-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Passive Debt Index Funds

A better solution to access the Fixed Income opportunity!

- Debt market yields are becoming attractive against the backdrop of conducive economic environment - moderated inflation, sustained economic growth, accommodative monetary policy etc.

- Investors can potentially take advantage of this opportunity by investing in high quality Corporate Bonds with pre-defined maturity.

- Investing in Corporate Bonds through a Passive Debt Fund can bring multiple advantages for investors

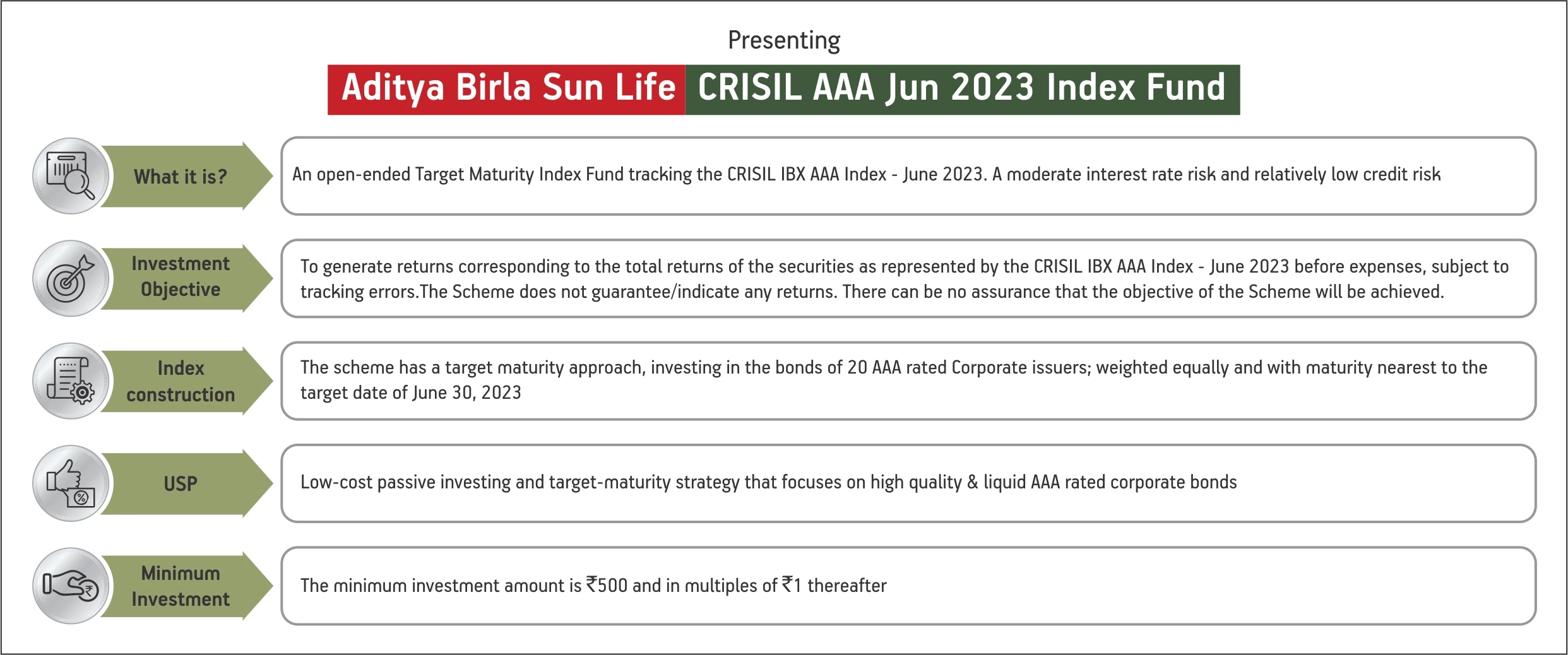

Why should you invest in Aditya Birla Sun Life CRISIL AAA Jun 2023 Index Fund?

• Reasonable Returns

It invests in AAA-rated corporate and PSU bonds of fixed tenure and fixed coupon rate, with an aim to provide reasonable returns to investors.- • Target Maturity Approach

The scheme is expected to mature on June 30, 2023. This fixed maturity term allows investors to plan their investments and align them with suitable goals. • AAA rated Portfolio

The scheme invests only in highest quality corporate debt instruments, with AAA rating. This lowers the credit risk for investors.• Risk Management

The scheme has no duration risk when held till maturity. Further, its roll down strategy is conducive to the current interest rate environment.• Liquidity

Being an open-ended fund, with no exit load or lock-in period, it offers good liquidity to investors throughout the term of the fund.• Low Costs

Being a passively managed index fund, it has a lower expense ratio.• Low Minimum Investment

Investors can start investing in this scheme with as low as Rs.500.

*Minimum Investment Amount: Rs.500/- and in multiples of Re. 1/- thereafter

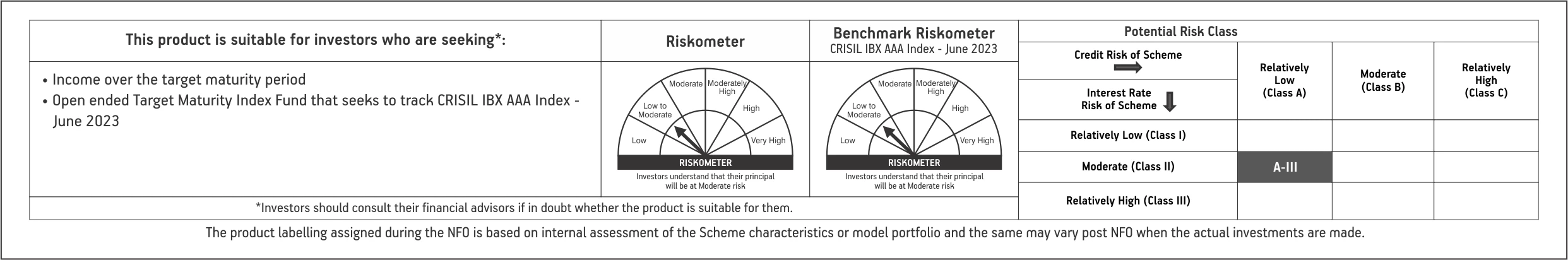

Product Labelling

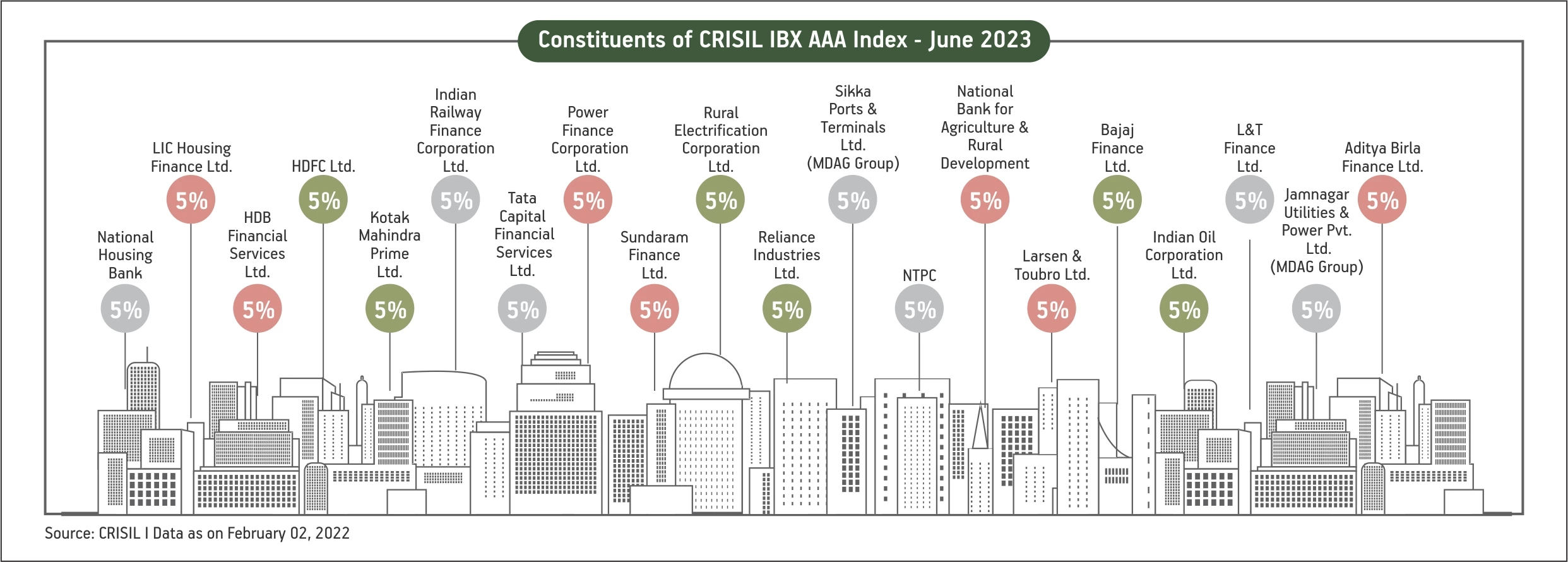

Aditya Birla Sun Life CRISIL AAA Jun 2023 Index Fund

Download

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000