-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

All Roads Lead to Long Term Investing

Aug 26, 2019

6 mins | Views 7631

The month of August spells Freedom for us Indians and we would like to wish you a very happy Independence Day. We hope that this month will also bring about freedom from worries & financial independence for many.

While the past few weeks & months have seen increased market volatility in both equities & fixed income for a variety of reasons, we are turning more and more confident that the turnaround could be near. In the recent monetary policy, RBI conceded a slowdown in the economy and hence has also surprised the market with a 35-bps rate cut and reiterated further stance for being ‘Growth accommodative’. The Hon’ble Finance Minister is also holding a week-long series of meetings with industry representatives to find out means to revive the flagging economic growth.

With equity markets having seen billions of dollars of market cap having shaved off on concerns including global growth, trade wars & domestic growth & policy it is important to point out that equity markets are at an abnormal point in terms of valuations. The earnings yield gap (difference between the benchmark bond yield & Equity earnings yield) is at a point seen only 6 – 7 times in the last 15 – 20 years. This ratio is indicating that perhaps it is time to add some risk component to your portfolio in terms of equities.

In each of these instances when this yield gap has contracted, the markets have tended to rally in near future. In this back drop we would also like to highlight that fixed income investors (especially those in accrual oriented schemes) who have been largely stressed with rising interest rates, spreads and credit events over the past year or so would’ve seen one of the best monthly performances by fixed income in over years. As Govt bond yields tested new lows, and market liquidity got enhanced with continuous rate cuts by RBI, almost all debt fund categories delivered stellar returns. Our credit portfolios saw positive news on resolutions to IL&FS & Essel Group companies and we expect our investors and partners who continued to trust us with their money, to benefit with the expected resolution to the respective portfolios. We believe that Credit Risk category is still a good bet for those seeking higher accrual over at least a 3-5year investment horizon.

With so many tail winds, I believe that this is the time to take a leap of faith and invest with a longer-term view on economic growth & markets reflecting the same.

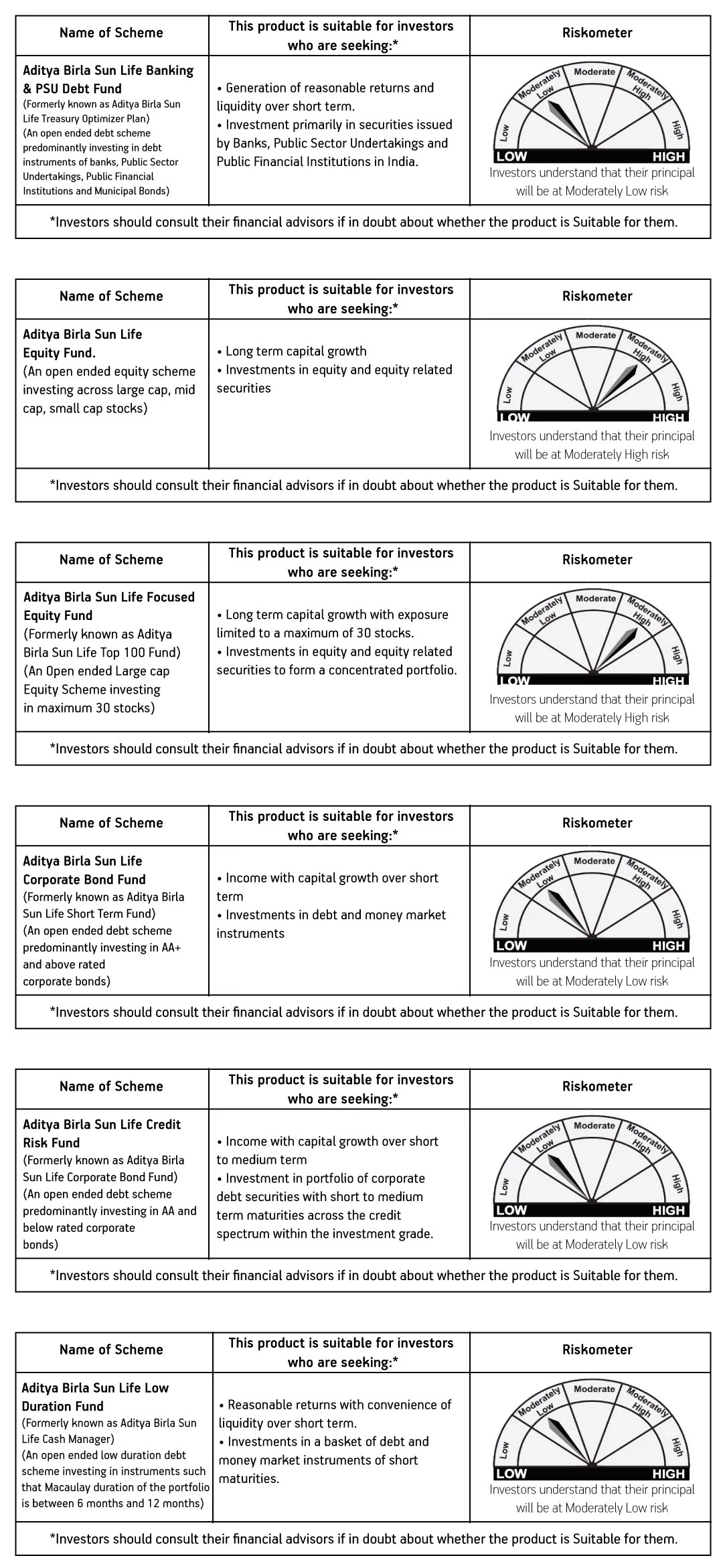

At this stage, we feel, diversified mandates like Aditya Birla Sun Life Equity Fund (An open ended equity scheme investing across large cap, mid cap, small cap stocks) & Aditya Birla Sun Life Focused Equity Fund (An Open ended Large cap Equity Scheme investing in maximum 30 stocks) are good equity bets while your shorter-term savings can find place in Aditya Birla Sun Life Low Duration Fund (An open ended low duration debt scheme investing in instruments such that Macaulay duration of the portfolio is between 6 months and 12 months) & Aditya Birla Sun Life Banking & PSU Debt Fund (An open ended debt scheme predominantly investing in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds).

For conservative investors, Aditya Birla Sun Life Corporate Bond Fund (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds) & Aditya Birla Sun Life Credit Risk Fund (An open ended debt scheme predominantly investing in AA and below rated corporate bonds) remain bets for over 1 year & above 3 years respectively.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Rate this

Rate this Article

Similar Articles

Our Experts

Our Experts

Tools and Calculator

Tools and Calculator

RSS News Feed

RSS News Feed

Archives

Archives

Close

Hover to Zoom

1800-270-7000

1800-270-7000

Thank You

Message will change according to your requirement.