-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

How can you invest in International stock markets?

Jun 24, 2019

6 mins | Views 8257

When we wake up to our smart mobile phones, strap on our fitness bands & joggers, or sip our favourite international flavour tea, we are part of the global village. We and millions others across borders and continents perhaps do the same every morning. When our everyday life is so impacted by the world, then why can't our investments also be balanced with a flavour of all opportunities available around the globe?

RBI allows Indians to invest upto $2,50,000 every financial year under its Liberalized Remittance Scheme (LRS)*. If taken at Rs. 70 to a dollar then, it's over crore rupees that may be invested in any asset of your choice. So you can start to invest in your favourite international equity based assets.

*https://www.indiafilings.com/learn/liberalised-remittance-scheme/

Now you may ask of the risks involved in investing in international assets and there are multiple. Investments in International (overseas) securities including Exchange Traded Funds involves increased risk and volatility, not typically associated with domestic investing, due to changes in currency exchange rates, foreign government regulations, differences in auditing and accounting standards, potential political and economic instability, limited liquidity, and volatile prices. Further, risks are associated with introduction of extraordinary exchange control, economic deterioration, and changes in bilateral relationships.

-

Regulatory risk: To the extent the assets of the scheme are invested in overseas financial assets, there may be risks associated with currency movements, restrictions on repatriation and transaction procedures in overseas market. Further, the repatriation of capital to India may also be hampered by changes in regulations or political circumstances as well as the application to it, of other restrictions on investment. In addition, country risks would include events such as introduction of extraordinary exchange controls, economic deterioration, and bilateral conflict leading to immobilisation of the overseas financial assets and the prevalent tax laws of the respective jurisdiction for execution of trades or otherwise.

-

Currency risk: The schemes may invest in securities denominated in a broad range of currencies and may maintain cash in such currencies. As a consequence, fluctuations in the value of such currencies against the currency denomination of the relevant scheme will have a corresponding impact on the value of the portfolio. Furthermore, investors should be aware that movements in the rate of exchange between the currency of denomination of a fund and their home currency will affect the value of their shareholding when measured in their home currency.

-

Country risk: The Country risk arises from the inability of a country, to meet its financial obligations. It is the risk encompassing economic, social and political conditions in a foreign country, which might adversely affect foreign investors' financial interests.

Then the question begs to be answered is, can we invest in rupees with an Indian company under Indian laws and still get international markets’ exposure? Wouldn't that be easy? Yes, there are mutual fund schemes that invest in global equities. Here you may invest in rupees while all the associated risks of international investing are managed by the fund house and its expert team of fund managers. You can read the scheme document to understand the strategies adopted to mitigate currency, geopolitical, regulatory and other risks.

These funds invest in equity and debt instruments globally. One thing to keep in mind is that if the fund has more than 35% of its holdings in foreign assets then, the tax treatment# is akin to debt fund i.e. with indexation benefit.

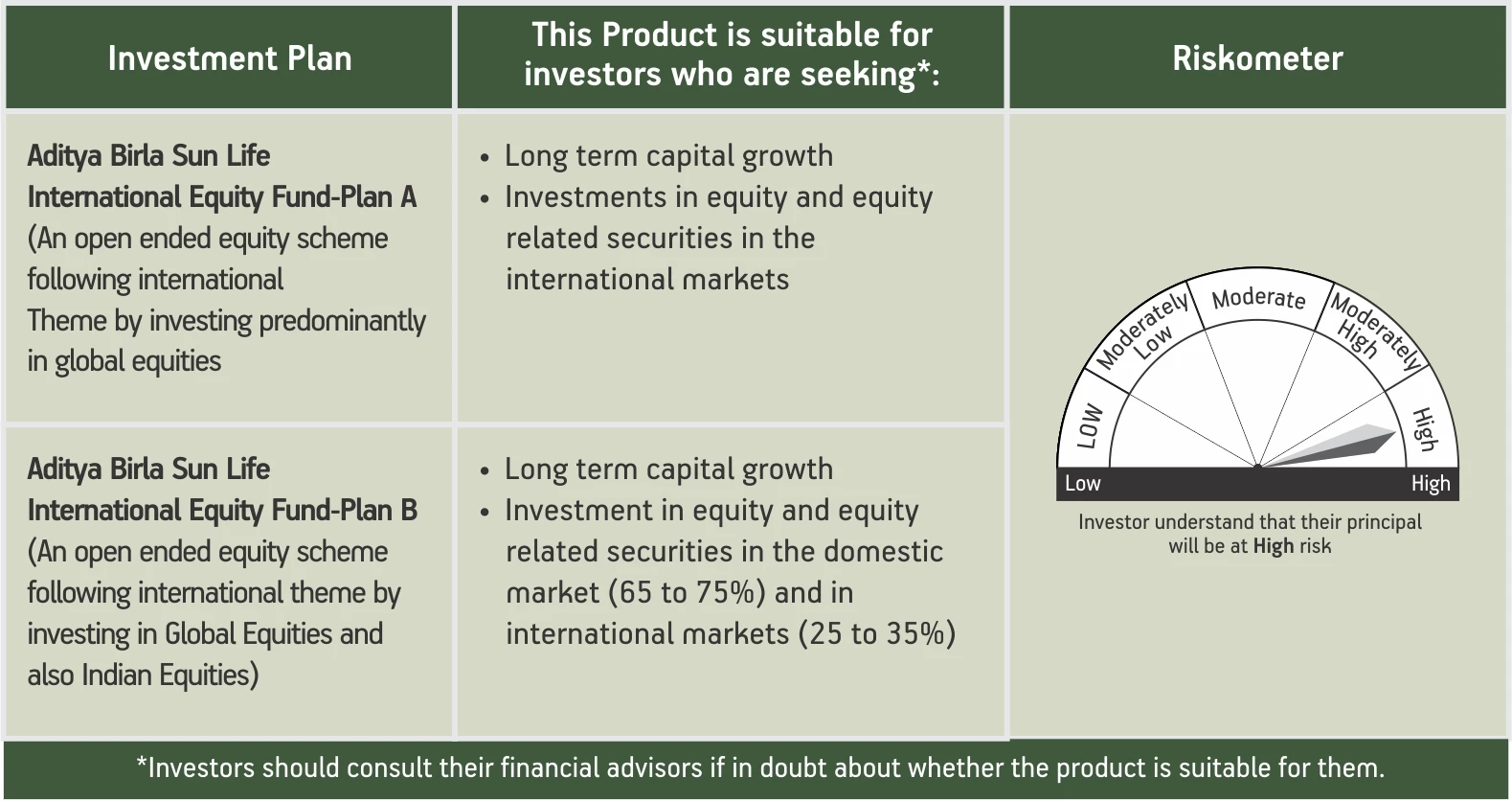

Aditya Birla Sun Life Mutual Fund also offers one such option through which you can invest in international markets. You may start investing with as low as Rs. 1000.There are this scheme. The plans are:

-

Aditya Birla Sun Life International Equity Fund-Plan A

An open ended equity scheme following international theme by investing predominantly in global equities

-

Aditya Birla Sun Life International Equity Fund-Plan B

An open ended equity scheme following international theme by investing in Global Equities and also Indian Equities

You can consider this scheme only if your investment objective is long term capital growth.

Do consult with your financial advisor to understand which international fund is best for your risk appetite, portfolio diversification and financial goals.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Rate this

Rate this Article

Our Experts

Our Experts

Tools and Calculator

Tools and Calculator

RSS News Feed

RSS News Feed

Archives

Archives

Close

Hover to Zoom

1800-270-7000

1800-270-7000

Thank You

Message will change according to your requirement.