-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Your Investment Prospects: What's in store?

Mar 27, 2019

5 mins

5 Rating

The past month has proven to be quite an eventful month with respect to both the markets and geopolitical situation in the Indian Sub-continent. It started with the RBI cutting the Repo-rate by 25bps which was hardly anticipated in this policy statement. This bodes well for not only the bond market but also for the overall economic growth. During the month, we also witnessed a tragic incident, one of the biggest terrorist attacks on our security personnel over the last 3 decades. My deepest heartfelt condolences for the brave martyrs who sacrificed their lives safeguarding our borders. As we speak, the geopolitical tensions that emerged for a few days have abated with very strategic and diplomatic manoeuvring of the situation, abhinandan to everyone!

Global equity markets continued the positive momentum in February buoyed by a decisively dovish Fed coupled with optimism on the resolution of US-China trade talks. Locally, the markets have remained under pressure mainly because of the mixed Q3 earnings season and heightened cross –border issues. With the current market sentiments favouring, there is a probability that the current government remains in power after elections. This would ensure not only higher transparency but also higher political stability in the future. All the reforms such as GST, IBC, RERA etc. may further stabilise and become efficient. FPI confidence too is boosted which is reflected through the uptick in FPI Inflows. Micro Indicators such as an uptick in bank credit growth also augurs well from the liquidity point of view.

SEBI, with its continuous monitoring and guidance through various mandates has always kept the investor interest at the core and a top priority. This year, post the reclassification on schemes, ban on upfront commission and the reduction on TER (Total expense ratio) slab rates, recently SEBI has once again shared a press release, keeping in mind the investors risk appetite for the Debt and Money Market category. As per the press release, the residual maturity limit for amortization based valuation shall be reduced from the existing 60 days to 30 days. Even with this change, Liquid funds have the potential to offer better risk reward ratio because of their higher liquidity and diversified portfolio compared to any other alternative investments for short term surplus deployment. However, we see investors increasingly trading up to Money Manager and Ultra Short Term fund categories for their investments with a few weeks of visibility. Favourable interest rate outlook makes this shift even more compelling.

So how do the investment prospects look like? Good, to me. Considering the following:

Small cap index to large cap valuation ratio as of Feb end is the lowest since 2013. So what? Are absolute valuation levels not very high, still? Is Nifty trading at trailing PE of 26 plus not really expensive? Yes, it appears that way, but as we adjust the Nifty performance for a handful of large weight stocks, the real picture is that large caps are not as expensive. Particularly with earning cycle turning up, and the increasing possibility of political stability, equity might surprise everyone. While I believe one need not be overweight equity, it’s the right time to start reducing the underweight. After all, not investing in equity could be riskier than investing, over a period.

ETF segment in the Indian MF sector has grown exponentially and is gaining traction in the last couple of years. As the market evolves and investors mature, Index investing becomes a very important part of investors’ portfolios. As a category, it’s gradually making a mark in India too! One compelling proposition is Nifty Next 50 ETF (larger Midcaps and smaller large caps) that has outperformed Nifty over 3, 5 and 10 years. However, recently it has underperformed Nifty and currently offers a great investment opportunity.

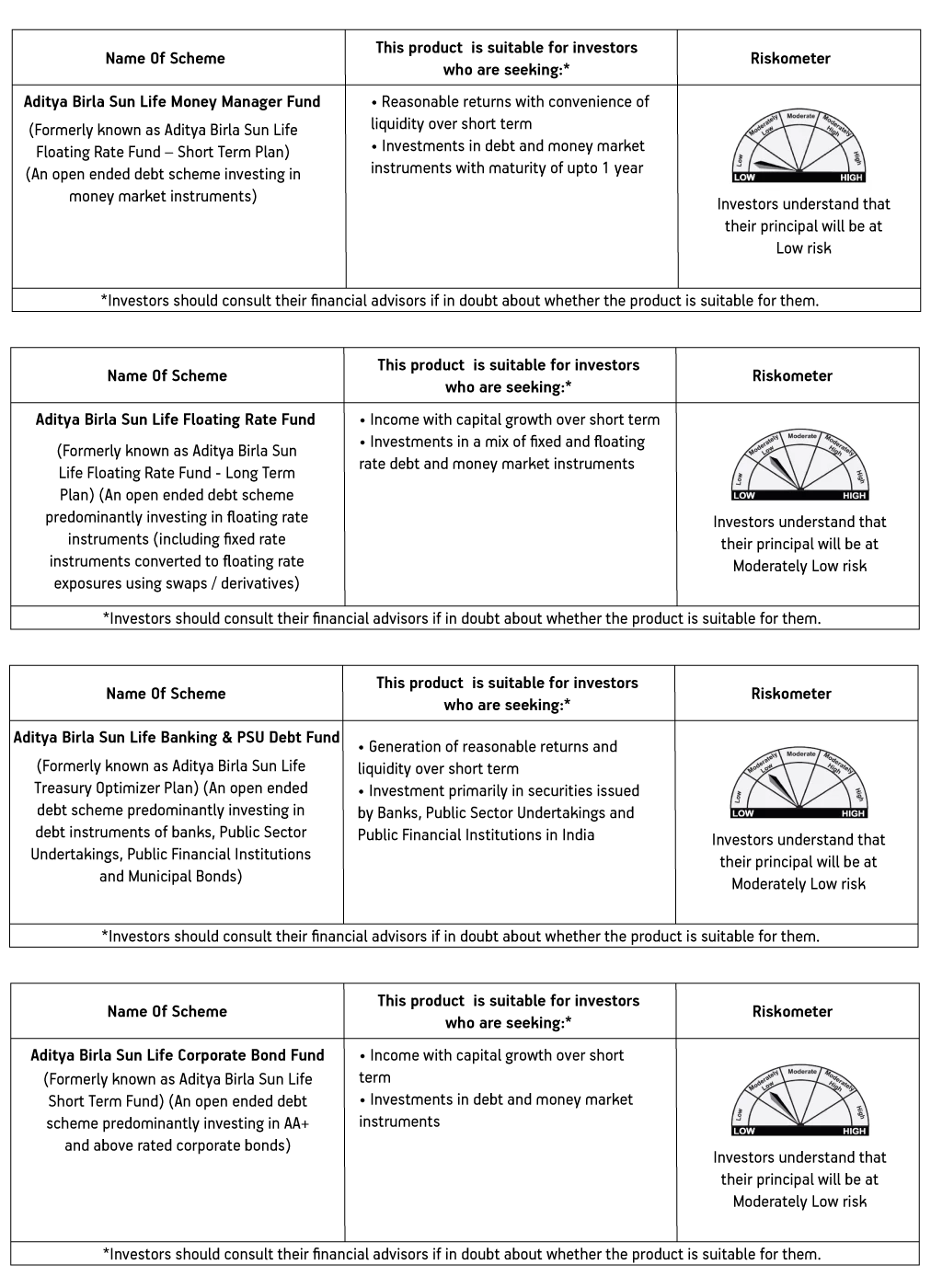

Liquidity and refinancing risk for NBFCs could result in a higher spread for the entire corporate bond segment and the sector in particular. Therefore across fixed income portfolios (ex-credit), we are running a very conservative portfolio construct, particularly, Aditya Birla Sun Life Money Manager Fund (An open ended debt scheme investing in money market instruments), Aditya Birla Sun Life Floating Rate Fund (An open ended debt scheme predominantly investing in floating rate instruments (including fixed rate instruments converted to floating rate exposures using swaps / derivatives), Aditya Birla Sun Life Banking & PSU Debt Fund (An open ended debt scheme predominantly investing in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds), Aditya Birla Sun Life Corporate Bond Fund (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds).

The derivative markets in fixed income market are pricing in 40 bps rate cut in next 1 year. As system liquidity becomes surplus after the year end seasonal deficit, we see short term rates moderating. This augurs well for money market, ultra-short term and low duration products.

The last and the most important: Credit. Is credit the new equity? At current YTM, and current risk perception, both? May be yes. Advisors and investors might do well to weigh the chances of loss given default v/s current YTM and take decision for investing in Credit Risk Funds. While the relative risk in debt is low, one should always remember, Debt investing is relatively safer but not risk free.

Investment returns are cyclical in nature. While the current market phase is a bit challenging, I am sure, as always we will successfully navigate this turf too. Ultimately, we as a fund house always stay committed in providing the best possible experience to all our investors.

Stay committed and happy investing!!!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

1800-270-7000

1800-270-7000