-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Welcoming the Government's Booster Shots

Oct 23, 2019

4 mins

5 Rating

A Balasubramanian

A Balasubramanian

At the outset, let me take this opportunity to wish you all a very happy Navratri and Dussehra festival.

As you all know, both the Government and RBI have been very supportive and have taken the necessary measures to revive the slowdown in economy. RBI has slashed rates consecutively for the fifth time this year up to 135 Bps. Government’s bold move of slashing corporate taxes by almost 10% for all domestic companies has boosted the sentiment. I must say, it is one of the major steps towards economic reform and is primarily aimed at reviving capital expenditure and private investment. I am also equally bullish on foreign companies investing in India capitalizing the tax benefit advantage for setting up new industries. This would make India once again a very attractive destination for both foreign capital and long term capital. However, the credit markets continue to be challenging on the back of ongoing concerns, especially the Banking & NBFC sector and corporates with high promoter leverage. Hence, staying vigilant and being proactive during this phase would be crucial. Ultimately, Good monsoon, lower interest rates, and the upcoming festival season will all together give a fillip to consumption and should see the broad economy voyaging towards 5 trillion dollar economy, as we highlighted in our Voyage - Investment conference event.

As we step into the second half of this financial year, the asset base of mutual fund industry stands at ₹ 25.67 lakh Crs (As on Sep 30, source: AMFI). While the overall industry growth over previous quarter remains muted, SIP inflows and accounts continued to be encouraging. In September, SIP inflows stood at ₹ 8,263 crore, higher than ₹ 8,230 crore in August. No doubt last one year has not been that great for equity investing. However, equity is bound to give bumpy return in a golden period and vice versa, but in the long run it does give a good experience. However, fixed income schemes have delivered relatively better output but for the credit noises. Also, the fixed income related credit issues is a very small proportion of the overall assets. Hence, I would recommend:

Staying focused on asset allocation and goals will give better results.

SIP way of investing to beat the volatility and help build long term portfolio

Avoid paying heed to the unwanted noises and don’t get swayed away by recent events.

Given, Time and Patience, Mutual funds can help generate wealth and relatively stable returns.

We also have created an Investor education video that we sincerely hope will help you in understanding the debt fund nuances.

(Please click on the link: https://youtu.be/XWlh5sCXQRY)

Our constant guiding factor, Mutual fund regulator, SEBI has come up with a slew of measures to make debt funds more safer. I am sure these measures would certainly increase transparency and risk framework. Recently, SEBI has also guided and is keen on increasing retail participation from B30 markets. Hence, in our continuous endeavor to increase our B30 presence and engagement, we have added another 28 locations, as part of our emerging market strategy. We are also continuously educating investors through our Nivesh Kumbh - big format investor education events. Recently, we had one such event in Berhampur, Odisha and reached out to more than 600 retail investors in the city to spread financial literacy and investor awareness.

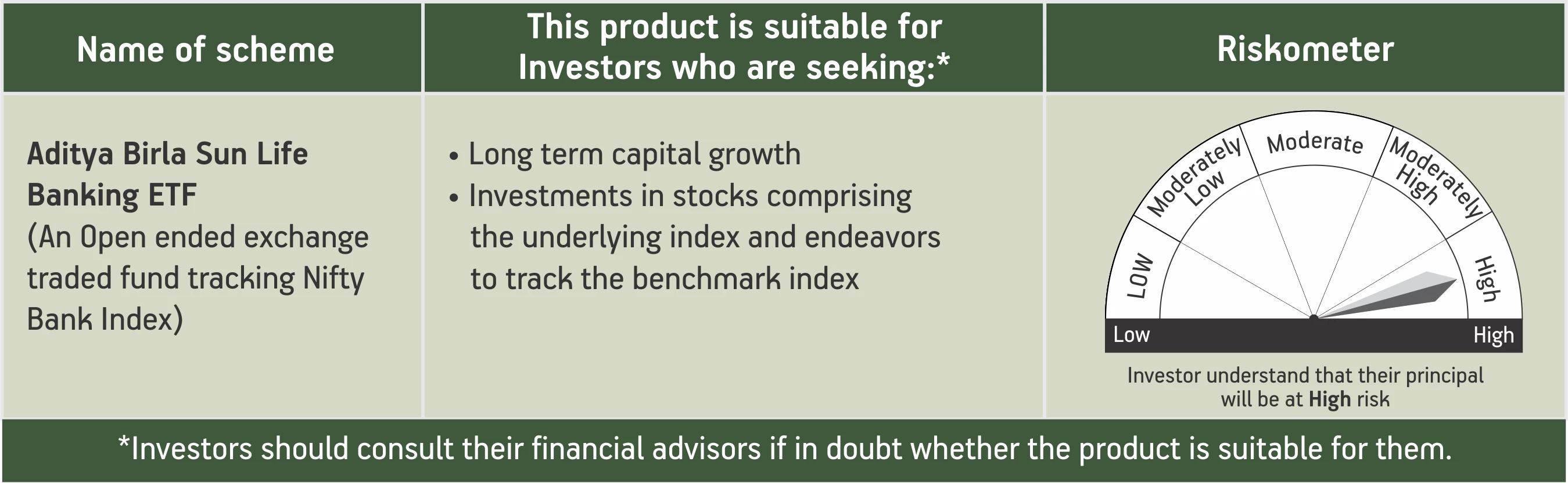

Let me also take this opportunity to thank all our valued partners and investors for their continuous association and support. Currently, we have are present at more than 300 locations and service more than 7 million active customer folios. Very soon, we are also launching our NFO – ‘Aditya Birla Sun Life Banking ETF’. I am sure, our team would engage with all of you through various modes and make the most of this opportunity. I would also recommend you all to capitalize on all our value added products and services such as our of C-SIP facility, offering a benefit and life coverage without any additional charge. I am sure, this would not only help the customers but also would help distributors to on-board new customers in the Industry. Ultimately, SIP way of investing would beat the volatility and help in building long term portfolio.

Stay invested and committed to your financial goals!

For further details please refer SID/KIM of the scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000