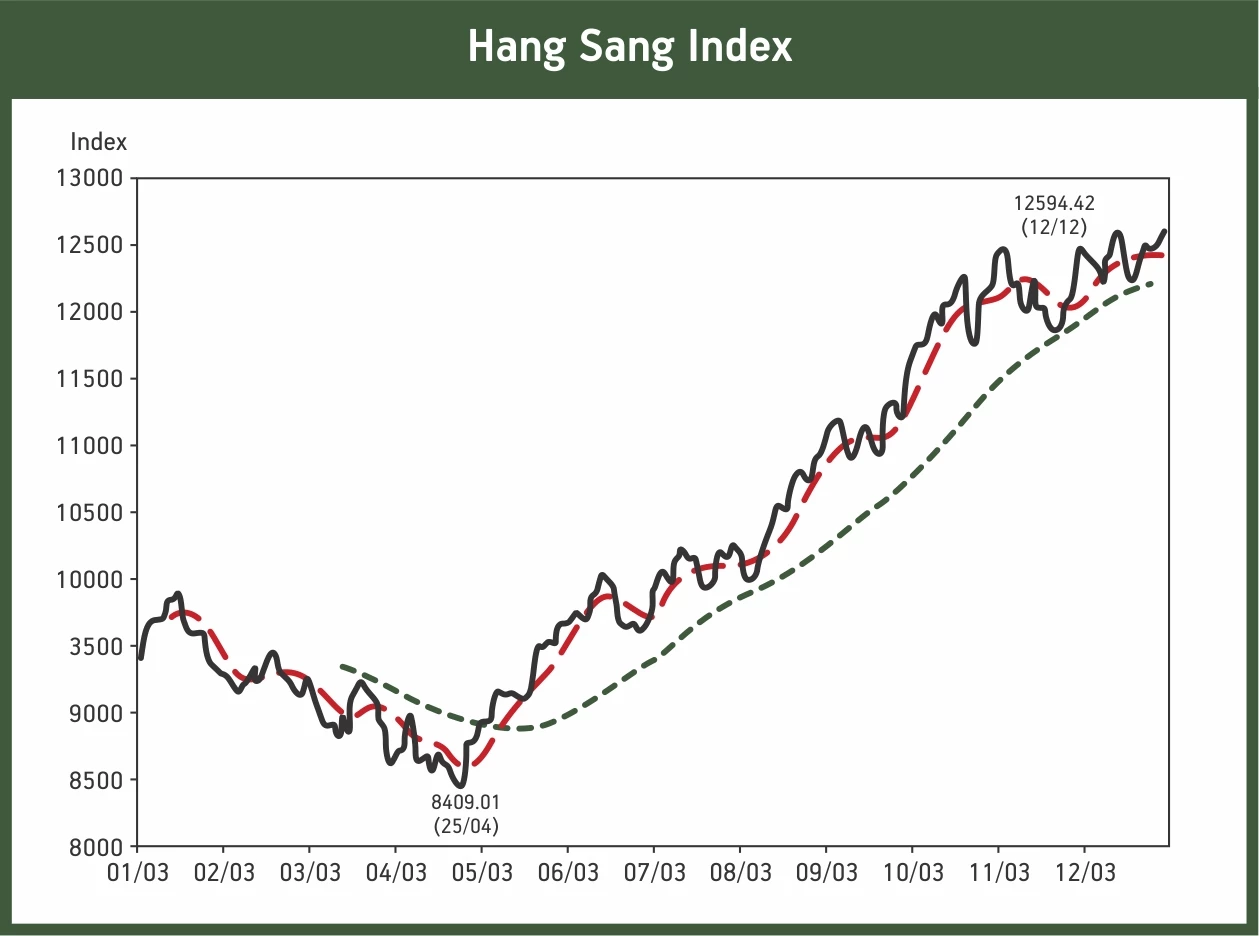

Global stock markets bore the brunt of the SARS pandemic, especially markets of China and Hongkong. In fact, the Hang Sang Index of Hongkong fell sharply to a 4 and a half year low of 8409 points during the SARS outbreak, on 25th April 20032. Although markets plummeted with the onset and spread of SARS, they bounced back with equal fervour in the months following its containment.

In fact, the Hang Seng Index reached a 28-month high of 12,594 at the close of 20032.

What caused the fall?

In the SARS outbreak, negative impact was predominantly seen in local consumption as people stayed indoors and in tourism and air travel services.

Similar impact pattern can be seen today with covid pandemic. With nationwide lockdowns imposed, people are staying indoors which would impact the non-essential consumption pattern. The blanket ban on travel will also have an impact on all travel and tourism related areas. But as the experience from the SARS outbreak revealed, these impacts were short term and temporary lasting only during the peak period of the pandemic.

As the famous quote goes – ‘History repeats itself’. The market bounce back after the SARS pandemic can give us an insight into what we can expect in the months and years to come post covid.

… And the subsequent rise?

The recovery post SARS was driven by a positive change in investor sentiment once the initial panic settled. The markets received a considerable boost with several governmental initiatives like the signing off the Closer Economic Partnership Agreement (CEPA) between China and Hongkong to encourage free trade to assist Hongkong to emerge from the slump post SARS, the subsequent launch of the Individual Traveller Scheme by China to boost tourism sector in Hongkong etc2.

As of date today, Governments across the globe have taken multiple steps to spur economic recovery and improve market sentiment. The Indian government has also maintained pace with other nations by announcing various measures to support the economy.

Lessons can be and have been learnt from previous experiences with outbreak of pandemics. As countries across the globe work on containing the pandemic with an equal focus on safeguarding the economy, we need to believe that - ‘every dark night is followed by a bright morning’. So be patient and hold tight as this too shall pass with brighter days in store.

Source:

1. www.bseindia.com – January 16, 2020 all time high of 42,063 points to May 3, 2020 closing of 31,715 points

2. HKEX Fact book - https://www.hkex.com.hk/-/media/HKEX-Market/Market-Data/Statistics/Consolidated-Reports/HKEX-Fact-Book/HKEx-Fact-Book-2003/FB_2003.pdf

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000