-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Investment Roadmap for a Conservative Investor

Mar 06, 2020

3 mins

5 Rating

It often so happens that investors think the investment options are very limited for a conservative investor. As anyone who has ever invested in mutual funds will tell you, that’s not true. What is required here is an unbiased comparison of the traditional modes of investments and the mutual fund schemes that match your risk appetite. Mutual Funds, in a way, teach you that your different financial goals require different investment vehicles. Here’s how you can start your journey with mutual funds.

Let the mutual fund games begin

If you are a new investor, the first thing you can do is to find a financial advisor who is honest with you and stands by you when your portfolio is underperforming. A learned advisor will always have answers to all your questions.

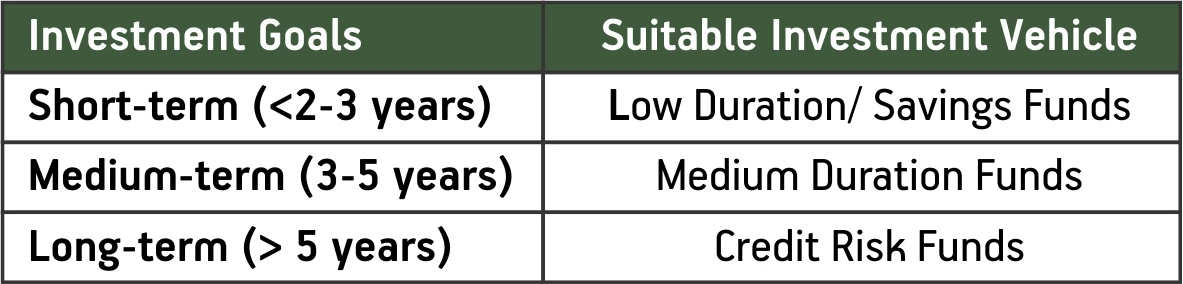

The next thing to do is to list down your investment goals like- retirement, children’s education, buying home etc. You would also need to assess your risk appetite and decide investment horizon for each goal. This is done because your short-term goals (< 2-3 years), medium-term goals (3-5 years) and long-term goals ( > 5 years), will need different investment approaches.

And if you are unable to decide, you may park your excess money in a debt fund, to begin with. Debt oriented mutual fund schemes are less risky than equity-oriented ones and may be suited for a low risk-appetite investor.

Slow and steady still works

Here’s our guide for investment in debt-oriented mutual fund schemes-

Even though the above suggestions can be referred to as a starting framework for any investor, your decision will depend on your specific needs and can be different from these. The suggestions above are basis the assumption that the investor has a low-risk appetite. However, if you are not risk-averse, the investment option for a long-term goal could be to begin a Systematic Investment Plan (SIP) in an equity-oriented mutual fund scheme.

Things to remember while investing in mutual funds

Further to the above, here are a few rules of thumb that might help you in your investing journey with mutual funds-

-

Power of Compounding

Always remember that mutual funds operate on the principle of compound interest. This implies that the returns you earn are function of the time period you stay invested for. Hence, it is not advisable to redeem your money unless the investment goal has been met or you need the money for an emergency.

-

Law of Averages

Most investors tend to panic when the market plummets and their returns reduce temporarily. This actually could be a good opportunity for the investors to put in more money in their equity mutual fund schemes. For example, if you are investing Rs 10,000 in a scheme where the NAV is Rs 100; you will end up buying 100 units of the scheme. On the other hand, when the market is bearish, the NAV will drop down to say Rs 50 (say), and for the same amount of money invested, you shall end up getting a higher number of units (200). This mechanism helps you average out the returns over a period of time.

In conclusion, let us remember that any kind of investments must be directly linked to an investment objective. More importantly, it is relevant that you step out of your comfort zone, make few mathematical comparisons, seek the help of experts and select the investment vehicle best suited to your goals and risk appetite.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

1800-270-7000

1800-270-7000