-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

The SIP Story of 2024: Why Systematic Investing Never Goes Out of Style

Jan 30, 2025

5 min

4 Rating

Indian Mutual Funds currently boast over 10.23 crore (102.3 million) SIP accounts, allowing investors to consistently invest in a wide range of schemes. The year 2024 has been a stellar one for SIPs, with contributions surging by an impressive 43% through November1.

But what is driving this success? Why are SIPs grabbing the attention of so many investors right now?

Let us dive into the key reasons behind their increasing appeal and what makes them such an attractive investment mode today:

Let us take a closer look at what the numbers reveal for 2024:

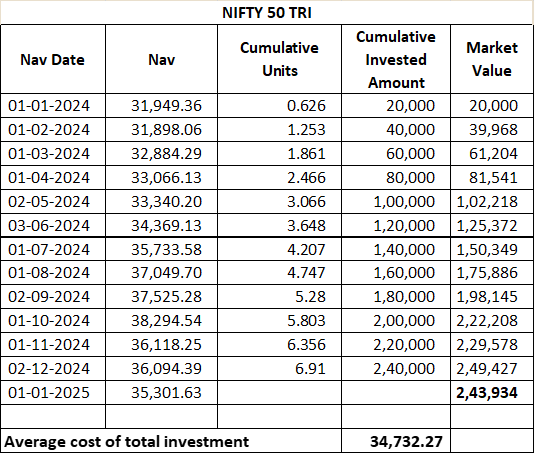

The NIFTY 50 TRI index began the year at 31,949 and closed at 35,3012, delivering a moderate growth of around 10.5%. However, it was not a straight path. As with most years, the index experienced its fair share of ups and downs, even breaching the 38,000 mark before ultimately settling around 35,000 by year-end.

So, how did Systematic Investment Plans (SIPs) perform in comparison? Had you had invested Rs. 20,000 on the 1st of every month in 2024:

By the end of the year, the average cost of your total investment comes out to around 34,732, which is not only lower than where the index closed, but also significantly less than its peak levels of 36,000, 37,000, or even 38,000. This means you effectively invested at a more favourable price compared to the highs of the market!

So, how did this happen?

The Key Factor: Rupee Cost Averaging

A crucial reason for the success of SIPs lies in a unique and noteworthy feature: rupee cost averaging.

As mentioned earlier, the NIFTY 50 index fluctuated throughout 2024. Sometimes, you would have been investing at higher levels, and other times, at lower ones. This is where the magic of rupee cost averaging comes into play.

What is Rupee Cost Averaging? With SIPs, you invest a fixed amount every month, regardless of market conditions. This means that you buy more units when prices are low and fewer units when prices are high, thereby averaging the cost of your investment over time.

Why is this beneficial to you?

The key advantage here is that it helps smooth out market volatility and lowers the impact of short-term market fluctuations.

In simple terms, even though the NIFTY 50 saw both highs and lows, your weighted average cost of investment worked out in your favour. By the end of the year, your SIP units were accumulated at an average cost, potentially lower than the overall market price, leading to greater returns when the market surged back.

This strategy ensures that over the long term, SIPs can offer significant growth potential, even if the market experiences short-term volatility.

The benefit of rupee cost averaging is just the beginning. There are several more powerful advantages to SIPs that make them an appealing investment strategy, especially for those looking for long-term wealth creation.

SIPs Allow for Compounding of Returns

One of the most compelling reasons to invest through SIPs is the power of compounding. When you invest consistently, not only are you earning returns on your initial investment, but you are also earning returns on the returns themselves. Over time, this compounding effect can significantly amplify your wealth.

However, it is important to note that the full power of compounding reveals itself most effectively when you commit to long-term investing. The longer your investment horizon, the more time your money has to grow exponentially, making compounding work its magic.Promotes Investment Discipline

Investing through SIPs fosters a disciplined approach. By committing to a fixed monthly investment, you develop a habit of investing regularly—no matter what the market is doing. This routine builds consistency and helps you stay on track, even during periods of volatility.

Amenable to Goal-Based Investing

SIPs are highly adaptable, making them a great tool for goal-based investing. Whether you are saving for your child’s education, a dream vacation, or retirement, SIPs allow you to break down large goals into manageable, regular contributions. The regularity and flexibility of SIPs can align with your financial objectives, helping you stay focused on your long-term goals.

Ease of Investing

One of the most attractive features of SIPs is the ease of investing. You do not need to time the market or make complicated decisions. The simplicity of setting up an automatic monthly transfer means that investing becomes a hassle-free process. Whether the market is high or low, the consistent investment helps ensure you win in the long run.

SIPs have proven themselves time and again to be one of the most reliable and effective ways to invest. They thrive on a simple yet powerful principle: consistency over time. And this is why SIPs do not go out of style.

A famous investing quote states, "The wealthy invest in time, not timing." SIPs perfectly embody this idea, emphasizing long-term commitment and consistency, making them an evergreen investment strategy that continues to deliver results, regardless of short-term market fluctuations.

SIP does not assure a profit or guarantee protection against loss in a declining market. The illustration mentioned above is not based on any judgements of the future return of the debt and equity markets / sectors or of any individual security and should not be construed as promise on minimum returns and / or safeguard of capital.

Sources:

1. As per AMFI data – November 2024 SIP contribution of Rs.25,320 cr vis-à-vis Rs.17,610cr in December 2023

2. NIFTY 50 TRI data from www.advisorkhoj.com

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000