-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABSL BSE India Infrastructure Index Fund is Live Now

New Year New Beginnings

Nov 25, 2019

4 mins

5 Rating

Anil Shyam

Anil Shyam

As we welcome Samwat 2076, the markets seem to have joined in the celebrations as the Sensex made a new high and the Nifty 50 is very close to the 12000 mark. The Government’s early Diwali gift of lower corporate taxes has been a big contributor to this rally. The global sentiment has also turned positive with a likely trade deal between US and China in the offing. The mood in equity markets has turned bullish as markets achieved new highs with foreign investors re-gaining their confidence in the Indian economy and markets. The market breadth has also improved as the SENSEX and Nifty-50 were up 3.8% and 3.5% while BSE Midcap gained 5.4%.

The Government has taken cognizance of the problems faced by the economy. While just the acknowledgement of the problems is half the battle won but the government has also taken a few steps to heal the ailing economy and capital markets. And the government is in an all-out kind of approach to bring growth & momentum back into the economy, even at the cost of some fiscal prudence. Consequently, the government has announced a slew of measures to improve the sentiment and it seems to be working. After the tax cut, government announced a 5% hike in dearness allowance for central government employees and pensioners. RBI too has helped by continuing with its accommodative policy stance. India is well on its way to potentially become a $5 trillion economy by 2025.

The Indian Banking system continues to be flush with liquidity in contrast to the conditions that prevailed in the last year. Domestic bond markets have rallied in the last month on account of rate softening by RBI as well as a rate cut by the US Fed. Domestic interest rates have been cut by 135 basis points to a nine-year low of 5.15%. The central bank has embarked on a rate softening regime to boost slowing economic growth.

Both FII and DII buying continued with $2bn and $0.7bn (vs $0.9bn and $1.7bn last month) respectively during October taking the YTD net inflows to $10.2bn and $7.2bn respectively. Mutual Funds were net buyers in October to the tune of $0.8bn (YTD $8.2bn). This is due to the strong inflows for the industry especially due to SIPs which have now at INR 8245 crores a month.

On the global front, a further rate cut by the US Federal Reserve along with geo-political tensions settling down has improved global sentiment. The S&P 500 also made a new all-time high of 3,050 on 30th October 2019. Equities rallied globally on the back of de-escalation of geopolitical risks, as the US and China signalled a likely phase one deal on trade and related matters. Better-than-expected US GDP growth data and monetary easing by the Fed (25 bps cut in policy rates) also aided sentiment. The UK and the European Union also struck a long-awaited Brexit deal. As things stand, this could be the bottom of the global economic cycle, and only way forward, possibly, is an economic recovery and an upcycle.

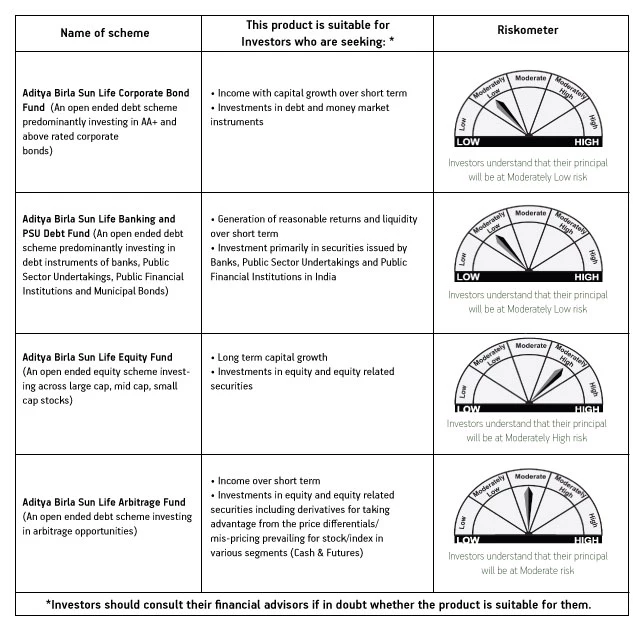

In this environment, I would encourage our investors to remain invested in the markets and possibly look to increase their exposure. As always, SIP remains one of the best ways to invest as it takes away the risks of timing the market. I would also urge you to consider your asset allocation (equity & debt mix) as it is very important to reach your investment goals and solutions. In the present market context, one must have exposure to both asset classes in right measure and your financial advisor can also help you understand the same. Amongst the debt schemes that can be considered are Aditya Birla Sun Life Corporate Bond Fund and Aditya Birla Sun Life Banking & PSU Debt Fund. On the equity front Aditya Birla Sun Life Equity Fund and Aditya Birla Sun Life Arbitrage Fund can be considered which also comes under our wealth creation solution for long & short term investments in equities.

Hope this New Year is as much and more rewarding and exciting as the year gone by.

Source: Bloomberg, AMFI

Abbreviations

FII: Foreign Institutional Investors

DII: Domestic Institutional Investors

Bps: Basis points

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000