-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Passion is Important, so is Experience

"Knowledge is acquired by studying, but wisdom through experience." At Aditya Birla Sun Life AMC Ltd., we stand at the intersection of experience and youthful enthusiasm, celebrating 30 years of empowering investors. #Thinklike30 embodies our journey—a blend of experienced decisions and youthful passions, guiding investors towards wise and fulfilling financial choices.

Join us as we embark on a journey where experience meets passion, presenting two essential pillars for investors:

Systematic Investment Plan (SIP) for Long Term Growth

Multi Asset Allocation Funds for Diversified Investments

Passion for Growth, Wisdom through SIP

Experience the power of disciplined investing with SIP (Systematic Investment Plan). Like life's experiences, SIP steadily shapes your investments over time, helping you grow your wealth while navigating the highs and lows of the market.

What is SIP?

It is a disciplined and convenient method of investing in mutual funds. It involves investing a fixed amount of money at regular intervals, typically monthly or quarterly. SIPs help investors accumulate wealth gradually over time by taking advantage of rupee cost averaging and the power of compounding.

Rupee cost averaging involves investing a fixed amount regularly, which can lower the average cost per unit over time due to market fluctuations. Compounding, on the other hand, is the process of earning returns on your initial investment, and then earning returns on those returns as time passes. This creates a compounding effect, leading to exponential growth in your investment.

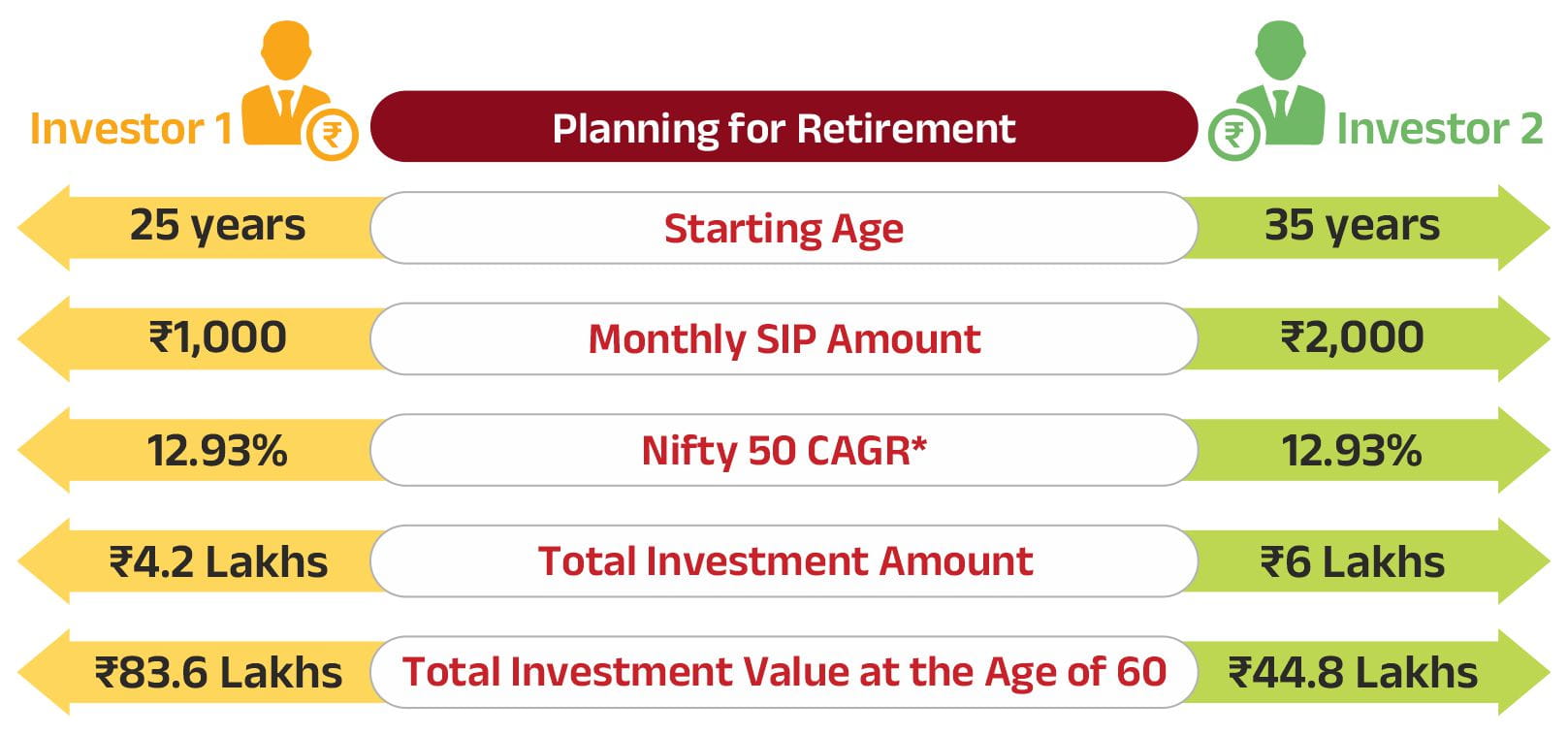

Just as a plant needs time to grow and flourish, the concept of compounding also requires time to work its magic. To illustrate this, consider the following example involving two investors, Investor A and Investor B, each at different stages of life but with the same goal of planning for retirement. Both individuals decided to start a Systematic Investment Plan (SIP) in the Nifty 50 Index:

*Mean of 10 years rolling return between 01/06/13 and 30/05/23 of Nifty 50 Index as prescribed the AMFI. The above calculation is for illustrative purposes only. Past performance may or may not be sustained in future and is not a guarantee of any future returns.

In the above example, despite Investor B contributing twice the amount, his investment value at age 60 is less than that of Investor A. This highlights the importance of starting early to benefit from the potential exponential growth with compounding. Starting your investment journey sooner allows your funds more time to grow, resulting in long-term gains.

Balance your passion and experience and make everyday count with an SIP.

Start an SIP

Embark on a Diverse Investment Journey with Multi Asset Allocation Funds

In the investment landscape, diversification is often one of the keys to success. This is where a Multi Asset Allocation Fund comes into play. This fund, which combines multiple asset classes such as equities, fixed income, and commodities like gold and silver in a single portfolio, offers a diversified investment strategy.

By spreading investments across various asset classes, this fund aims to optimize returns and mitigate risk, making it an ideal choice for investors seeking diversification in their strategy for wealth accumulation.

It’s time to get out of your comfort zone and be excited for the future. Let the Multi Asset Allocation Fund guide your investment journey, blending passion with experience.

Invest in Multi Asset Allocation Fund

An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund. All investors have to go through a one-time KYC (Know Your Customer) process. Investors invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link: https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

1800-270-7000

1800-270-7000