-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Why is focus important in investing?

Sep 21, 2020

4 Rating

Diversification is considered to be one of the key investing strategies that you should follow. Diversification both within your investment portfolio – across asset classes as well as diversification within asset classes – across different stocks or different bonds, is desirable. Suitable diversification helps manage the risk of your portfolio through a ‘broad basing’ strategy, but is there such a thing as ‘over-diversification’?

It’s often said that – ‘too many cooks spoil the broth’. Well such can be the case in case you over-diversify your investments. Let us look at over-diversification in mutual funds. While diversification can reduce the overall risk of the mutual fund portfolio, over-diversification can negatively impact its performance. In an over-diversified fund, the returns earned by a handful of stocks can be negated by lower returns earned by the balance stocks. All in all, it can limit your gains.

So, what kind of fund can keep such over-diversification at bay? The answer lies with ‘focused’ funds. These funds, as the name suggests, limit their investment portfolio to a focused group of stocks. The upper limit on number of stocks held is capped at 30 by SEBI.

Key investment philosophy of focused funds

These funds focus on investing in a limited number of reasonably performing stocks. The objective here is to earn high growth by seeking out stocks with high growth potential while ensuring to still have diversification within this selection of stocks.

The key philosophy here is investing a higher % in a limited set of well researched stocks as against investing smaller % across several stocks in an over-diversified portfolio.

Let us look at one such category of focused fund – Large cap focused fund:

Why look at large cap focused fund?

Large cap companies are the top 100 listed companies in terms of market capitalisation. Just as we tend to choose big brands while buying high value appliances for our home due to the ‘reliability’ factor, large cap companies can be chosen while selecting a focused fund. These companies are not only large in size but also established in their sector and tend to have strong fundamentals and financials.

Sectoral advantage and outlook

Investing in large cap companies carries several advantages, mainly

Reliability

These companies are established in their field, making them more reliable as investment choices

Returns

The strong financials and established track records of large companies help investors earn reasonable returns from their investments.

In a falling market

Their strong base may allow them to withstand market falls and downswings in a better manner. In fact, it is the strong fundamentals of large cap companies that can bounce back faster from a market fall.

These advantages stand to be magnified by a focused investing strategy wherein fund managers seeks out stocks with potential within the large cap category – with the objective of boosting the fund’s growth potential.

The stock market today continues to be volatile, being affected by the uncertainty of the looming global pandemic. In such times, it is the established stocks which may have the potential to remain and emerge stronger. In fact, over the last 3 months, the Equity Focused fund category has clocked a return of 22.7%1!

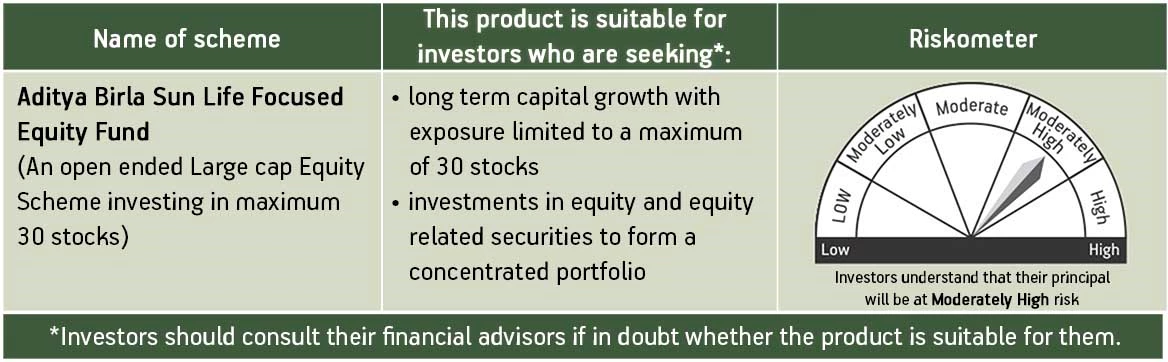

Aditya Birla Sun Life Focused Equity Fund

Aditya Birla Sun Life has its own focused fund in the large cap category – Aditya Birla Sun Life Focused Equity Fund (An open ended Large cap Equity Scheme investing in maximum 30 stocks). This fund invests in a concentrated portfolio of up to 30 stocks selected from the top 100 companies as per market capitalisation. The objective of seeking out a concentrated portfolio of stocks is to achieve long term capital appreciation by investing in upto 30 companies with long term sustainable competitive advantage and growth potential.

About fund investment strategy

With a view to achieving its key objective and sticking to its focused investment philosophy, the fund follows a combination of bottom up and top down approach. Focusing on both – identifying the best of the best individual stocks as well as ensuring representation of sectors with potential and outlook.

When should you consider such investments?

As our fundamental investing philosophy revolves around ‘diversification’ – focused funds too could form a part of your equity mutual fund portfolio. Investing across categories and across market capitalisations should continue to be the basic premise of investing – with focused funds being looked upon as having the potential to earn higher returns for investors with a higher risk appetite.

To know more about this fund and to invest click here

Sources:

1. https://www.moneycontrol.com/mutual-funds/performance-tracker/all-categories- 3 months returns as on 27th August 2020

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000