-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Attaining Balance of Payments sustainability-1

Jan 31, 2019

10 mins

4 Rating

Bhupesh Bameta

Bhupesh Bameta

Recent volatility in INR has brought into focus the sustainability of India’s Balance of Payments (BoP) account and the economy’s external competiveness. The period 2014 to 2017 was quite lucky for Indian external account with abundant global liquidity, low crude price and weak domestic demand creating healthy BoP surpluses and masking the emerging underlying weakness in external account.

The sustained BoP surpluses resulted in healthy accretion in forex reserves, which rose by US$113.7 bn in 2014-2017. However, only a marginal rebound in crude and some reversal in global liquidity created stress in our BoP account and currency in 2018, reflecting the underlying weakness.

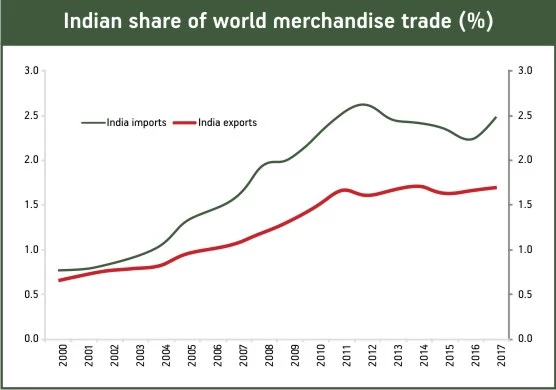

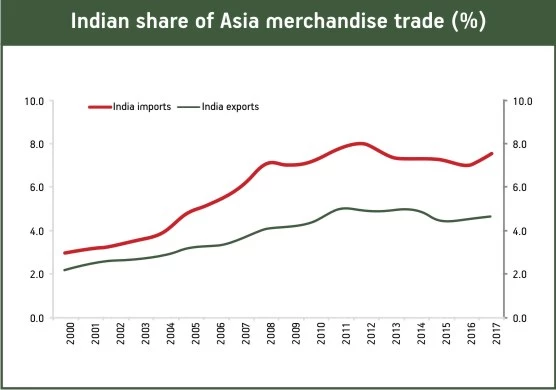

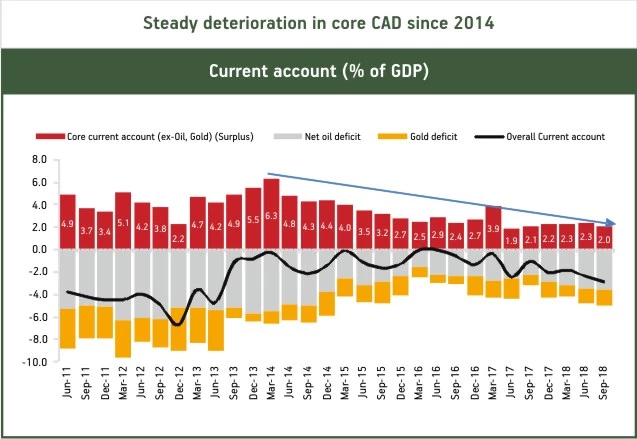

There are signs of weakening trend in India’s external competiveness: 1) India’s share of world and Asian exports have been plateauing even as its share in global and Asian imports continue to inch upwards, along with the size of its economy, 2) India’s core current account surplus (ex-gold, ex-crude) has been steadily deteriorating since 2014

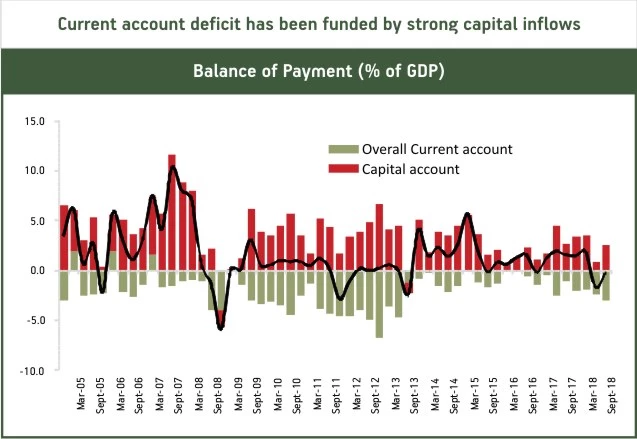

India’s BoP account had historically shown persistence of current account deficit funded by healthy capital inflows, generally in excess of current account deficit (CAD) , resulting in BoP surpluses and build-up of forex reserves. At India’s level of capital and energy requirements, it could be fine to have moderate current account deficit especially if it’s being used to fund investments.

However, we would like to highlight some emerging trends in India’s external account which warrants caution:

- The deterioration in core CAD has happened at a time when domestic growth and investments demand had been subdued

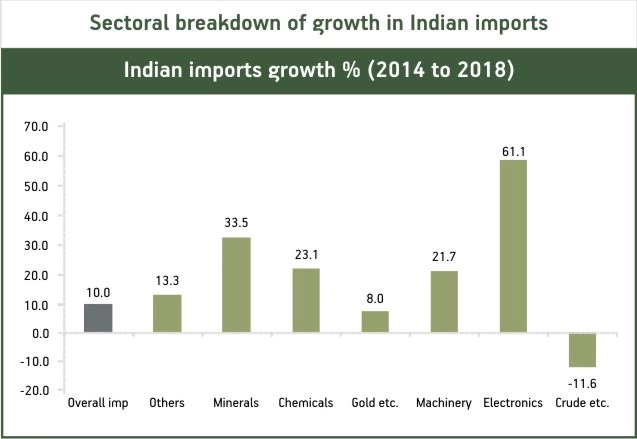

- Breakdown of imports data suggest strong growth in consumption items like electronics and even items like minerals and agri products, where imports is giving strong competition to domestic producers as also stunting evolution of new high tech consumer industries like smartphone, TVs, computer hardware

- India has largely failed to be a part of global value chains, which had given a big boost to industrialisation and capacity creation in manufacturing in many countries in East Asia, despite reduction in tariffs and opening up of its economy

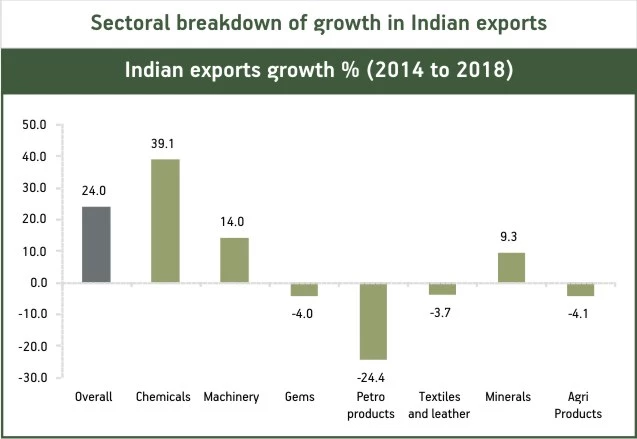

- Indian exports are also struggling in high labour intensive segments like textiles, leather, gems and jewellery, and agri products, where we have natural advantages

Sectoral breakdown of growth in Indian imports

Sectoral breakdown of growth in Indian exports

Current account deficit has been funded by strong capital inflows

Steady deterioration in core CAD since 2014

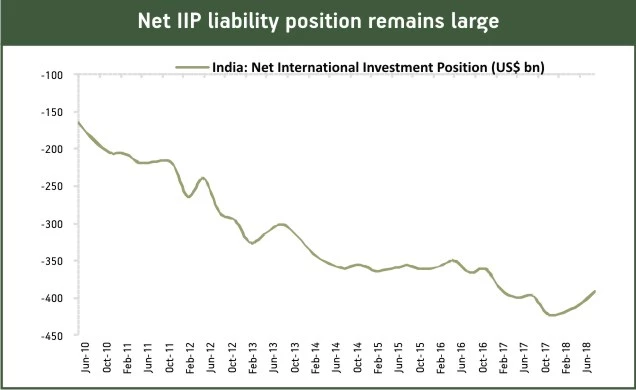

Long period of current account deficit has resulted in build-up of net liability in International Investment position (IIP) account, which means that India has a net liability with rest of world. International Investment Position (IIP) is the sum total of all the assets and liabilities of a country with rest of the world.

Net IIP liability position remains large

Persistent high net liability position in IIP account is served through income transfer out of India on net assets owned by foreigners, which creates a further drag on current account. Over long-term horizons net IIP liability would generally be expected to be served through running current account surpluses in future, which also entails need for greater domestic competitiveness. (There are of course other ways to serve net IIP liability through running capital account surplus like acquisition of foreign assets by domestic investors and write down/selloff by foreign investors, which cannot be regarded as optimal for India at least in foreseeable future).

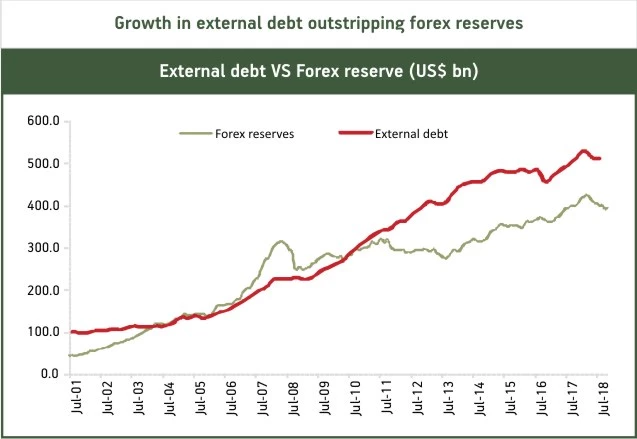

Besides IIP, external debt also indicate need to be careful towards boosting external account sustainability. India’s external debt has been running ahead of forex reserves. While the share of short term debt is not very high, and in cross country external debt profile India is still at benign levels, Indian external debt has to be seen in conjunction with high FII investment, persistent CAD and high dependence on energy imports.

Growth in external debt outstripping forex reserves

Improving external balance through competitive exchange rate

While there are many structural reasons for the erosion of competitiveness, exchange rate adjustments is one of the natural adjustment channels for its correction. However, many times, strong capital flows mask the underlying trend in external balance and hinder the natural adjustment through the exchange rate adjustment channel. In such cases we believe the role of policy intervention to ensure a reasonably competitive exchange rate becomes important.

There is a justification in allowing currency to find its own level in market and an overtly interventionist policy towards currency could have international repercussions given the escalation in global trade tensions. However, we believe that there is a need for policy intervention towards a competitive exchange rate if the currency is misaligned for prolonged period due to strong capital flows. An over-valued exchange rate results in more painful and sharper correction in currency later on, which has destabilising impact on economy. The sharp decline in 2018, was one such correction, which should thus help in correcting some of the deterioration in current account.

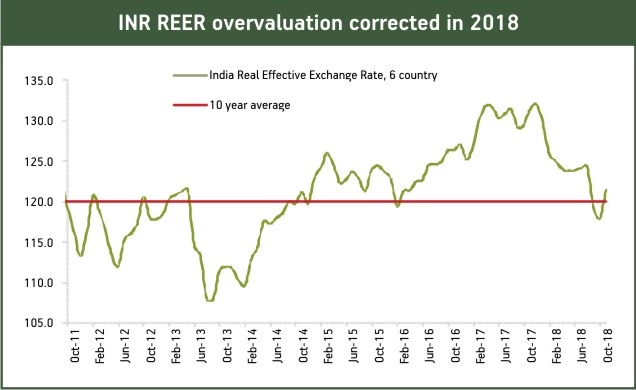

Our analysis suggest that value of currency impacts trade competitiveness in India with a 2-4 quarter lag. The steady increase in INR REER, Real Effective Exchange Rate (exchange rate adjusted for inflation) since mid-2013, had been one of the contributor to steady deterioration in India’s core current account, in our view. The correction we witnessed in 2018 had brought the down the REER overvaluation and it is currently at close to 10 year average value.

Policy intervention can take the form of RBI intervention in currency market as well as government regulations to ensure that capital inflows come only where it is required. While there are many long term and strong benefits of foreign capital for the economy, the welcome of foreign capital should not be totally unfettered. We need to keep in mind that capital account is generally the mirror image of current account and there is no harm in being somewhat selective in the type of capital we solicit.

INR REER overvaluation corrected in 2018

To summarise, we are witnessing a steady decline in India’s external trade competitiveness and there are both stock (external debt, IIP) and flow signals (deterioration in core CAD), of potential weakness in India’s BoP account. The likely uptick in Indian GDP, end of global quantitative easing and domestic political uncertainties should mean that BoP would likely witness continued pressure in 2019 and reclaiming external competitiveness and restoration of balance in external account should be important focus area for Indian policymakers.

We should be aiming at long term structural improvement in external account by boosting domestic productivity, removing infrastructural bottlenecks to exports and keeping domestic costs under control. However, a competitive currency also has to be part of the policy mix for offsetting other weaknesses in India’s trade competitiveness.

Datasource: CEIC

Author - Mr. Bhupesh Bameta

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000

.jpg?h=403&w=725&la=en&hash=9D8A3BE92C1D1DBB8CD7227660A9ECDF)